The real-world-impact of real-time payments

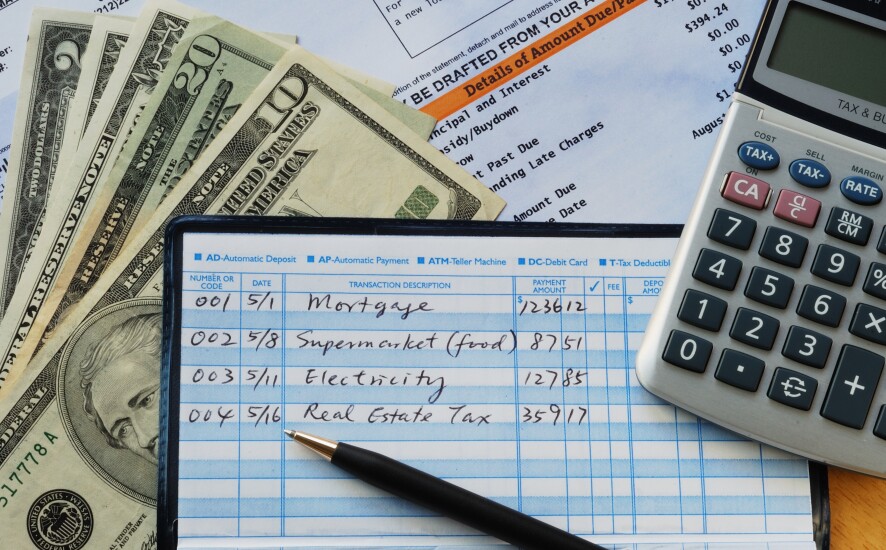

Commercial banking clients are likely to reap the biggest and most immediate benefits from the change, bank executives say, noting that real-time settlements will help businesses trim expenses. Consider the mounds of paper checks and invoices that could be eliminated — not to mention the costs associated with high-cost wire transfers.

Consumers also stand to benefit. Instantaneous updates to their checking accounts will help them keep closer tabs on their spending and avoid overdrafts, executives said.

For banks themselves, of course, the picture is a bit more mixed. In order to differentiate themselves in the industry and keep pace with client demands, banks have invested heavily to upgrade their technology. They also have done so with the expectation that, as clients grow more comfortable with faster payments, various sources of fees — from interchange to overdrafts and merchant acquiring — may decline over time.

Bankers shared their thoughts on the impact of faster payments during an industry conference last week. The event was sponsored by The Clearing House, which last month received a green light to move forward with its real-time payments network,

Here’s an overview of what bankers and other payments executives are expecting.

Businesses (finally) ditch paper checks

Many businesses have continued to use checks for bookkeeping purposes, and for the transparency that comes with physically attaching a check to an invoice. With the adoption of faster payments, however, companies will have the tools they need to modernize their accounts receivable systems.

With the help of their banks, businesses will be able to link invoices with the relevant, real-time digital transactions, according to J.P. Jolly, global head of financing and channels at Bank of America.

Offering real-time commercial payments will be crucial to banks that want to gain market share, Jolly said.

“If you want to be a deposit-taking institution for your clients, you have to at some point provide this alternative,” he said.

Charles Ellert, payments strategy leader at Verizon, underscored the point. He said the telecom behemoth currently receives a large portion of its business payments through wire transfers. But when real-time payments become available, businesses of all sizes will likely jump on the opportunity use a potentially cheaper and more efficient option.

“I just know in my gut I know these folks are probably paying $35 to send us a wire, because they want the finality of the process,” Ellert said. “It just eats me alive that they are paying those fees to send us money."

Consumers become better money managers

“When you look at it from a consumer’s perspective, the benefit of real-time payments is that it carries the benefits of cash, but it’s digitized,” said Jim Reuter, the CEO of FirstBank in Lakewood, Colo.

For banks, that presents an opportunity to help customers manage their money as they spend it, through text messages or other push alerts, Reuter said. A bulk of FirstBank’s business comes from consumers, and offering real-time payments could help the $17 billion-asset bank attract new deposits.

A big question is whether banks will charge consumers for the option of making payments in real time. If they do, Reuter said, fees should be low enough to make small transactions affordable.

Less hassle in opening accounts online

But there are limitations. Transferring funds from one bank to another can be cumbersome, so a consumer who opens an account online faces a choice of having to visit a branch to make a deposit, or never funding the account at all.

The adoption of real-time payments will make it easier to move money from one bank to the next, which Reuter said should help consumers finish the last step of the online account-opening process.

“One of the things we get excited about with this push is funding those new online accounts,” Reuter said. “That’s a use case we’re brainstorming.”

Another option for online purchases

As consumers grow more comfortable with real-time payments, merchants may offer a new checkout option for online shoppers that do not involve a credit or debit card, according to Bank of America’s J.P. Jolly.

From the merchant’s perspective, a direct withdrawal from a shopper's bank account offers the benefit of real-time collections. It could also cut out the costs associated with processing debit and credit card payments.

Of course, many consumers already conditioned to using credit and debit cards to make purchases online might balk at giving up information that would give merchants direct access to their bank accounts. But they might be willing if the merchant offered an incentive to not use debit or credit, such as a discount or rewards points that could later be redeemed.

“The bigger opportunity is that you have a lot of merchants who are maybe going to look at an opportunity to try to change consumer behavior,” Jolly said.

Jolly noted that a shift to real-time payments in e-commerce could have an impact on B of A’s merchant acquiring business, which helps process card payments for businesses. But he said that the move, overall, could allow the bank’s commercial clients to become more efficient.

The return of checking account fees?

The widespread adoption of real-time payments, whenever it happens, will likely make consumers’ and businesses’ lives easier, but it could also put a damper on banks’ fee-based revenue.

For consumers, up-to-date checking account balances will help them avoid overdrafts. Online retailers’ use of faster payments technology could eliminate interchange fees. And companies that pay their bills using new technologies could avoid wire-transfer charges.

Banks, of course, will want to find new ways to recoup all that lost revenue, and FirstBank's Reuter said they will need to give serious consideration to reintroducing fees on checking accounts.

“As an industry, we’re not going to just sit by and let our revenues disappear,” he said. “I think there will be a restructuring of how we price accounts, to be very honest.”

It's happening. Train clients and employees accordingly

That’s according to Charles Ellert, payments strategy leader at Verizon.

“The banks ... are talking to Verizon, but I don’t know that they are talking to the small and medium-size businesses about the opportunity,” Ellert said. “That message needs to be clear, consistent, and it also needs to be clear and consistent with consumers.”

B of A has spent time training its front-line business bankers about how faster payments will work, to make sure clients are aware of their options, according to J.P. Jolly.

“What we’ve been doing is making sure that our bankers, our treasury sales officers, are aware of efforts around real-time payments,” Jolly said. “They’ve been briefed, and they know we have a timeline.”