Key reasons for the lack of momentum include patchy retailer support and the fact that consumers show little interest in alternatives to physical cards at the point of sale. But new data released by the Federal Reserve Bank of Boston reveals that in 2016, during the second full year of mobile wallets' short history, U.S. banks and credit unions across seven Fed districts harbored serious concerns about mobile payments security and other perceived issues.

Most respondents were still weighing their strategies for mobile payments, but more than half were already committed to the concept. A quarter offered mobile payments, 40% planned to do so by the end of 2018 and 36% said they had no plans at that time to offer mobile payments.

Sixty percent of banks cited security as the most important factor influencing their decision not to offer mobile payments or wallet services; lack of customer demand was of nearly equal importance. The other top deterrents were regulatory issues, the lack of obvious benefits to the financial institution or a solid business case/return on investment and the absence of consistent standards and interoperability between mobile payment systems.

Sixty-four percent of banks and credit unions said inadequate customer security behavior controls were the most important area of concern, followed closely by card-not-present fraud. Fifty-seven percent of respondents cited inadequate mobile device security as a top concern, with data breaches, account-takeover fraud and inconsistent customer authentication methods also ranking high in importance.

However, Google recently complicated its own mobile marketing strategies when it announced that Google Pay will be the new umbrella brand for in-store, online and in-app payments. Merchants are required to add the new “G Pay” logo wherever Android Pay previously existed at checkouts and on websites, which analysts say could create some consumer confusion. Google Wallet, now reduced to a P-to-P service, also falls under this umbrella.

Banks demonstrated strong mobile payment brand recognition for Samsung Pay and PayPal, but fewer than half were familiar with other digital wallet and mobile payment checkout services operated by the card networks, merchants and third parties.

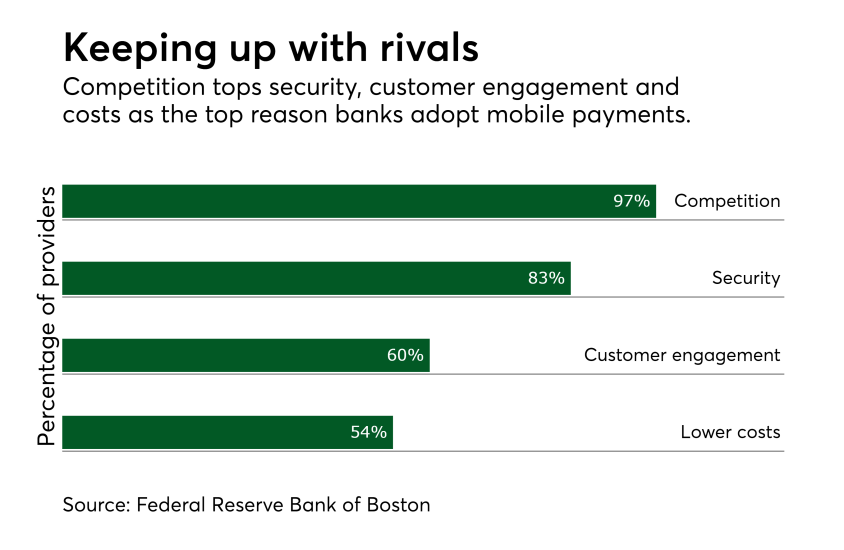

A healthy majority, or 67%, of banks and credit unions said the pressure to compete with rivals was the most important reason to support mobile payments at the time the survey was conducted, followed by 60% who said it was important because mobile payments are gaining momentum. Half of respondents cited the need to compete with nonbanks—presumably third-party mobile wallet providers and merchants—as an important reason to get on board.

Just over a third of financial institutions said it was important to provide mobile payments in response to customer demand, while another third said mobile devices represent a more secure channel for payments than other methods. Only about a quarter of respondents said mobile payments could be important to increasing customer engagement with loyalty, rewards or incentives; 20% thought mobile payments were important for cutting costs or generating revenue; and 17% said the technology was important for enabling two-way mobile communications with customers.