EMVCo has developed guidelines that allow the travel industry to provide more data to issuers authorizing ticketing transactions as a way to reduce fraud in air travel, hotel and car rental purchases.

Businesses affected by the pandemic are accepting online and touchless in-person payments from consumers with the help of technologies developed originally for B2B invoicing and payments.

Some criticized the Fed’s decision to temporarily lift capital restrictions for megabanks, but the move will help ease the crisis.

Video banking can be safe and effective but members and staff need to be reminded of common-sense precautions to guard against cybercriminals.

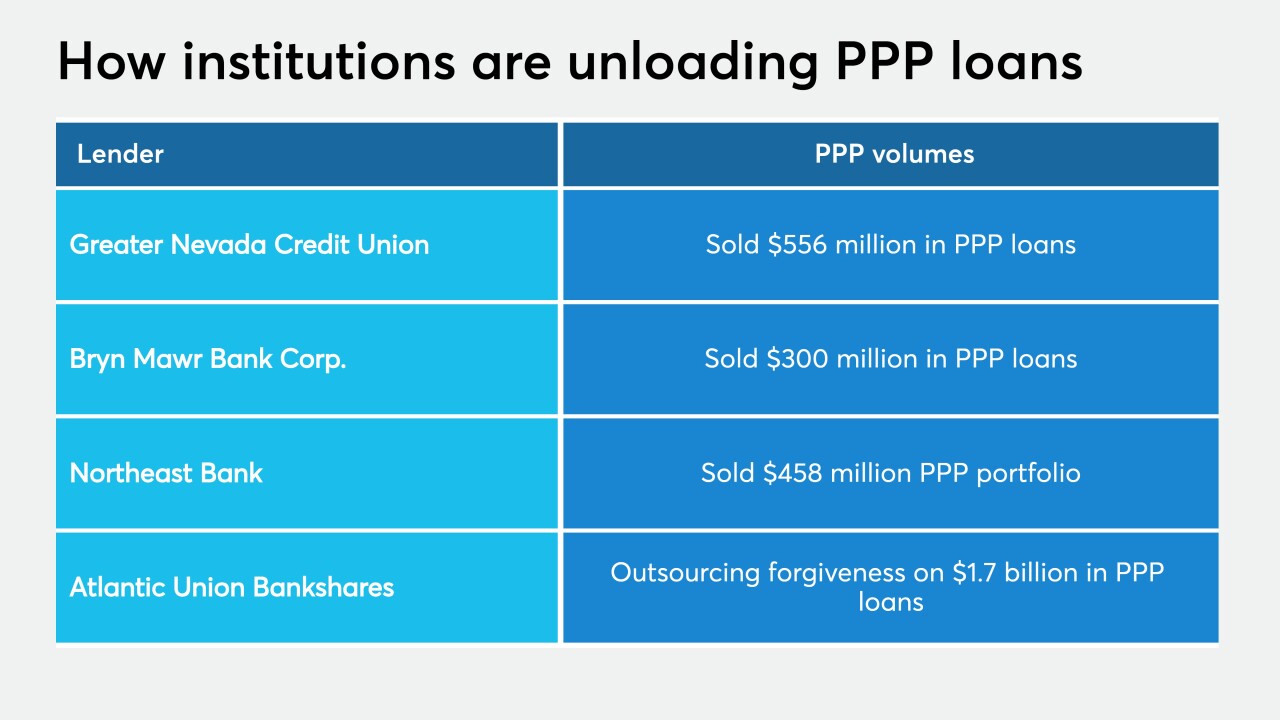

A growing number of lenders are unloading loans made through the Paycheck Protection Program.

The energy sector, retail and hospitality are among the industries that are faring poorly during the pandemic. The bank expects loan losses to remain elevated well into 2021.

Net charge-offs fell at Citigroup and Wells Fargo, thanks to forbearance and federal stimulus. Leaders of those banks are warning that delinquencies could rise once the benefits of those programs wear off.

Switching core banking systems has long been done face to face, but the pandemic has driven the process into the digital arena. The change could be permanent.

-

EMVCo has developed guidelines that allow the travel industry to provide more data to issuers authorizing ticketing transactions as a way to reduce fraud in air travel, hotel and car rental purchases.

July 15 -

Businesses affected by the pandemic are accepting online and touchless in-person payments from consumers with the help of technologies developed originally for B2B invoicing and payments.

July 15 -

Some criticized the Fed’s decision to temporarily lift capital restrictions for megabanks, but the move will help ease the crisis.

July 15 Financial Services Forum

Financial Services Forum -

Video banking can be safe and effective but members and staff need to be reminded of common-sense precautions to guard against cybercriminals.

July 15 University Credit Union

University Credit Union -

A growing number of lenders are unloading loans made through the Paycheck Protection Program.

July 15 -

The energy sector, retail and hospitality are among the industries that are faring poorly during the pandemic. The bank expects loan losses to remain elevated well into 2021.

July 14 -

Net charge-offs fell at Citigroup and Wells Fargo, thanks to forbearance and federal stimulus. Leaders of those banks are warning that delinquencies could rise once the benefits of those programs wear off.

July 14

![“Many don't see [normalization] coming until we feel like there's an antivirus vaccine that's available for the mass population," says Citigroup CEO Michael Corbat. "So the economy ... will continue to be hit.”](https://arizent.brightspotcdn.com/dims4/default/4cfb48d/2147483647/strip/true/crop/750x423+0+10/resize/520x293!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fd1%2F9d%2Fbf18d6814feeaf046e79f1b7236d%2Fmichael-corbat.jpg)

![“Many don't see [normalization] coming until we feel like there's an antivirus vaccine that's available for the mass population," says Citigroup CEO Michael Corbat. "So the economy ... will continue to be hit.”](https://arizent.brightspotcdn.com/dims4/default/5bd101e/2147483647/strip/true/crop/750x422+0+11/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fd1%2F9d%2Fbf18d6814feeaf046e79f1b7236d%2Fmichael-corbat.jpg)