Killer compliance costs

The toll on human capital

Not just a bank problem

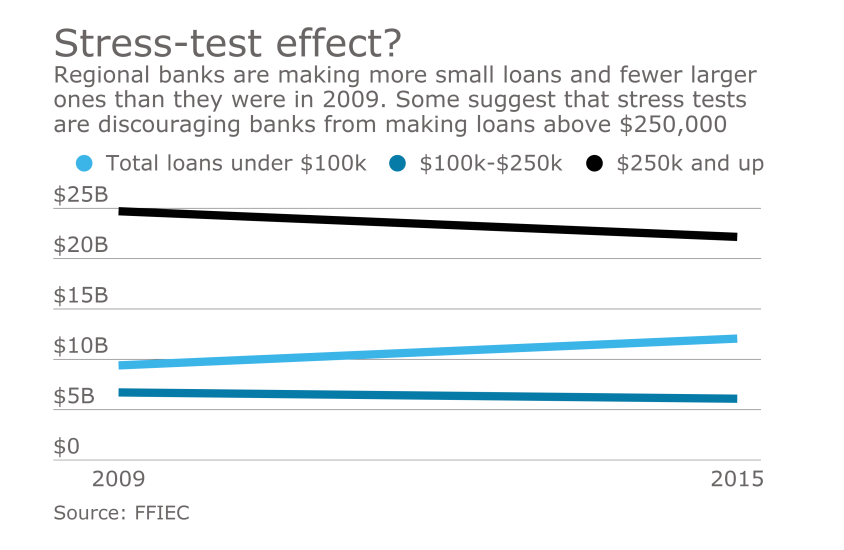

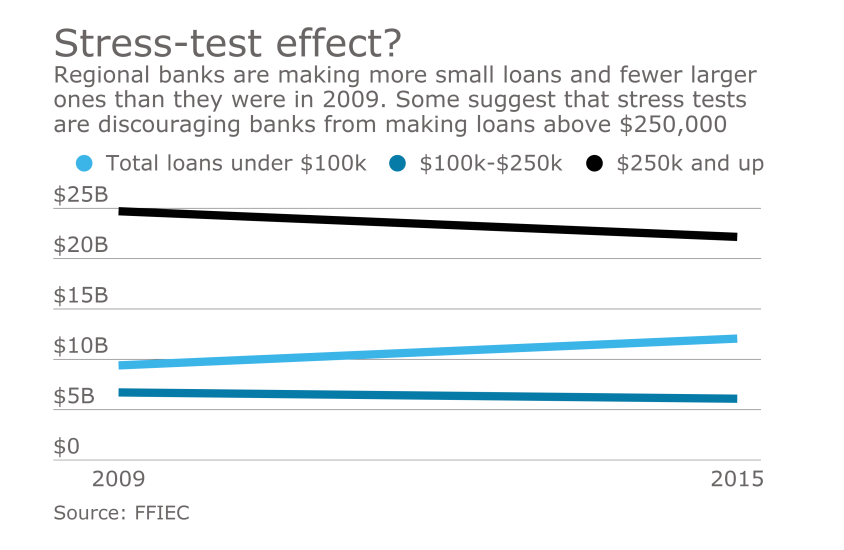

Stressed-out small businesses, part one

Stressed-out small businesses, part two

Losing ground in mortgages

Generative artificial intelligence has usurped its traditional counterpart as the next growing technology taking the payments industry by storm.

The Seattle-based company, which had made home loans for more than a century, announced it was quitting the mortgage business in January. It booked nearly 400 small business loans in the first quarter and expects that total to grow as its team gains traction.

The Pittsburgh-based bank cited "changes in macroeconomic factors and portfolio activity" for the 41% increase in provisions for credit losses.

Affirm is reporting consumers' buy now/pay later loans to Experian, following a February study with FICO. It's one of the first steps in credit reporting for BNPL, potentially complicating banks' assessments for other types of lending.

In a settlement with bank trade groups that sued the Consumer Financial Protection Bureau, the Trump administration has agreed to drop the credit card late fee rule with prejudice.

An industry consultant thinks Edward Jones' latest bid to start a bank is an attempt to add revenue sources as the traditional brokerage business becomes less lucrative.