Bankshot

A podcast about banks,

finance and the world we live in

By John Heltman

Episode 21

The devil and the details of CRA reform

Banks and public advocacy groups agree that the Community Reinvestment Act needs to change. But is the latest proposal moving in the right direction?

Episode 20

Can the Trump administration reform housing on its own?

With Congress deadlocked on a future for Fannie Mae and Freddie Mac, the administration is prepping to move by itself.

Episode 19

Why reforming Fannie and Freddie is so hard to do

As the administration gears up to end a decade of government control of Fannie and Freddie, are there any good options? (Part 1 of 2)

Episode 18

Has banking become too political?

Large banks are increasingly taking stands on social issues like gun rights and climate change. Some see this as a troubling development.

Episode 17

Financial abuse of elders is getting worse

Elder financial exploitation is a vast and growing problem in the U.S., and one that presents difficult policy challenges for law enforcement and banks.

Episode 16

Do big credit unions act too much like banks?

From expanding their membership to buying naming rights for major stadiums, big credit unions are taking unfair advantage of their tax exemption, bankers and industry observers argue.

Episode 15

Libor is ending. We aren't ready

The most widely-referenced interest rate benchmark will cease to function after 2021, and the financial system is still coming to grips with that complicated reality.

Episode 14

Who’s afraid of the 'narrow bank'?

A new kind of institution wants to make the interest rate the Federal Reserve pays to its member institutions more widely available, but that could have big implications for monetary policy.

Episode 13

Are AML rules catching only the 'stupid' criminals?

Anti-money-laundering regulations are among the most costly, and few criminals get caught. Banks say there’s a better way.

Episode 12

Facebook’s bid to break banking

The social media giant says its cryptocurrency project can bring services to the world's unbanked. Lawmakers and regulators aren’t so sure.

Episode 11

'Farmers are caught in a liquidity trap'

America's farms have taken on near-record levels of debt in recent years, and commodity prices and trade wars are putting pressure on farm country. That could spell bad news for bankers that lend to them.

Episode 10

CECL's uncharted territory

Beginning next year, banks will have to dramatically change the way they account for future credit losses, but experts disagree on the new rule's long-term impact.

Episode 9

Is leveraged lending a systemic risk?

Lending to companies with heavy debt loads is a growing business — one that many fear could lead to the next financial crisis.

Episode 8

The 'secret enforcement tool' that has bankers spooked

Banks claim that regulators have been avoiding using a transparent public process to implement new regulations, opting instead to use informal guidance that has the impact of policy.

Episode 7

The evolution of the Fed's stress tests

Stress tests have come a long way since first unveiled to shore up confidence in banks. But some critics fear that proposals to make the system more efficient would compromise its safety.

Episode 6

Why is the U.S. payments system still so slow?

The U.S. still relies on antiquated payment processing technologies while other countries can process in real-time. What's the holdup?

Episode 5

What is the 'branch of the future'?

Branches are closing at the fastest pace in years, and keeping them relevant to customers is a problem banks are being forced to solve in ever more creative ways.

Episode 4

'Merge or Die': How BB&T-SunTrust has changed the conversation

The biggest deal in more than a decade has sparked debate about the pressure for more bank consolidation and whether consumers will be hurt.

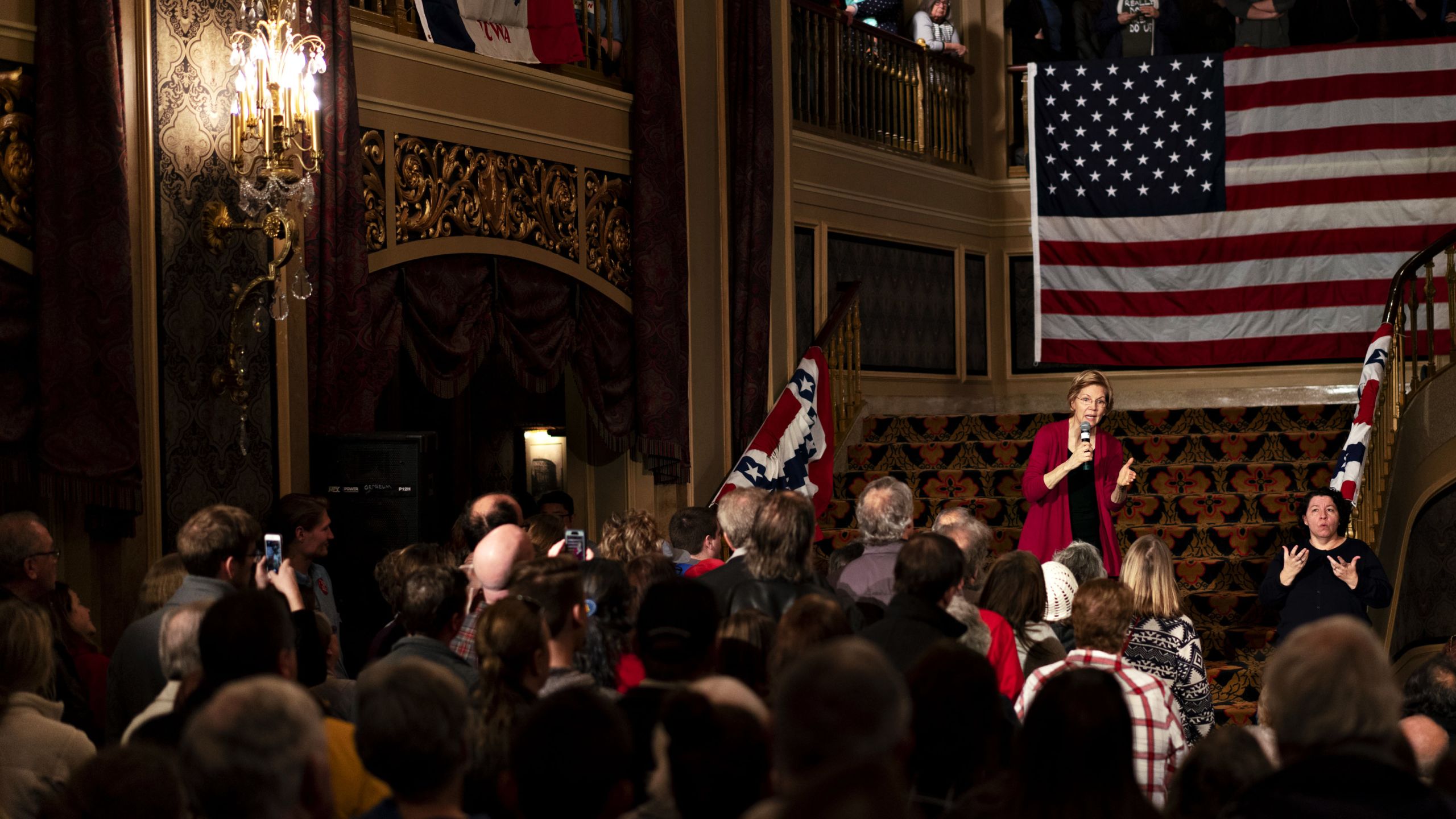

Episode 3

'Banks are a big, fat target': Inside the 2020 race

Presidential candidates aren't talking about banking now, but that's likely to change as the Democratic primary heats up.

Episode 2

The unstable stability council

At first the Financial Stability Oversight Council wanted to target individual nonbanks that pose a risk to the economy. Now it wants to target activities rather than firms. Is that a good idea or a political ploy?

Episode 1

Greed isn't good enough

Changing demographics and cultural trends are making bank CEOs think beyond profitability and toward addressing what they stand for.

New episodes each Thursday