The Georgia runoffs and resulting balance of power in Congress will help determine which bills on bankers’ wish list gain traction. But regardless, existing coronavirus relief such as the Paycheck Protection Program and a push for more economic aid will remain top of mind for lawmakers and the industry.

Nearly 70% of consumers surveyed said they were confident in their ability to pay their full monthly statement in December, up 5 percentage points from November, according to monthly data from the online lending marketplace LendingTree.

The new legislation includes a provision sparing lenders from having to pay such fees on Paycheck Protection Program loans, except in cases where they agree in advance with borrower representatives to do so.

The year 2020 was disruptive and chaotic. And while it derailed or delayed some companies' plans for growth, it also created opportunities for new combinations — or, at the very least, didn't slow them down.

Gilles Gade, one our community bankers to watch in 2021, led an effort that made Cross River Bank one of the biggest Paycheck Protection Program participants. He is ready for his team to pick up where it left off when the new stimulus package kicks in.

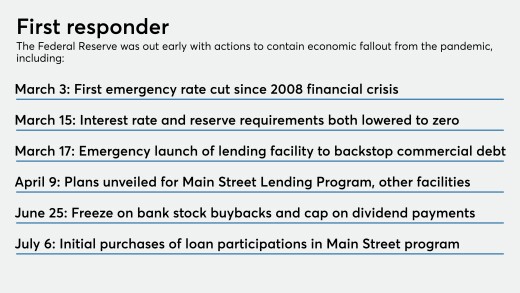

The Federal Reserve is credited with containing damage to the financial system from the coronavirus pandemic, but experts say the limits of the central bank’s power to prop up the economy will likely become more apparent in the new year.

In the early days of the pandemic, when consumers seemed loath to touch cash or a PIN pad, it seemed that PIN authentication might have had few days left. But that hasn't been the case.

The legislation would let banks postpone the start date of the Current Expected Credit Losses accounting standard and delay categorizing pandemic-related loan modifications as troubled debt restructurings.

-

The Georgia runoffs and resulting balance of power in Congress will help determine which bills on bankers’ wish list gain traction. But regardless, existing coronavirus relief such as the Paycheck Protection Program and a push for more economic aid will remain top of mind for lawmakers and the industry.

January 4 -

Nearly 70% of consumers surveyed said they were confident in their ability to pay their full monthly statement in December, up 5 percentage points from November, according to monthly data from the online lending marketplace LendingTree.

December 30 -

The new legislation includes a provision sparing lenders from having to pay such fees on Paycheck Protection Program loans, except in cases where they agree in advance with borrower representatives to do so.

December 29 -

The year 2020 was disruptive and chaotic. And while it derailed or delayed some companies' plans for growth, it also created opportunities for new combinations — or, at the very least, didn't slow them down.

December 29 -

Gilles Gade, one our community bankers to watch in 2021, led an effort that made Cross River Bank one of the biggest Paycheck Protection Program participants. He is ready for his team to pick up where it left off when the new stimulus package kicks in.

December 28 -

The Federal Reserve is credited with containing damage to the financial system from the coronavirus pandemic, but experts say the limits of the central bank’s power to prop up the economy will likely become more apparent in the new year.

December 28 -

In the early days of the pandemic, when consumers seemed loath to touch cash or a PIN pad, it seemed that PIN authentication might have had few days left. But that hasn't been the case.

December 24