-

The account-to-account payment method has become prevalent in countries such as China, India and Brazil, but adoption has been slow in the U.S. and limited to small- and medium-sized businesses. That paradigm is expected to shift amid continued fintech investment.

December 30 -

Improved consumer confidence helped to drive greater use of buy now/pay later as younger generations turned to short-term installment options.

December 27 -

The buy now/pay later company beat analysts' expectations on revenue, net income and earnings per share as it issued new guidance for the end of its next fiscal year. Its stock was up as much as 31%.

August 29 -

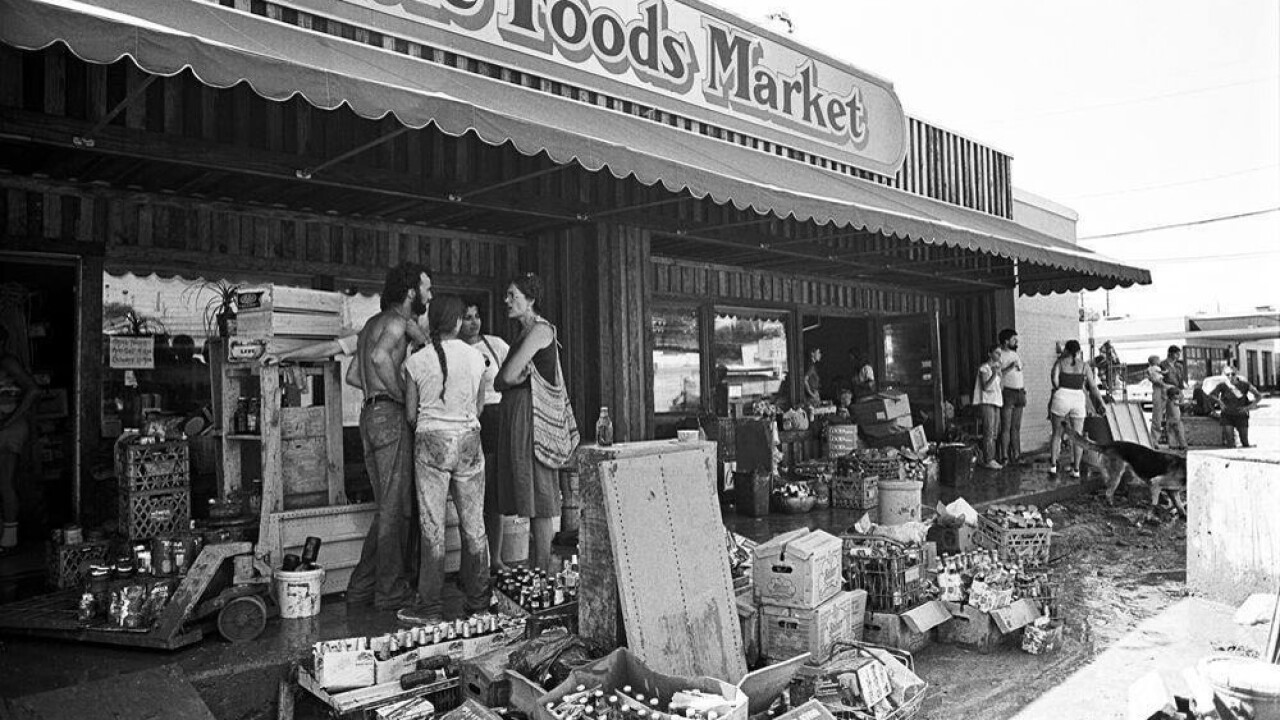

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

July 3 -

VersaBank plans to use the one-branch Stearns Bank Holdingford in Minnesota as a platform to expand a lucrative niche business acquiring loan and lease receivables from point-of-sale lenders.

June 27 -

Klarna is looking to get out of one of its key payments businesses after the financial technology giant found the unit created a conflict of interest with peers like Adyen or Stripe.

June 24 -

A $30 billion settlement between Visa Inc., Mastercard Inc. and retailers to cap credit-card swipe fees is likely to be rejected by a federal judge in Brooklyn, a setback in the two decade-long litigation.

June 14 -

Retailers like Walmart, Target and Dollar General are changing the ways they collect payments in person. This, in turn, could influence payment habits, but it is unlikely to slow the overall momentum of digital transactions.

May 31 -

National Australia Bank is adding a Pay By Bank option for near-instant payments, Italy is bringing open-loop payments to buses in Tuscany, and more.

May 8 -

Companies are taking vastly different approaches to how they implement generative AI, whether it's to empower employees or to overhaul the way they bring products to market.

April 15 -

A digital-payment trend that began during the COVID pandemic is being bolstered by features such as rewards and state ID storage.

April 5 -

With countless fintechs nipping at its heels, the bank is working harder to be a one-stop shop for e-commerce, retail store management, payments and authentication.

February 12 - AB - Policy & Regulation

As the Senate debates this year's defense spending package, analysts say the highly partisan politics of this Congress, as well as the banking industry's lobbying, make it difficult for Sen. Dick Durbin's, D-Ill., credit card legislation to slip through this round.

July 19 -

Two executives behind BMO's purchase of Bank of the West from BNP Paribas discuss how the deal happened and what comes next for BMO.

-

Supermarket chain Kroger refused to accept Apple Pay and similar options in stores for nine years. It's changed its mind — but Walmart, Home Depot and Lowe's remain holdouts.

April 17 -

Not every shopper wants to charge the same card every time — but many do. Retailers like Adorama and Nordstrom, and payment companies like PayPal, are digging into their data to determine when an invisible payment is the best option for a customer, and when it's a pain point.

January 24 -

The more that stores reinvent the physical point of sale — or remove it entirely — the more they gather insights that go beyond just the payment. This can be extremely valuable to retailers that know how to use this new information, particularly for targeted marketing.

January 23 -

Thieves are getting more organized and aggressive in how they steal from shelves to fund bigger schemes. Emerging checkout systems that track shoppers can deter some of this activity, but not enough to address the full scope of the risk.

January 20 -

The metaverse is already blurring the lines between physical and online commerce, and many retailers are profiting from it. Banks and payment companies can play an even bigger role by helping money move without friction.

January 19 -

Starbucks and Kroger have invested heavily in payment technology over the years to gain an edge over their competitors. Their newest systems are focused on shaving off valuable seconds at checkout.

January 18