10 to watch in 2017

Over the past several months, the retail banking giant has been hit with a class-action lawsuit alleging that it improperly adjusted the terms of mortgage loans for borrowers who were in bankruptcy, acknowledged charging some 500,000 car-loan customers for

Keeping Wells Fargo honest is priority No. 1 for Elizabeth “Betsy” Duke, the bank’s incoming board chair and one of American Banker’s 10 people to watch for 2018. A former banker and Federal Reserve governor, Duke will become of the few female chairs at a large U.S.-based bank and the first-ever at the $1.7 trillion-asset Wells. Few would doubt her credentials, but

Other big players to watch in 2018 are fintechs in banking. Among the biggest of the disruptors is Square and Jack Dorsey, its founder and CEO, who stands at the center of the debate over whether fintechs deserve to be granted a bank charter.

Others to watch in 2018 include Terry Turner at Pinnacle Financial in Nashville, John Ciulla at Webster Bank in Waterbury, Conn., and Margaret Keane at Synchrony Financial.

Some are in new roles or replacing legends, others are embracing new strategies or eyeing big deals and at least one is currently out of banking — but could soon resurface. Here are the industry executives to keep an eye on in 2018.

Elizabeth "Betsy" Duke, incoming Chair, Wells Fargo

Whenever Wells seems finally to be flying under the radar, news of

But is Duke, a former banker, Federal Reserve Board governor and member of Wells Fargo’s board since early 2015, independent enough to do what’s necessary?

Jack Dorsey, CEO, Square

If Square’s application to charter an industrial loan company is successful — over community banks’ vigorous objections — other challengers from the tech sector could follow.

The fate of the payment processor’s application rests with the Federal Deposit Insurance Corp., which for years has been perceived as being skeptical of allowing new ILCs, but could be more amenable once its new leadership, nominated earlier this month, is in place.

John Ciulla, Incoming CEO, Webster Financial

John Ciulla, Webster’s president, succeeds longtime CEO James Smith as of Jan. 1. It’s a milestone moment for the $26 billion-asset company, which was founded as the First Federal Savings and Loan of Waterbury in 1935 by Smith’s dad, Harold Webster Smith, who was only 24 at the time. He ran the bank for more than 50 years before his son took over in 1987 and proceeded to grow it from a local thrift to a regional commercial bank.

Ciulla joined Webster in 2004 when it was still largely a thrift, and among his key contributions has been expanding its commercial lending capabilities. As is the case with many smaller regionals facing stiff competition with larger rivals,

Charlie Scharf, CEO, BNY Mellon and Michael O’Grady, Incoming CEO, Northern Trust

Charlie Scharf, who has been CEO at Bank of New York Mellon since July, and Michael O’Grady, who becomes the CEO at Northern Trust as of Jan. 1, are both tasked with determining how to best use technology to increase efficiency.

Scharf was hired in part due to his fintech background, as BNY Mellon aims to continue former CEO Gerald Hassell’s digitization of its operations, including the use of robotic process automation.

Northern Trust was one of the first companies to use IBM’s blockchain, but only to manage private-equity transactions, a low-volume business. Perhaps Northern Trust will be able to find other uses for blockchain technology, like processing hundreds of thousands of transactions.

Matt Zames, former chief operating officer, JPMorgan Chase

He has yet to re-emerge in the industry, but speculation has been that he will join the growing list of former Jamie Dimon protégés who have become CEOs elsewhere. They include Charlie Scharf, first at Visa and now at BNY Mellon, and Jes Staley, at Barclays.

For now, Zames has taken a role in academia, as an executive in residence at his alma mater, MIT’s Sloan School of Management.

Margaret Keane, CEO, Synchrony Financial

Consumers use PayPal Credit to finance big-ticket items they purchase online and Synchrony is set to become the exclusive issuer of PayPal Credit for the next 10 years. This gives Synchrony a new way to reach consumers at a time when store-branded credit cards — its main business — are losing appeal, particularly among younger generations.

But the move comes with some risk, as nearly half of PayPal’s $6 billion of outstanding loans are to borrowers with credit scores below 680.

Another reason Keane is worth watching:

Craig Dahl, Chairman and CEO, TCF Financial

Amid rising credit concerns in the auto-lending sector, TCF in May said it would

The big question is about Dahl’s next move: Will he be able to replace a business that was 17% of his loan book and produced lots of noninterest income, or

Terry Turner, CEO, Pinnacle Financial Partners

Pinnacle was fairly big in Tennessee, and then in June it bought BNC Bancorp in High Point, N.C., increasing its asset size by two-thirds. That deal

The company is eyeing “strategic target markets” like Atlanta, Richmond and Virginia Beach for banks that have at least $1 billion of assets, specialize in commercial lending and meet other criteria.

Turner is particularly interested in metropolitan Atlanta, but noted that, with the number of targets there limited, de novo expansion is possible.

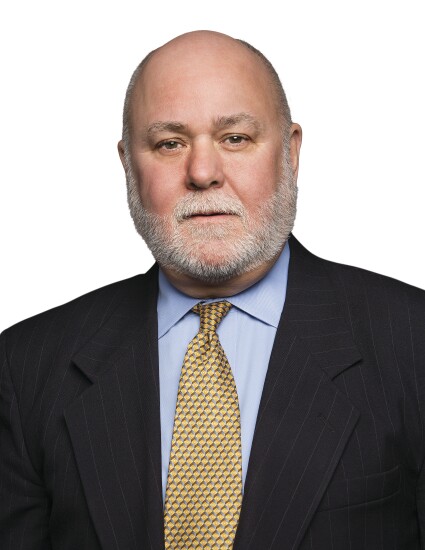

Ron Paul, Chairman and CEO, Eagle Bancorp

Eagle responded with not one but two statements in which it

The question is, will the bank’s response satisfy investors? Eagle’s stock plunged 25% after the Aurelius report surfaced and though it did rebound some in subsequent days, history has shown that it can take weeks or months for a stock to fully recover from such a drastic decline.

There’s a chance, too, that this is not the end of the story. As Sandler O’Neill analyst Casey Whitman put it in a research note to clients, “There are some linkages that raise more questions than answers.”