-

A Texas banking company formed two years ago to acquire distressed or failed banks is buying its first healthy bank.

March 6 -

Prosperity's agreement to pay $529 million for American State Financial is one of the priciest deals since Comerica agreed to buy Sterling Bancshares more than a year ago, but the reaction to it is much more positive than it was to Comerica's deal.

February 27 -

With numerous attractive institutions and robust growth markets, the state could kickstart a round of traditional deals nationwide. The only problem? Texas bankers also know they're attractive, and the most comely banks aren't interested in low-priced dates.

February 8

Last month, James D'Agostino at Encore Bancshares Inc. was prepared to execute on a three-year growth strategy that management had already mapped out and the board had approved.

Those plans were shelved once Encore received a call from Cadence Bancorp LLC, a competitor that had other plans,

Cadence's offer was "essentially equal to the future value that we would produce" with the recently adopted long-term plan, says D'Agostino, Encore's chairman and chief executive. Instead of waiting three years, "we'd able to provide our shareholders that value today."

The deal surprised many industry observers, including D'Agostino, who just last month told American Banker that

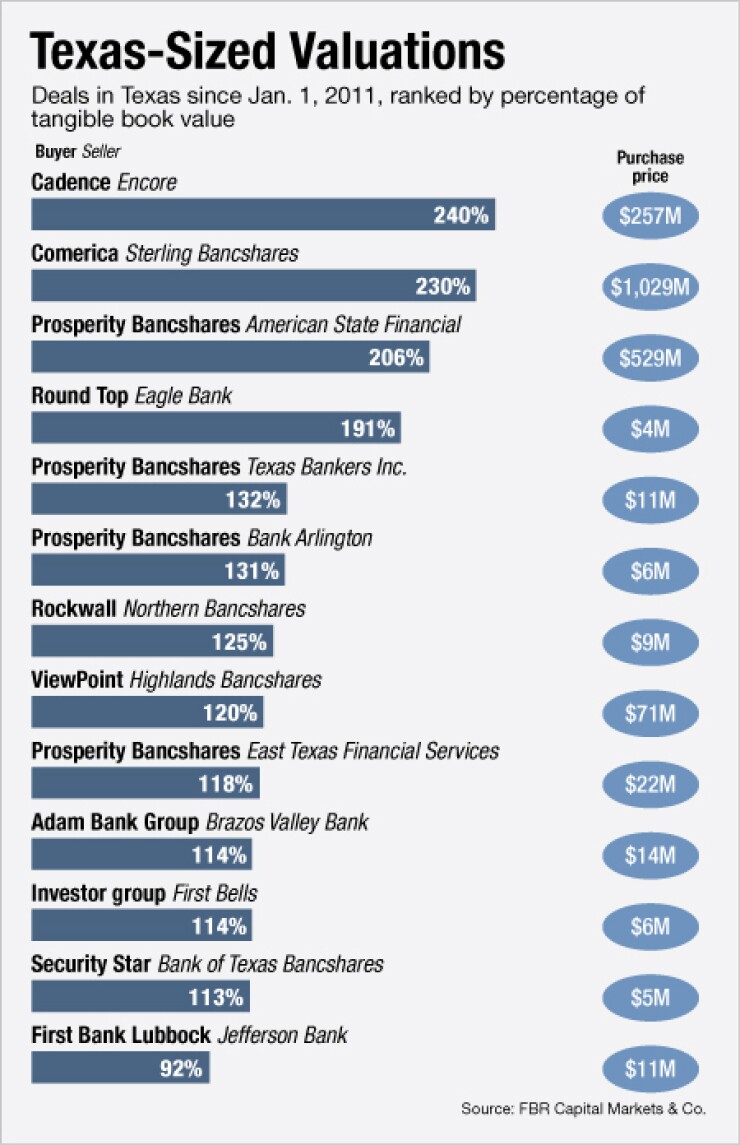

The premium Cadence is paying Encore — 2.4 times tangible book value — is the highest among deals announced in Texas in the past two years, though far less than those that took place before the financial crisis, according to data from FBR Capital Markets and SNL Financial. Industry observers said rising premiums should give coveted sellers an upper hand in negotiations.

"We've already had a couple of Houston bankers call us saying this is the best thing that could happen to them" as sellers, says Dan Bass, a managing partner at FBR.

Buyers may not be as ecstatic. "There are a lot of banks we talk to on a frequent basis who are trying to get big in Houston and I'm sure they're very upset," Bass says. "The next person that tries to buy a bank in Houston …they're going to have to pay up."

Cadence's premium surpassed

Paul Murphy Jr., Cadence's chief executive, had been watching Encore since his investment group raised $1 billion roughly 18 months ago. Murphy says he knew Cadence had to get Encore's attention.

"We knew they were not for sale," Murphy says. "We had to claw our way in."

Last month, Cadence made an unsolicited offer for Encore. D'Agostino says he took the offer to his board and, after comparing it to Encore's growth strategy, determined that shareholders would get the same return, only sooner. Selling also removes unknown macroeconomic risks that D'Agostino calls "black swans" that fly in and weaken internal growth plans.

"As I expressed previously, we were very excited about remaining independent," D'Agostino says. Cadence's offer, at $20.62 a share in cash, "fully recognizes the value created by the plan" without "the unknowns that are out there in the economic environment."

"We think [the price is] an attractive value for the bank but we certainly don't think we stole the bank by any means," says Murphy, who has been a Houston banker for more than 30 years.

Murphy knows the history of consolidation in Texas. He was the CEO of

Cadence is based in Houston, where it has an office with about 70 employees but lacks a branch network in the market, Murphy says. Encore has wealth management, trust services and insurance subsidiaries. Those divisions are large fee producers for Encore and are worth $40 million to $50 million, Murphy says.

Still, some industry observers argue that the pricing could be an anomaly, partly because of Cadence's heavy private-equity backing and its greater need for a branch franchise near its headquarters.

"Cadence paid up because they needed to get into Houston," Bass says. "This is where Paul [Murphy] spent a majority of his career, and all his management teams have ties here, so now they have some bulk to go with their headquarters."

Encore gives Cadence $1.6 billion in assets and 12 branches around Houston. Some industry observers say the high price was justified because of Encore's size and its limited number of problematic loans. At Dec. 31, nonperforming assets made up 0.85% of total assets.

"I don't think it was way overpriced," says George Lee, president and CEO of the $1.5 billion-asset MetroCorp Bancshares Inc. "If you look at Houston, there are less than a handful of banks with over a billion in assets, so it's really a rarity."

Lee, who runs one of the few remaining large Houston banks, spoke to American Banker Tuesday afternoon after presenting at Sandler O'Neill & Partners LP's West Coast banking conference. As the sole Houston banker speaking there on the same day of Encore's sale, Lee said investors were questioning his own strategy now that a key competitor was selling.

"There were a lot of questions being asked, and we think obviously that one-times tangible book value is very low and we'd like to …get ourselves stronger," Lee says. Still, recent sales in Houston, including Encore's, are "good for the banking industry."

The three deals announced in Texas this year have priced higher than most deals struck in the state last year, according to FBR. Prosperity Bancshares Inc. in Houston has been the only other buyer in the state this year, grabbing up Bank Arlington and American State Financial Corp. in Lubbock.

Prosperity is

"Buyers are always telling me they would never pay" two-times book, Bass says. "Buyers will say [Cadence] was a unique situation but at some point, it's a trend."