-

The former lawmaker joins the Swiss bank after years of pushing for bank deregulation as chairman of the House Financial Services Committee.

April 11 -

Regulators and lawmakers go to great lengths to avoid using the term for reforms in the Trump era, but its meaning is consistent with recent steps to revise and clarify the post-crisis regime.

April 11 American Banker

American Banker -

The Federal Reserve Board unveiled a host of proposed changes to tailor U.S. supervision of foreign firms, as well as a proposal easing “living will” requirements for both domestic and overseas banks.

April 8 -

American Banker won 11 journalism awards during the past week, including its first Grand Neal, the highest of the honors announced at this year's Jesse H. Neal business journalism awards.

April 2 -

The changes will expand the role of the Consumer Advisory Board and other panels, but stopped short of reversing the downsizing ordered last year by former acting Director Mick Mulvaney.

March 21 -

If there is renewed interest in a proposal to restrict incentive-based plans, that isn’t enough to overcome obstacles that have hindered the rulemaking for so long.

March 13 American Banker

American Banker -

Comptroller of the Currency Joseph Otting and Federal Deposit Insurance Corp. Chairman Jelena McWilliams acknowledged industry concerns with the proposal meant to improve how banks comply with the trading ban.

March 11 -

In the face of tough questioning from House members, CFPB Director Kathy Kraninger appeared mostly unfazed and tried to strike a balance between heeding concerns about the agency’s power and supporting its mission to help consumers.

March 7 -

Sen. Sherrod Brown, D-Ohio, said "the best place for me to continue fighting for Ohio and for the dignity of workers ... is to stay in the U.S. Senate."

March 7 -

The interagency panel formed to head off approaching systemic risks must figure out its next move after having undone designations of nonbank firms.

March 5 -

FASB this week is also expected to discuss credit loss standards while a House subcommittee will discuss student borrowers and loan servicing, and more.

March 4 -

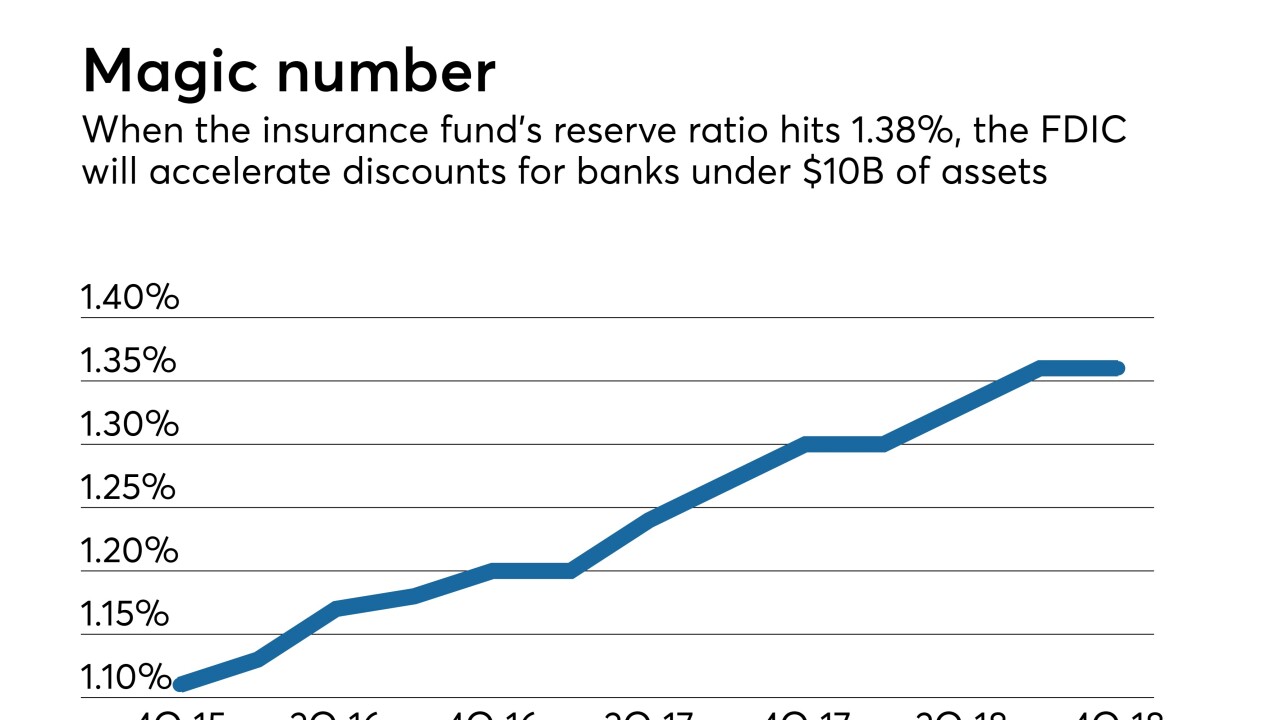

The FDIC reserve fund is nearing a threshold that will trigger a temporary reprieve on deposit insurance premiums for banks with less than $10 billion of assets.

February 28 -

“The board's record of summarily approving mergers raises doubts about whether it will serve as a meaningful check on this consolidation that creates a new too big to fail bank,” Sen. Elizabeth Warren said in a letter to the Fed.

February 8 -

House Financial Services Chairwoman Maxine Waters said the merger is a direct result of a regulatory relief bill that was signed into law in May.

February 7 -

In a major victory for small-dollar lenders, the agency plans to rescind underwriting requirements that were the centerpiece of the rule drafted by a Democratic appointee.

February 6 -

In a major victory for small-dollar lenders, the agency plans to rescind underwriting requirements that were the centerpiece of the rule drafted by a Democratic appointee.

February 6 -

The Consumer Financial Protection Bureau has published a new "frequently asked questions" tool to help mortgage lenders with TILA-RESPA integrated disclosures compliance.

February 1 -

When a Columbia University professor surveyed 1,000 payday loan customers, little did he know that the resulting research report would become a lightning rod in the drafting of rules for small-dollar lenders.

January 23 -

With a permanent director confirmed, the agency should take steps to establish a small-business data collection rule mandated by the Dodd-Frank Act.

January 23 U.S. Chamber of Commerce

U.S. Chamber of Commerce -

The agency is expected soon to propose a revamp of the 2017 regulation that would eliminate the ability-to-repay provisions, which small-dollar lenders saw as a direct threat to their business.

January 14