However, it would appear that momentum is continuing unabated for blockchain projects and initial coin offerings, as the potential for blockchain continues to be realized.

Following is a look at the landscape of the blockchain and ICOs to gauge where they are headed in 2018 and beyond.

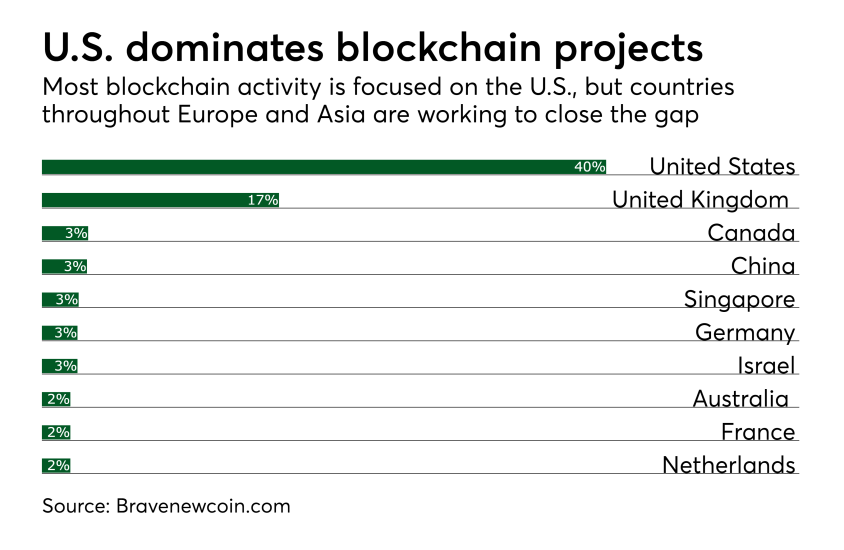

There are also a notably high number of Asian countries closing in on the dominant North American and European ones.

These are not necessarily surprising goals since there is a universal need for for speed, security and cost reduction across all businesses. The question remains — will the promise of blockchain meet these lofty expectations?

However, 2018 ICO funding levels have already dwarfed these figures ...

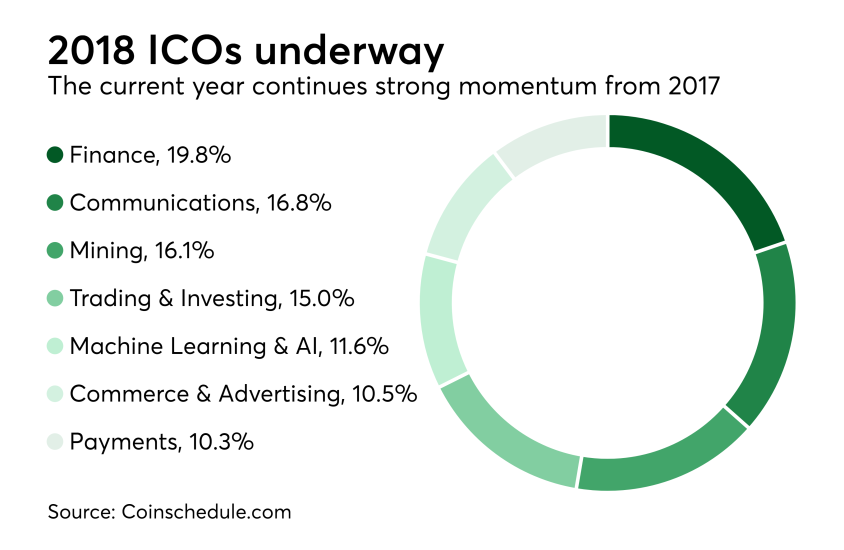

This marks a change from 2017, when the top three categories for ICO funding were infrastructure, finance and trading. Also, it is early to say, but there may be a move away from more frivolous — and plain fraudulent — ICOs, as regulators such as the SEC become increasingly stringent on the quality and availability of these offerings.

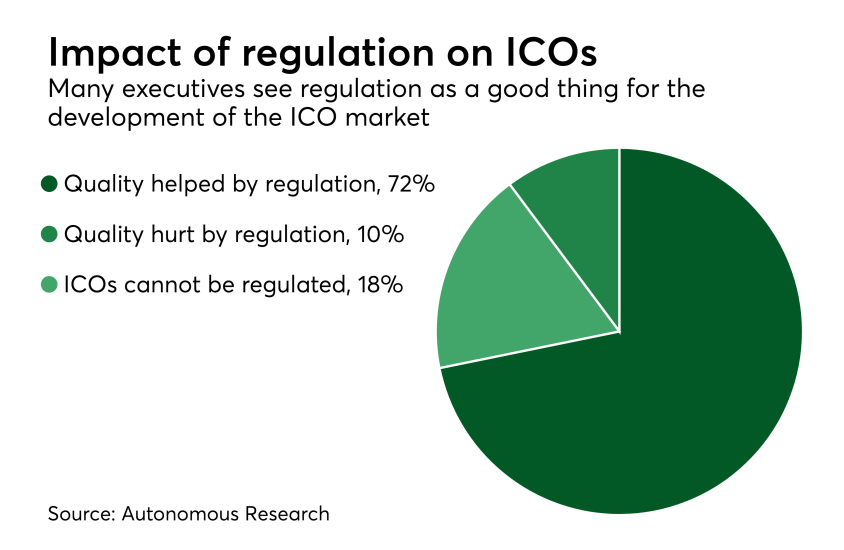

In a survey conducted by Autonomous Research of executives familiar with ICOs, nearly three-quarters agreed that the quality of ICOs would be helped by regulation, with just 10% saying the quality would be hurt. Reflecting the somewhat anti-establishment roots of the crypto community, a further 18% stated that ICOs cannot be regulated.