Mass transit usage cratered during the coronavirus pandemic, but there’s signs of recovery based on how people are paying for their fares.

Second-quarter earnings fell by more than 50% from the same period last year after the company allocated $5.1 billion for potential loan losses.

With the COVID-19 health pandemic wreaking havoc on jobs, investments, consumer debt and lending, secured credit cards can address a vital need for people who may not have considered the product in the past.

While the use of behavioral biometrics such as keystroke patterns has become commonplace for web-based security, this has less applicability to mobile commerce given the different form factor and interface of a smartphone, says Incognia's André Ferraz.

The credit union regulator revised its summary of what examiners will focus on to reflect legal and regulatory changes that have taken place since the COVID-19 outbreak began.

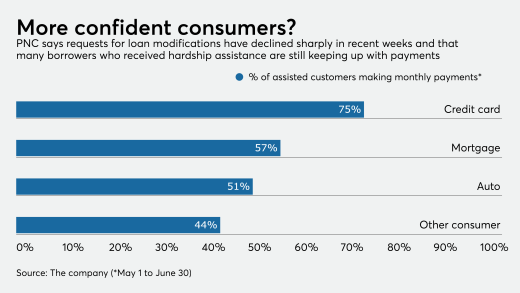

The Pittsburgh bank says fewer borrowers are asking for help and that many borrowers who received assistance are making payments again. But with the coronavirus pandemic still raging in much of the country, CEO William Demchak and other bankers are tempering their optimism.

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

EMVCo has developed guidelines that allow the travel industry to provide more data to issuers authorizing ticketing transactions as a way to reduce fraud in air travel, hotel and car rental purchases.

-

Mass transit usage cratered during the coronavirus pandemic, but there’s signs of recovery based on how people are paying for their fares.

July 16 -

Second-quarter earnings fell by more than 50% from the same period last year after the company allocated $5.1 billion for potential loan losses.

July 16 -

With the COVID-19 health pandemic wreaking havoc on jobs, investments, consumer debt and lending, secured credit cards can address a vital need for people who may not have considered the product in the past.

July 16 -

While the use of behavioral biometrics such as keystroke patterns has become commonplace for web-based security, this has less applicability to mobile commerce given the different form factor and interface of a smartphone, says Incognia's André Ferraz.

July 16 Incognia

Incognia -

The credit union regulator revised its summary of what examiners will focus on to reflect legal and regulatory changes that have taken place since the COVID-19 outbreak began.

July 15 -

The Pittsburgh bank says fewer borrowers are asking for help and that many borrowers who received assistance are making payments again. But with the coronavirus pandemic still raging in much of the country, CEO William Demchak and other bankers are tempering their optimism.

July 15 -

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

July 15