-

Four months after its planned sale to Texas investment group fell through, The Bank Arlington near Dallas has found another buyer.

January 20 -

Integration of rare find in Texas could be done by yearend, and Comerica will be "regimented" about future expansion, Babb says.

July 28

Investors winced a year ago when a Texas bank struck a pricey deal for another franchise in the Lone Star State. On Monday the same thing happened — and Wall Street cheered.

That is because Prosperity Bancshares Inc.'s agreement to pay $529 million for American State Financial Corp. looks like a safer bet than Comerica Inc.'s takeover of Sterling Bancshares Inc., experts say. The price tag on the Comerica deal was $1 billion when announced in January 2011; the valuation dropped to $800 million by the time it closed in July.

Both buyers agreed to pay hefty prices to extend their reach into new parts of the highly-desirable Texas market. But Houston-based Prosperity's takeover of the $3 billion-asset American State of Lubbock is a reminder of how banks are like used cars: the level of sticker shock depends on what is found under the hood.

Investors welcomed what it heard from Prosperity in announcing its fourth deal in six months; its shares rose more than 6% to $43.65 by the afternoon. The 37-branch American State is highly profitable and has few bad loans. Prosperity expects to charge off just 2% of them. It has a leading share of key markets west of Dallas and a trust division that generates a healthy amount of fees.

Sterling of Houston was a different story. The 56-branch company was barely making money thanks to big batches of overdue construction and home loans. Comerica had to take a $330 million, or 12%, haircut on its loans. Sterling was also a public, urban bank that was forced into play by a proxy battle with its largest shareholder, a hedge fund. American State is a private, largely rural bank.

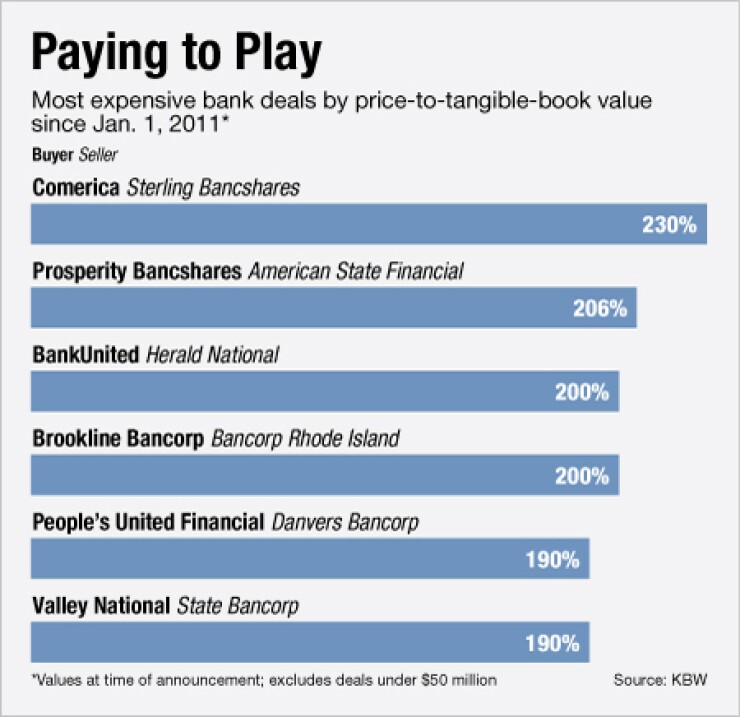

Some investors and analysts fretted that Comerica overpaid for an asset it argued had scarcity value, due to a lack of sizable takeover targets in Texas. It initially agreed to pay about 230% of Sterling's tangible book value, or equity excluding intangibles such as goodwill. The final price ended up being about 180% its tangible book, as stock market volatility lowered the final valuation. American State would get 206% of its tangible book.

The cash-and-stock structure of the deal is technically a merger, American State's chairman and chief executive, W. R. Collier said.

"We're not selling, we're merging. If it was just a sale I wouldn't be going on their holding company board," Collier said in an interview, adding that he will now answer to Prosperity CEO David Zalman as senior chairman of the combined company's west Texas operations.

Collier, 73, said the deal provides his bank's energy and other types of clients with access to Prosperity's deep connections in the Gulf Coast region. Prosperity, in turn, becomes a cross-state bank by entering 18 new counties west of Dallas, he said.

"I think they've gotten a plumb deal myself. I just think we're good," he said. "We've just finished our fifteenth, consecutive year of increased profits."

Prosperity is covering more than 66% percent of the purchase price with its own shares, which is favorable for the buyer. Prosperity's stock is among the most valuable currency in banking. It trades at a substantial premium to its equity, which means it can afford to pay up without blowing a hole in its capital structure.

Prosperity expects to earn back the equity exhausted in this deal within a year. Investors consider a two-year earn-back period to be good, and a three-year one to be acceptable.

The deal is a "fairly aggressive" but potentially "transformative move" for Prosperity because, said Jacob Thompson, a managing director in Dallas with the investment banking firm SAMCO Capital markets Inc.

"I don't think they are biting off something that they can't integrate," he said.

Sandler O'Neill & Partners LP advised American State; Keefe Bruyette & Woods Inc. advised Prosperity in the transaction.

American State earned more than $35 million through the first nine months of 2011, according to Federal Deposit Insurance Corp. data. Its return on equity in the third quarter was 15.40% and its return on assets was 1.51%, both well above industry averages.