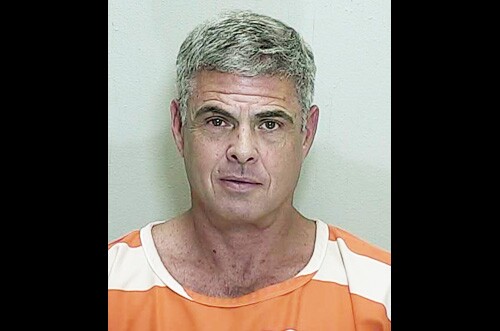

Time for Tarp Fraudster

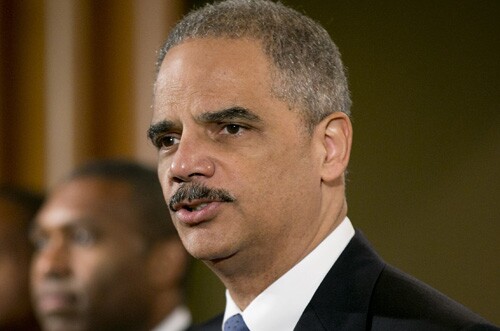

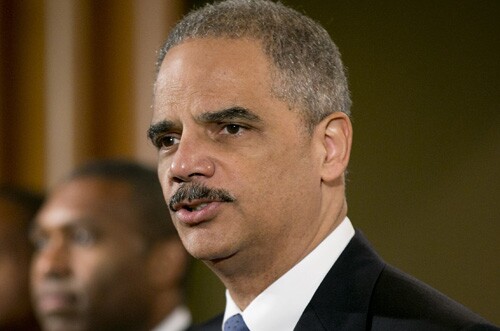

Georgia's Bank Fraud Problem

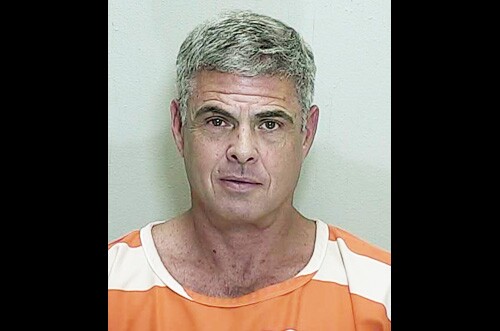

Busted for Mortgage Fraud

Bribes and Tax Evasion

30 Months for Book-Cooking

Nailed for Masking Bad Assets

Paying for a Lie

President Trump's tariffs on imported vehicles threaten to drive up auto prices at a time when more car owners are already drifting into delinquency on their loans.

Fears of a recession intensified after President Trump unveiled his plan to impose a minimum 10% tariff on all U.S. imports, and the KBW Nasdaq Bank Index tumbled by nearly 10%.

The federal Small Business Investment Company program has seen a spike in interest since a new rule incentivizing support for early stage companies took effect in 2023. Now there is growing political support for ways to further bolster the program.

The Consumer Financial Protection Bureau said in a court filing that it will repropose a rule requiring lenders to report small-business loan data, citing legal challenges.

Employees are using ChatGPT without telling their managers and the IT team. That's not necessarily a bad thing.

The bank technology is launching its signature payment platform in a country where rivals like Square and PayPal are also actively chasing business payments.