8 things banks need to know about Gen Z

One reason for the flashback in attitudes is that people’s views on financial matters tend to be shaped by the economic events that occurred during their childhood. And the not-too-distant economic doldrums are etched in the minds of young consumers.

“The defining things in life are the things that happen in early formative years, your early teens and mid-teens,” said Bill Handel, vice president of research at Raddon Research. “For Gen Z, that event was the financial crisis — they were 9 or 10 years old.”

The experience left them pragmatic and cleareyed.

“The notion of the American Dream, which was a baby boomer notion, disappeared a little with Gen X, but came back in full force with the millennials,” Handel said. “Gen Z doesn’t think this notion of the American Dream is something you can count on.”

As a result, they are hardworking, debt averse, frugal and already saving for retirement.

The following is an examination of eight important facts about their economic philosophy, banking habits and the financial services options at their disposal.

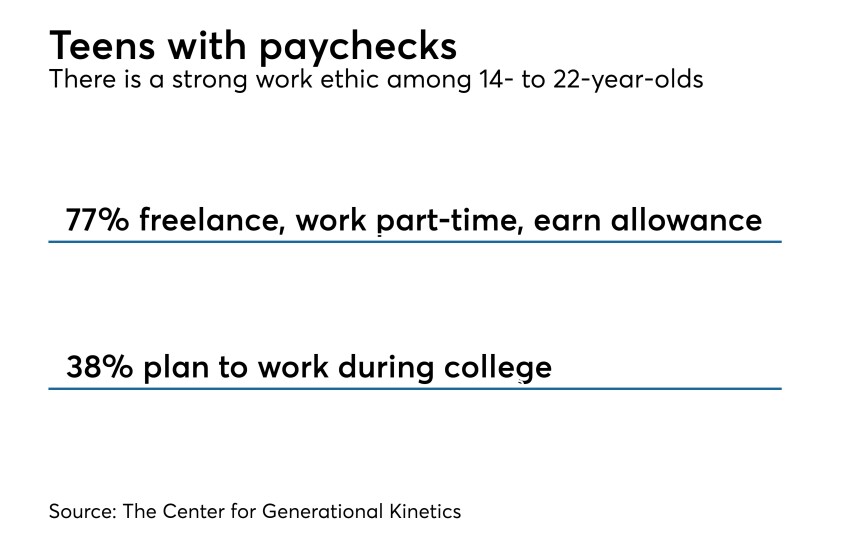

They're hard workers

In its report, “The State of Gen Z 2017: Meet the Throwback Generation,” the Center for Generational Kinetics said “the percentage of Gen Z members who are earning and spending money is about the same as the millennials we surveyed, who are ten years older.”

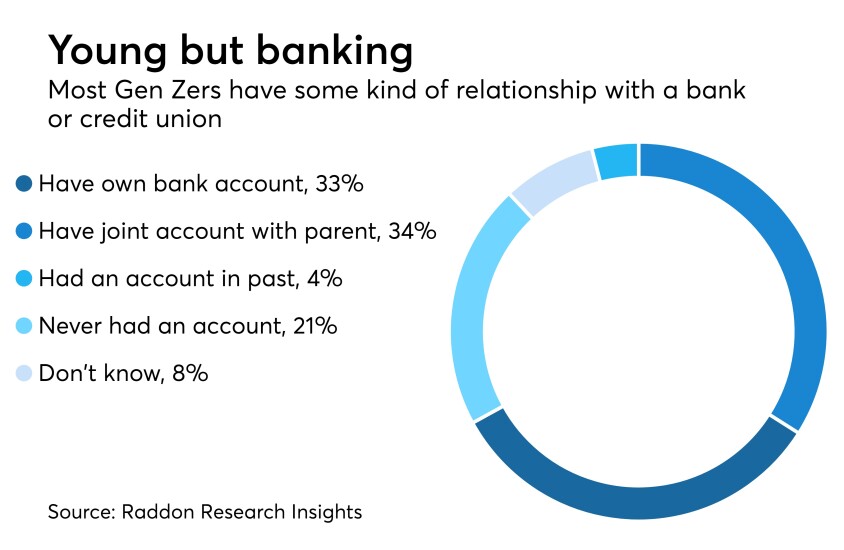

They have bank accounts

“It’s higher than we would have anticipated,” Handel said. “They seem to be a little more engaged in the system at an earlier stage.”

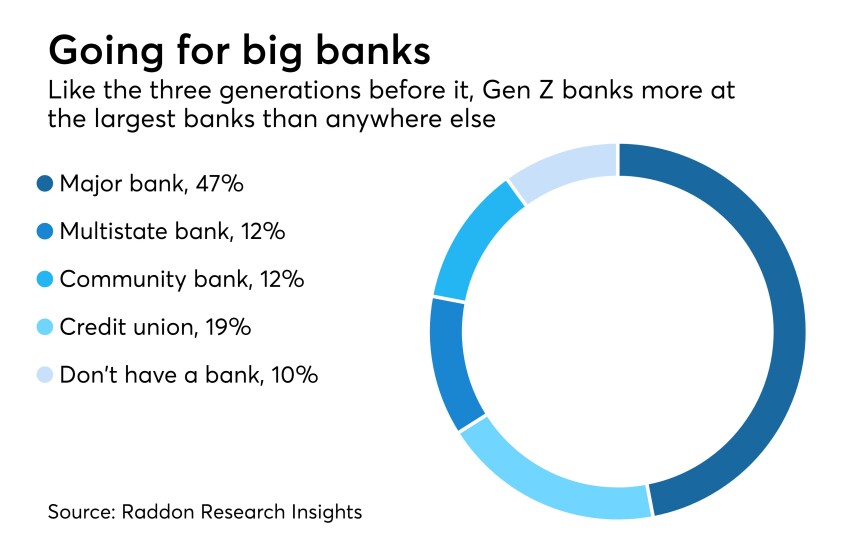

They're big-bank customers

It’s not that they like the big banks.

“Gen Zers have this notion of hating big banks — they don’t like what they stand for — but they like the technology and location convenience they offer,” Handel said. “When you look at BofA, Chase or Wells and how they advertise and promote themselves, it’s so much about technology. That’s the thing that differentiates them.”

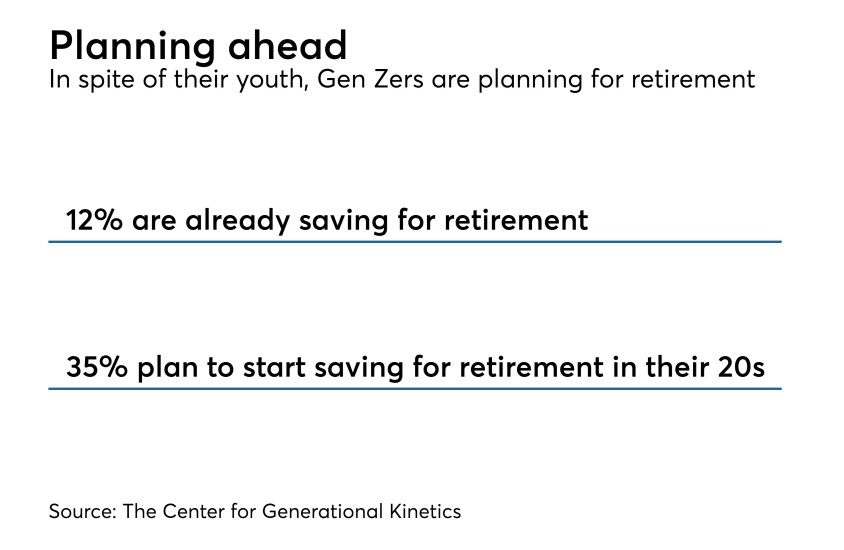

They're savers — in fact, already planning retirement

More than half of Gen Z members (52%) plan to use personal savings for retirement, 28% will continue to work in some form after retirement, such as freelance, part-time, or contract work, and 26% believe they will receive government assistance.

They dislike debt

“There’s a level of debt aversion, debt consciousness, that we didn’t see in the millennials,” Handel said. “Millennials grew up in late '90s, early 2000s, when times were good. Their parents could buy that next thing for them. That was much less true for Gen Z. We’ve seen them question things like, does it make sense to go to college? Whereas the millennials never questioned that. They said, it’s expensive but it will pay off.”

Such debt awareness could be helpful.

“If they’re able to avoid the massive amount of debt that previous generations, especially millennials, have racked up, that will be helpful for them as a generation,” Handel said.

They hate overdraft fees

“Banks have to rethink the notion that they're going to drive the profitability of a checking account through overdraft,” Handel said. “This generation will not stand for that type of thing. You need to think differently about checking accounts.”

Gen Z members use overdraft-free accounts like Bank of America’s Safe Balance at a higher rate than the general population. And many say that is the kind of account they would like to use.

“They like that there’s a governor on behavior and they won’t overspend on their credit card,” Handel said.

The checking or basic bank account may have to become a lead generator for profitable products like credit cards, rather than a self-sustaining product.

They're free spirits with a social conscience

And they take an idealistic approach to investing.

“Gen Z is the most passionate about making a difference through their investments,” said David Poole, head of Merrill Edge Advisory, Client Services & Digital Capabilities. "In fact, 88% said they only want to invest in companies that share their values, compared to 79% of millennials, 77% of Gen Xers and 69% of baby boomers. Gen Zers also prioritize investing in companies with diverse leadership and that provide three or more months of family leave."

They're being circled by fintechs

Amazon already has an Amazon Cash card that lets teenagers drop off money at stores such as 7-Eleven and CVS and add it to an Amazon wallet they can use online.

Walmart and American Express jointly offer accounts called Bluebird that are designed for teens.

The fintech startup

“We are growing well and seem to have hit upon good timing with our Gen Z bank play,” said Stuart Sopp, CEO of Current.

The Atlanta-based fintech startup Greenlight also offers debit cards for teens and parents. The personal financial management app provider MoneyLion is also going after Gen Z as well as millennials.

If banks want to appeal to this tech-savvy and mobile-centric generation, they need to act quickly.