-

The U.K. bank's "Scam Intelligence" tool uses Google's Gemini to analyze images and texts for red flags, aiming to reduce losses from authorized push payment fraud.

October 30 -

Capital One, PNC, Truist and, U.S. Bancorp are urging regulators to cut duplicative calculations and align U.S. rules with global standards, a longstanding preference for banks but one that will likely find a warm reception from a deregulation-focused Trump administration.

October 28 -

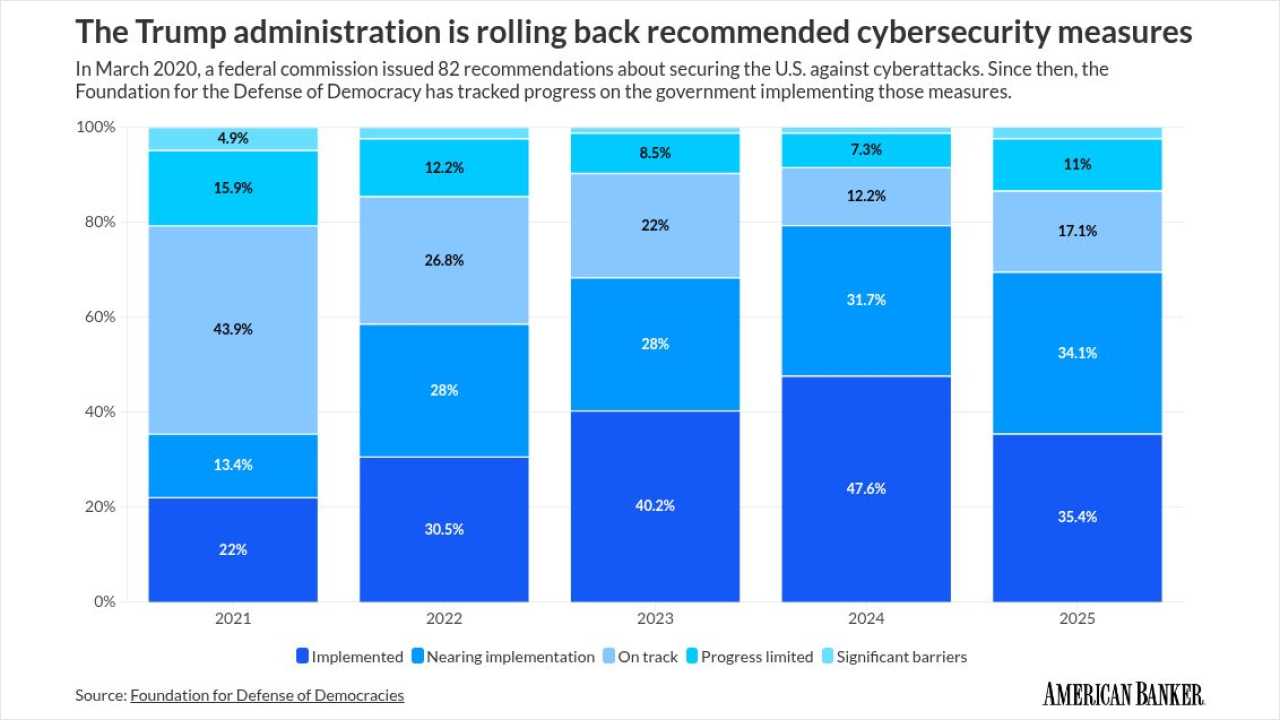

A think tank report details setbacks in U.S. cyber strategy, from shuttered partnerships and staff cuts to the expiration of key info-sharing laws.

October 24 -

The Federal Reserve Friday issued a set of proposed changes to its stress testing program for the largest banks that would disclose the central bank's back-end stress testing models, a move that the Fed had long opposed out of fear of making the tests easier for banks to pass.

October 24 -

Senate Banking Committee Republicans, led by committee chair Tim Scott, R-S.C., introduced a bill that would raise the mandatory reporting threshold for certain currency transactions, a move meant to ease banks' anti-money laundering compliance obligations.

October 21 -

Coordinated sanctions target two networks behind so-called pig butchering scams, human trafficking and money laundering for North Korean cybercrime groups.

October 17 -

Federal Reserve Vice Chair for Supervision Michelle Bowman said in a speech Tuesday that the central bank would unveil proposed revisions to its stress testing regime "in the next week or so."

October 14 -

A new interagency guidance clarifies when banks must report suspicious activity, easing compliance workloads and narrowing the reporting requirements to focus on higher-value cases.

October 9 -

The fund is designed to generate a financial return, as well as Community Reinvestment Act credit, for TD. Its inaugural investment is in a mixed-use project that will include 49 affordable housing units.

October 3 -

A government shutdown and a single senator's hold prevented the renewal this week of a bipartisan law that helped banks and other firms defend against hackers.

October 3