PayThink is focused on the rapidly changing, inter-connected markets of debit, credit, mobile, prepaid and digital payments. As the payments industry strives for faster innovation to launch new products ahead of competitors, PayThink provides insight from market participants and innovators leading the way. PayThink is designed for executives looking to stay relevant in the ever-changing payments ecosystem by finding and honing their competitive edge.

-

It's not just Capital One Cafés; banks all over the country are repurposing branches and offices. Marketing experts call it innovative, but critics say some lenders are crossing a legal boundary between banking and commerce.

December 30 -

Dr. Marla McLaughlin serves as chief medical officer at Apree Health, the parent company of Castlight Health and Vera Whole Health. With decades of experience as a primary care physician, she partners with employers to design high-value benefits strategies that combine advanced primary care and digital navigation, driving measurable ROI while improving employee health outcomes.

December 29 -

-

Under a proposed rule, the agency would let most nationally chartered firms off the hook for heightened regulatory standards. The rule would raise the bar from $50 billion to $700 billion of assets and leave only eight firms subject to heightened regulation.

December 29 -

Stories about data breaches, fraud and one neobank were reader favorites this year.

December 29 -

The Federal Reserve is slated to undertake a number of important rules and regulations in 2026, but decisions around agency leadership and the Trump administration's avowed effort to exert greater control over the central bank are likely to leave a lasting legacy at the agency.

December 29 -

National ad campaigns are impressive. But few things create more goodwill or lasting impact than visible, hands-on support of a community's youth, no matter the size of the bank.

December 29

-

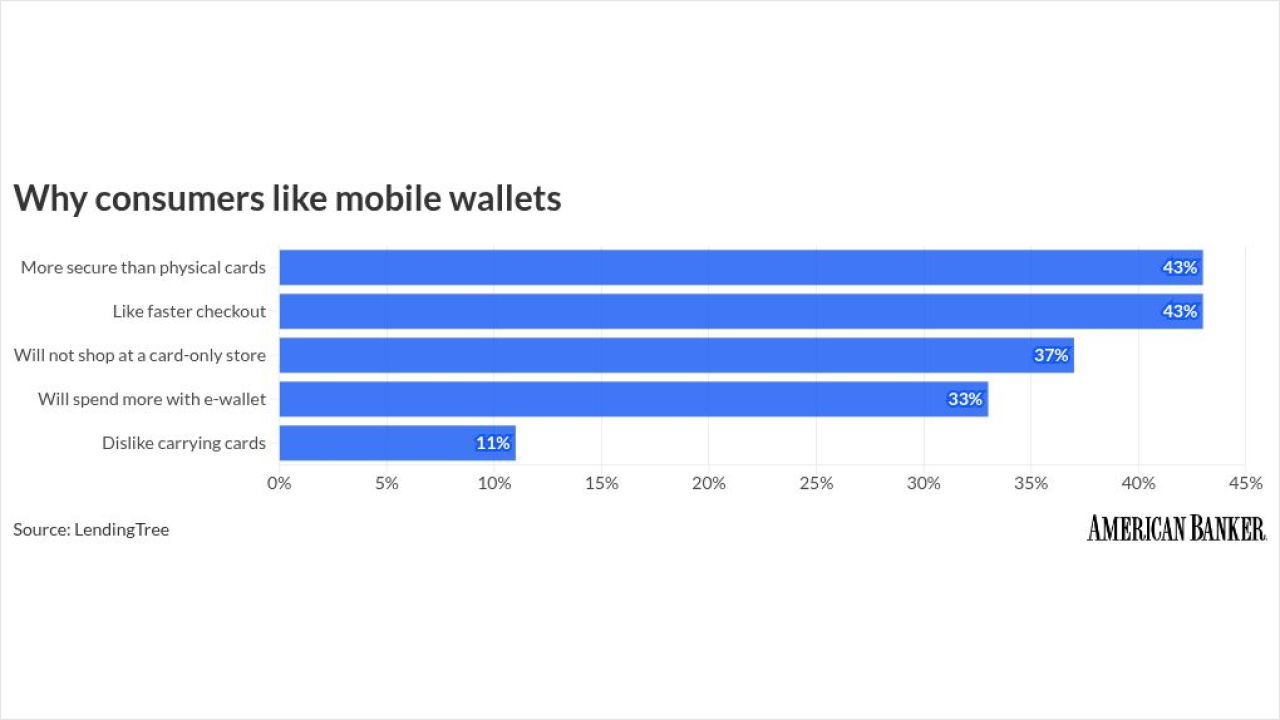

Consumer appetite for mobile wallets is growing, challenging banks to innovate to stay ahead.

December 29 -

As commissioner of Virginia's Bureau of Financial Institutions since 1997, Joe Face emphasized strengthening the dual banking system.

December 29 -

Thomas Rauschen is Global Industry Lead for CGI's insurance sector, where he helps strengthen the company's role as a trusted partner to insurers worldwide. With 20+ years of leadership experience across financial services, insurance and consulting, he brings deep expertise in strategy execution, business transformation, and operational excellence — guided by a strong focus on technology innovation. Drawing on a global perspective shaped by work across property and casualty, life and health, reinsurance, and brokerage markets, Thomas delivers strategic insights that help clients achieve measurable results.

December 26