No. 1: High Unemployment

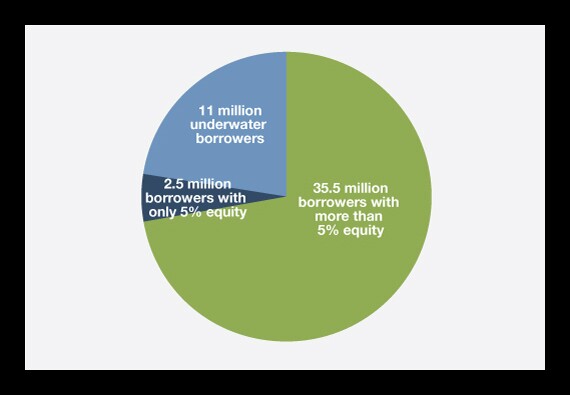

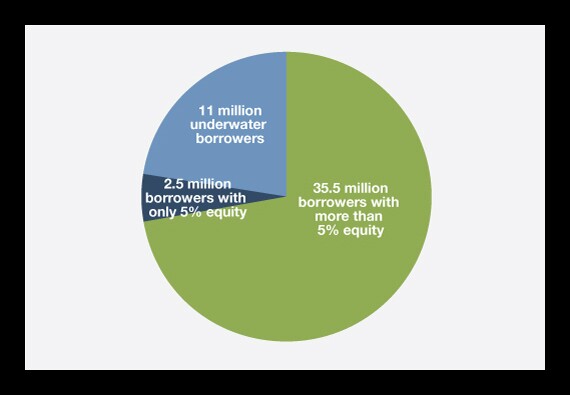

No. 2: Underwater Borrowers

No. 3: Shadow Inventory

No. 4: Stagnant Incomes

In its latest financial stability report, the Federal Reserve found that asset prices continue to exceed underlying fundamentals and leverage levels remain high, especially by hedge funds.

The Consumer Financial Protection Bureau's exit from a suit jointly filed with the New York attorney general's office narrows a major subprime lending case.

Even with its IPO on ice, the Swedish buy now/pay later lender is building a base of high-profile distribution partners.

The acquisition of the $5.7 billion-asset HarborOne Bancorp would be Eastern's third purchase of a Boston-area bank in the last five years.

Ranjana Clark is the newest member of Texas Capital Bancshares' board of directors; Minnesota's Wings Credit Union and Colorado's Ent Credit Union are merging; Regions Bank adds Angela Santone to its C-suite; and more in this week's banking news roundup.

The Long Island-based regional bank, which reported another quarterly loss Friday, continues to hire in the commercial-and-industrial lending sphere as it seeks to diversify its commercial real estate-heavy business.