-

The bank is adding senior tech executives from Amazon and Verizon as partners; bank allegedly inflated prices and overcharged investors for mortgage bonds.

September 13 -

Lenders considering other factors for those with bad or no credit history; the bank plans to sell its French retail unit.

September 12 -

Dimon doesn’t expect it to happen, but the bank is getting ready just in case; the state will require banks to disclose their relationship with gun sellers.

September 11 -

Mnuchin hopes to strike a deal soon to recapitalize the two mortgage giants, a prelude to privatization; the bank’s focus on mid-tier corporations is starting to bear fruit.

September 10 -

The six biggest banks are expected to issue disappointing forecasts as rates continue to decline; technology stock mutual funds scored with payment plays.

September 9 -

The mortgage agencies would be privatized under Trump administration plan; central bank will probably cut rates by 25 bps, not 50 bps, at its next meeting.

September 6 -

About 15% of the bank’s partners are likely to leave this year to make room for new ones; the bank said it is looking into why it charges some customers even after their accounts are closed.

September 5 -

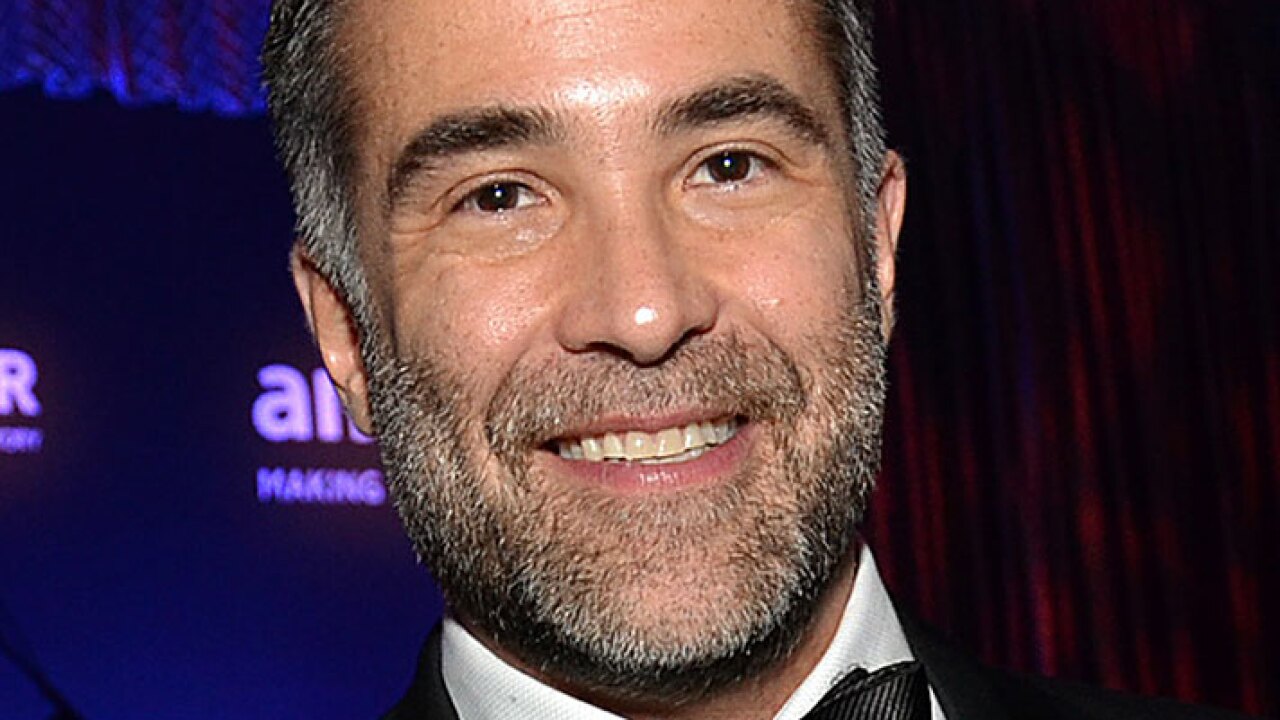

The co-head of the bank’s securities division, 55, was once seen as a possible CEO; the institutions are gobbling up small banks at a record pace, prompting pushback from banks.

September 4 -

A growing number of companies, led by Walmart, are offering payroll advance loans to their workers; Christian Sewing said he will invest 15% of his net earnings in the German bank’s struggling shares.

September 3 -

The bank elevated three senior executives who could be possible successors to CEO Sergio Ermotti; the move to a new rate benchmark won’t trigger a “tax event.”

August 30 -

New unit will work with foreign governments; standards too soft on those without conventional paychecks.

August 29 -

Politics not considered, a spokesman said in response to Dudley’s call for the Fed to stop enabling trade war; the agency lifts a two-year hiring freeze.

August 28 -

An economic downturn is likely to force industry consolidation; the legit firms only offer borrowers things they can get for free, while others are scams.

August 27 -

The banks considered an “unusual” investment banking merger; Volcker rule win will be followed by fights on capital rules, liquidity and stress tests.

August 26 -

After years of keeping a low profile, banks plan to spend in next year’s elections; the digital currency has eyes on the unbanked.

August 23 -

While bank stocks flounder, their bonds are seen as a haven against a possible recession; the senator asks bank about overdraft fees on closed accounts.

August 22 -

The FDIC and the OCC relax the rule restricting proprietary trading; home buyers with bad credit, lots of debt, or employment issues are again getting loans.

August 21 -

The power couple wants to help turn Acorns Grow from a niche app into a megabank; with many floating-rate loans, regionals’ profits drop as yields slip.

August 20 -

The president discussed the recent market turmoil with three large bank CEOs; a daily and a monthly bitcoin contract expected next month.

August 19 -

Employees saw the bank’s cybersecurity unit's shortcomings; the state seeking records related to hidden profits from the family's opioid business.

August 16