-

FASB this week is also expected to discuss credit loss standards while a House subcommittee will discuss student borrowers and loan servicing, and more.

March 4 -

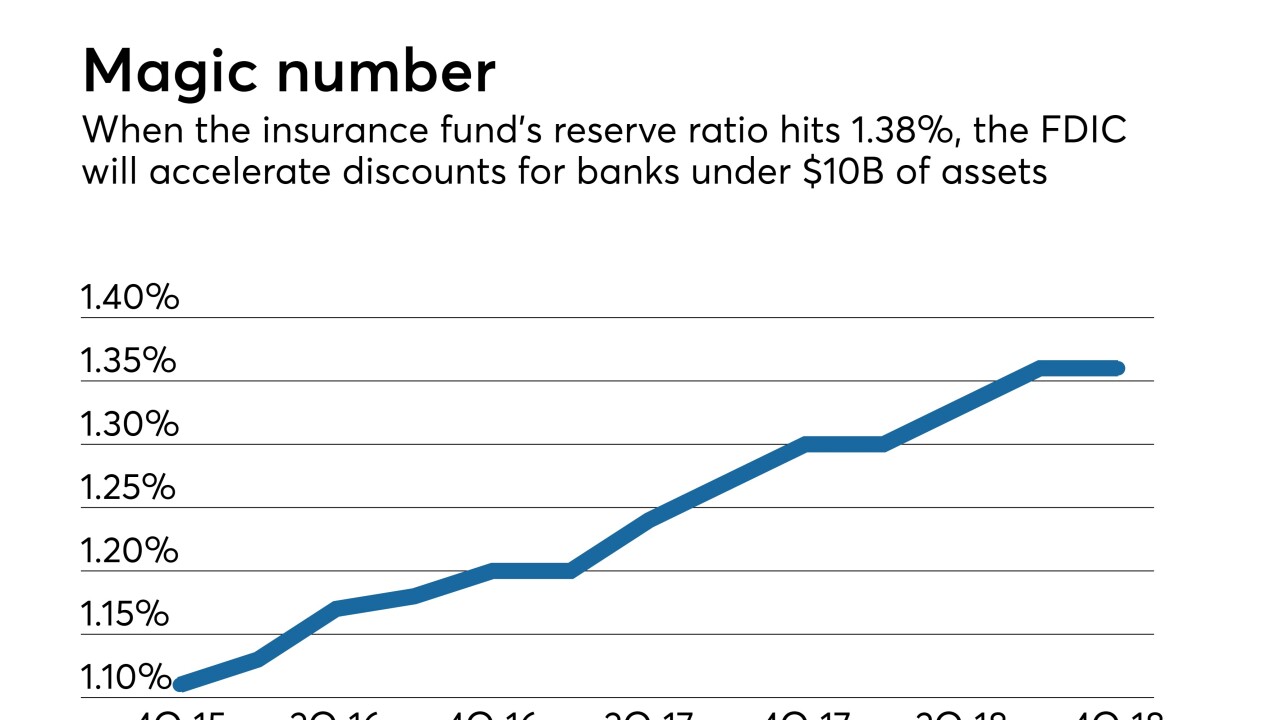

The FDIC reserve fund is nearing a threshold that will trigger a temporary reprieve on deposit insurance premiums for banks with less than $10 billion of assets.

February 28 -

“The board's record of summarily approving mergers raises doubts about whether it will serve as a meaningful check on this consolidation that creates a new too big to fail bank,” Sen. Elizabeth Warren said in a letter to the Fed.

February 8 -

House Financial Services Chairwoman Maxine Waters said the merger is a direct result of a regulatory relief bill that was signed into law in May.

February 7 -

In a major victory for small-dollar lenders, the agency plans to rescind underwriting requirements that were the centerpiece of the rule drafted by a Democratic appointee.

February 6 -

In a major victory for small-dollar lenders, the agency plans to rescind underwriting requirements that were the centerpiece of the rule drafted by a Democratic appointee.

February 6 -

The Consumer Financial Protection Bureau has published a new "frequently asked questions" tool to help mortgage lenders with TILA-RESPA integrated disclosures compliance.

February 1 -

When a Columbia University professor surveyed 1,000 payday loan customers, little did he know that the resulting research report would become a lightning rod in the drafting of rules for small-dollar lenders.

January 23 -

With a permanent director confirmed, the agency should take steps to establish a small-business data collection rule mandated by the Dodd-Frank Act.

January 23 U.S. Chamber of Commerce

U.S. Chamber of Commerce -

The agency is expected soon to propose a revamp of the 2017 regulation that would eliminate the ability-to-repay provisions, which small-dollar lenders saw as a direct threat to their business.

January 14 -

As required by the Dodd-Frank Act, the bureau released long-awaited "look-back" reviews to assess the impact of mortgage underwriting and servicing rules on the industry and the credit markets.

January 10 -

The Dodd-Frank Act gave the central bank authority to set capital requirements for insurance companies that own a federally insured bank, as well as those determined to be systemically important.

January 9 -

Before the financial crisis, federal and state regulators unabashedly pitched their charters to banks as the better choice. That's happening again, despite warnings that such jousting might result in lax oversight.

January 6 -

Both CUNA and NAFCU have responded to the bureau's request for input by raising concerns about cybersecurity, public complaints and more.

January 3 -

No matter how far the Massachusetts Democrat goes in the next presidential race, the financial regulatory issues that she trumpets will be front and center.

December 31 American Banker

American Banker -

The Massachusetts progressive said in a New Year's Eve email and video message to supporters that she’s launching an exploratory committee for a 2020 bid, which could give her an early edge in fundraising among several potential rivals for the Democratic Party nomination.

December 31 -

Linda Levy, CEO of Lower East Side People's Federal Credit Union, has no regrets about suing President Trump when he appointed Mick Mulvaney to run the CFPB, despite some negative reactions from her credit union colleagues.

December 28 -

Rep. Maxine Waters, D-Calif., will take the gavel on the Financial Services Committee next term.

December 24 -

Kathy Kraninger's first official action as head of the Consumer Financial Protection Bureau is to reverse course on acting chief Mick Mulvaney's effort to rename it the Bureau of Consumer Financial Protection, which consumer groups and others had sharply criticized as confusing and costly.

December 19 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17