-

In a contentious House Financial Services Committee oversight hearing, Treasury Secretary Scott Bessent sidestepped questions on the Trump family crypto conflicts of interest and inflation with pugnacious responses to Democratic lawmakers' questions.

February 4 -

Treasury Secretary Scott Bessent is slated to testify in the House Financial Services Committee Wednesday morning as part of the committee's regular oversight of the Financial Stability Oversight Council.

February 4 -

The Chicago-based, $261 million-asset Metropolitan Capital Bank & Trust was placed in receivership and its assets sold to Detroit-based First Independence Bank, costing the Federal Deposit Insurance Corp.'s Deposit Insurance Fund an estimated $19.7 million.

January 30 -

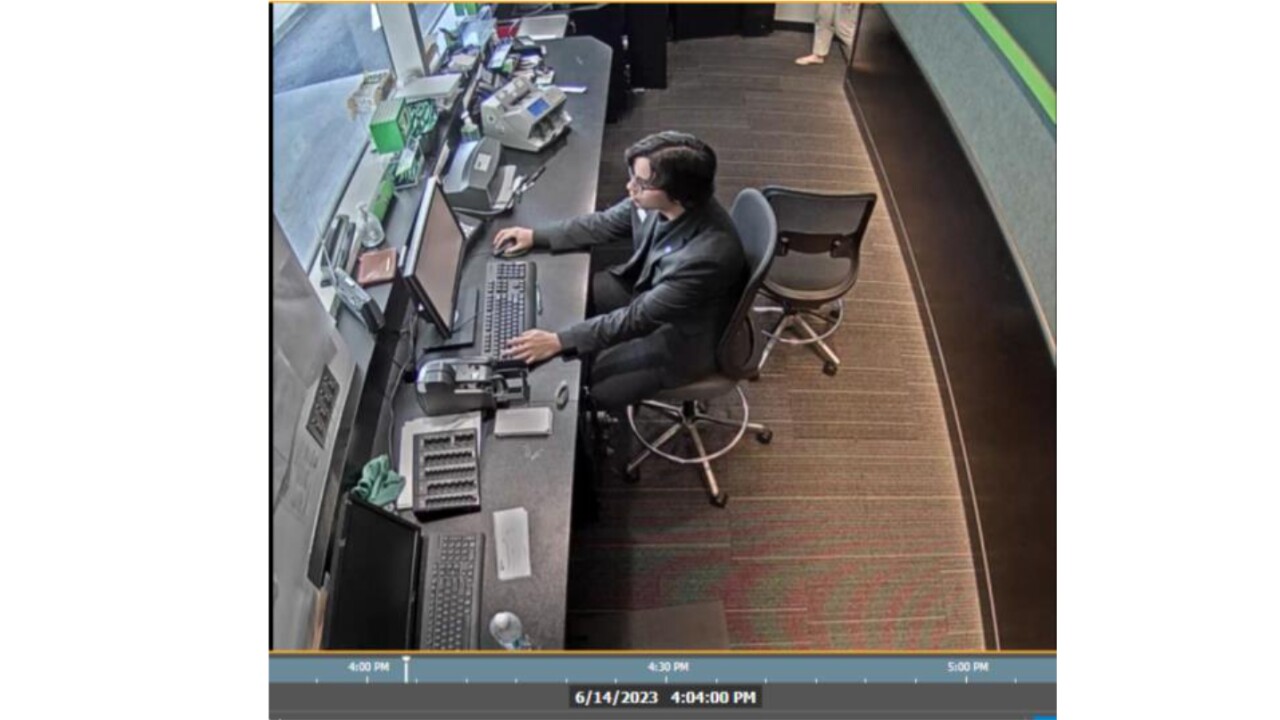

Court documents reveal how a teller used the drive-through window and work email to aid a scheme that bypassed TD's fraud defenses.

January 30 -

Former Fed Gov. Kevin Warsh is a relatively known quantity to financial markets, but his embrace of President Trump's agenda and the White House's own contentious relationship with the central bank make it hard to know with certainty where — or even whether — he will lead the Fed.

January 30 -

President Trump's announcement Friday morning that former investment banker and Fed Governor Kevin Warsh would be his selection as the next chairman of the Fed ends months of speculation and gives the president a key ally at the central bank.

January 30 -

The Office of the Comptroller's interpretation of federal trust powers has opened the door for dozens of charter applications by nonbank crypto firms in recent months. Some experts say the agency's interpretation may push the ambiguous statute beyond its limits.

January 30 -

The Brazil-based fintech got conditional approval from the OCC to bring its digital banking services to U.S. customers.

January 29 -

A Government Accountability Office report warns the Office of the Comptroller of the Currency to clarify which records from the Basel Committee on Banking Supervision should be treated as federal records and thus retained according to the Federal Records Act.

January 29 -

Federal Reserve Chair Jerome Powell said recent data suggests less tension between the employment and inflation sides of the central bank's dual mandate, reducing the need for an immediate policy change.

January 28