There's a way to manage the tricky balance between rapid digitization and the people who still need or prefer cash, and for Ram Chary it can be found in a casino.

The Federal Reserve has returned about $42 billion to the U.S. Treasury, and will soon transfer another $20 billion in excess funds connected to emergency lending facilities that stopped offering new loans last month, it said Thursday.

Bank of America's chief operations and technology officer says even digital experts benefit from in-person collaboration. She wants her 95,000-person staff to return once it's safe.

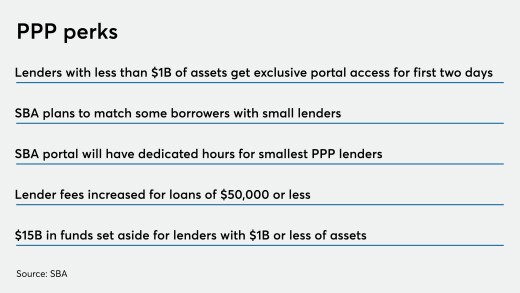

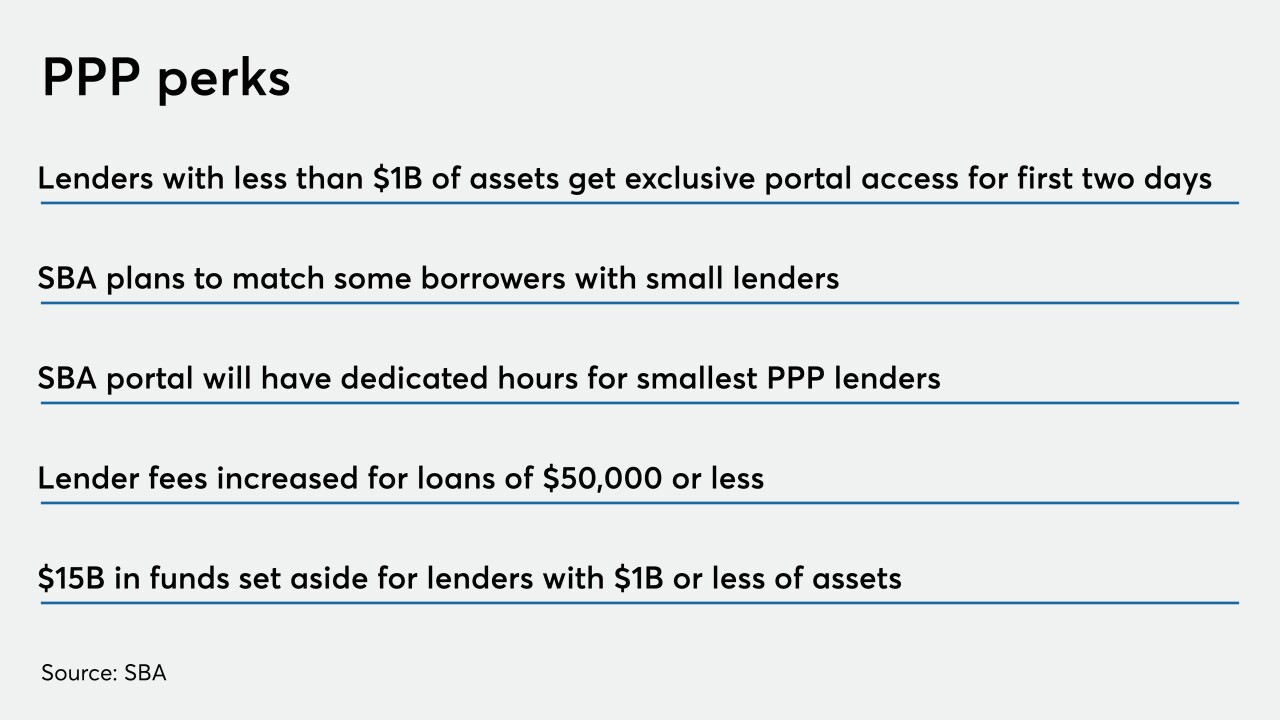

Community banks will have access to allocated funds and at least two days of exclusive portal access when the Small Business Administration relaunches the Paycheck Protection Program.

The trade group is the latest to call for financial services workers to be moved closer to the front of the line as COVID-19 vaccinations are distributed.

The year — and the coronavirus pandemic — caused a dramatic shift in attitude. Many consumers and merchants now saw contactless cards and mobile payments as a way to move ahead without the germ fears that come with touching cash and PIN pads. And even after those fears subsided, the new habits stuck around.

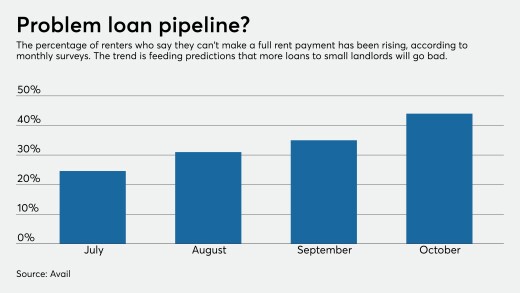

The recent stimulus law’s relief for renters and extension of the federal eviction ban were meant to ward off a housing crisis. But owners of 1- to 4-unit dwellings still face mounting mortgage and property tax debts, and delinquencies could start rising soon — followed by foreclosures.

The Georgia runoffs and resulting balance of power in Congress will help determine which bills on bankers’ wish list gain traction. But regardless, existing coronavirus relief such as the Paycheck Protection Program and a push for more economic aid will remain top of mind for lawmakers and the industry.

-

There's a way to manage the tricky balance between rapid digitization and the people who still need or prefer cash, and for Ram Chary it can be found in a casino.

January 8 -

The Federal Reserve has returned about $42 billion to the U.S. Treasury, and will soon transfer another $20 billion in excess funds connected to emergency lending facilities that stopped offering new loans last month, it said Thursday.

January 7 -

Bank of America's chief operations and technology officer says even digital experts benefit from in-person collaboration. She wants her 95,000-person staff to return once it's safe.

January 7 -

Community banks will have access to allocated funds and at least two days of exclusive portal access when the Small Business Administration relaunches the Paycheck Protection Program.

January 7 -

The trade group is the latest to call for financial services workers to be moved closer to the front of the line as COVID-19 vaccinations are distributed.

January 5 -

The year — and the coronavirus pandemic — caused a dramatic shift in attitude. Many consumers and merchants now saw contactless cards and mobile payments as a way to move ahead without the germ fears that come with touching cash and PIN pads. And even after those fears subsided, the new habits stuck around.

January 5 -

The recent stimulus law’s relief for renters and extension of the federal eviction ban were meant to ward off a housing crisis. But owners of 1- to 4-unit dwellings still face mounting mortgage and property tax debts, and delinquencies could start rising soon — followed by foreclosures.

January 4