-

The Federal Reserve Bank of Chicago president stuck by his view that the U.S. central bank has moved past its singular focus on price pressures.

October 10 -

Federal Reserve chair Jerome Powell flagged a recent upward revision to income and savings data as a sign of economic strength. He said the information could factor into the central bank's monetary policy discourse during the Fed's next interest rate meeting in November.

September 30 -

After cutting rates 50 basis points in September, the Federal Open Market Committee meets after Election Day to determine monetary policy. Join us live on Nov. 8 at 1 p.m., as Gary Pzegeo, head of fixed income at CIBC Private Wealth U.S., provides his take on the latest move.

-

This week, Federal Reserve Gov. Michelle Bowman cast the first dissenting vote at an FOMC meeting in years. On Friday, she explained why the economic data she's seen didn't convince her of the need to cut rates as much as her fellow governors thought.

September 20 -

Racquel Oden, HSBC's head of wealth and personal banking in the U.S., talks about how to guide clients through a year of political and economic upheaval.

-

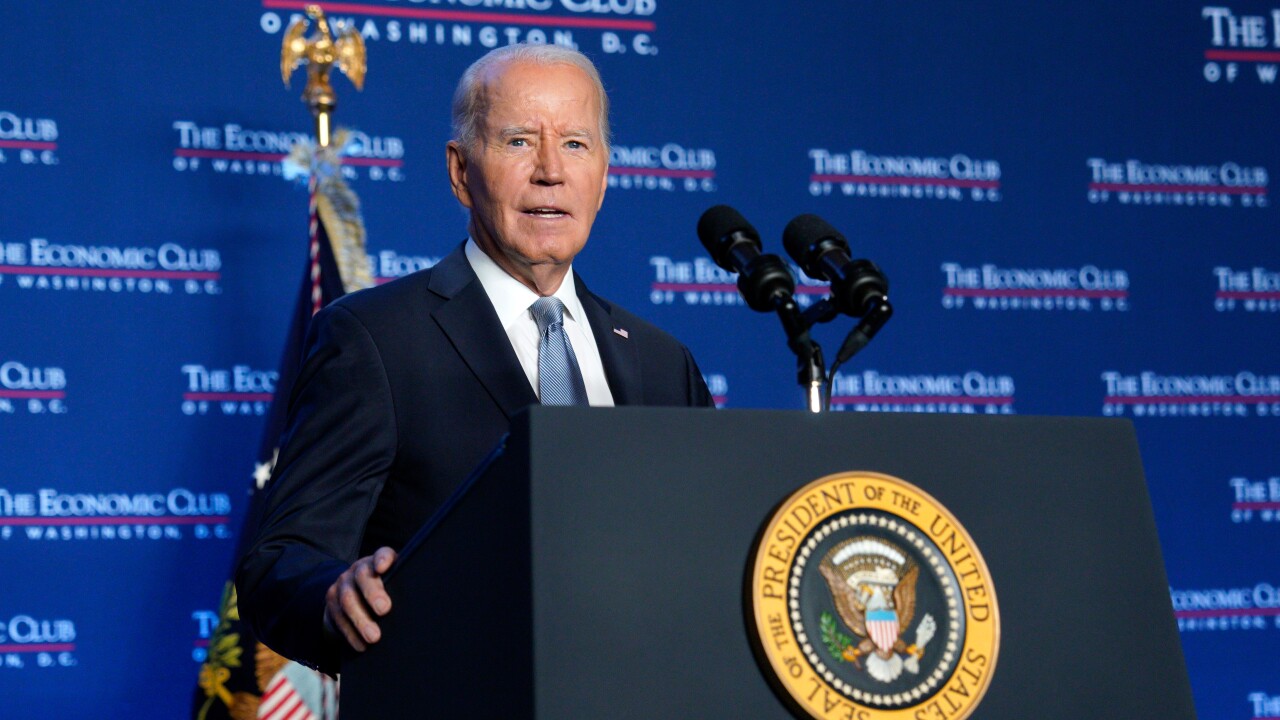

President Joe Biden, in a speech emphasizing the progress made on the economy during his administration, said he has never called Federal Reserve Chairman Jerome Powell during his time as president.

September 19 -

The move signals the end of the Federal Reserve's battle against runaway inflation in the wake of the COVID-19 pandemic. Fed officials expressed divergent views on further action this year.

September 18 -

Lower inflation doesn't equate to lower prices, and costs of living may still be higher than pre-pandemic, especially rents. But the varying cooldown could help.

September 11 -

Underlying U.S. inflation unexpectedly picked up in August on higher prices for housing and travel, undercutting the chances of an outsize Federal Reserve interest-rate cut next week.

September 11 -

Other estimates suggest nonbank mortgage employment grew in July as the industry cautiously added staff to handle incremental growth in demand for loans.

September 6