-

The Bank of Lithuania contends the U.S. fintech broke anti-money-laundering rules; while British contactless payments hit a record. That and more in the American Banker global payments roundup.

April 9 -

The bank has added Affirm as an option, after adding the fintech's rival Klarna to its merchant network in February.

March 25 -

The account-to-account payment method has become prevalent in countries such as China, India and Brazil, but adoption has been slow in the U.S. and limited to small- and medium-sized businesses. That paradigm is expected to shift amid continued fintech investment.

December 30 -

Improved consumer confidence helped to drive greater use of buy now/pay later as younger generations turned to short-term installment options.

December 27 -

The buy now/pay later company beat analysts' expectations on revenue, net income and earnings per share as it issued new guidance for the end of its next fiscal year. Its stock was up as much as 31%.

August 29 -

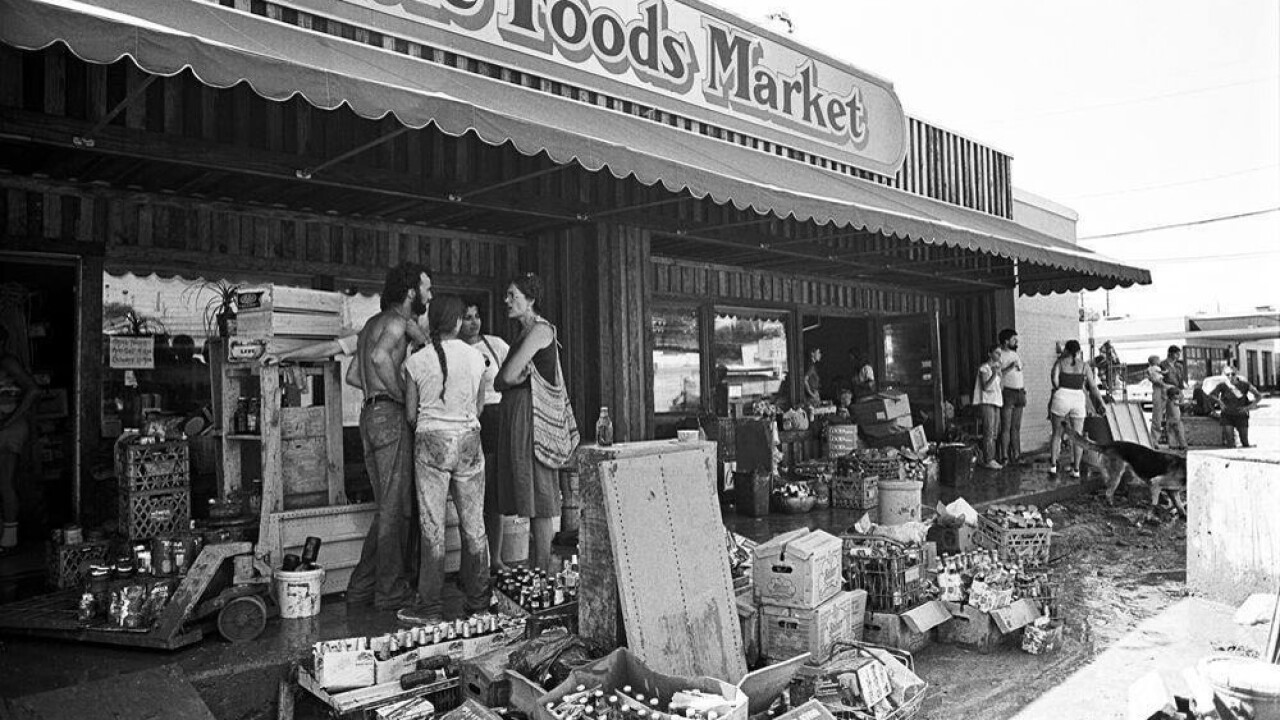

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

July 3 -

VersaBank plans to use the one-branch Stearns Bank Holdingford in Minnesota as a platform to expand a lucrative niche business acquiring loan and lease receivables from point-of-sale lenders.

June 27 -

Klarna is looking to get out of one of its key payments businesses after the financial technology giant found the unit created a conflict of interest with peers like Adyen or Stripe.

June 24 -

A $30 billion settlement between Visa Inc., Mastercard Inc. and retailers to cap credit-card swipe fees is likely to be rejected by a federal judge in Brooklyn, a setback in the two decade-long litigation.

June 14 -

Retailers like Walmart, Target and Dollar General are changing the ways they collect payments in person. This, in turn, could influence payment habits, but it is unlikely to slow the overall momentum of digital transactions.

May 31