-

Zelle's parent Early Warning Services said Friday it was planning to take its peer-to-peer payments network international through a new stablecoin initiative. It says the details will come later.

October 24 -

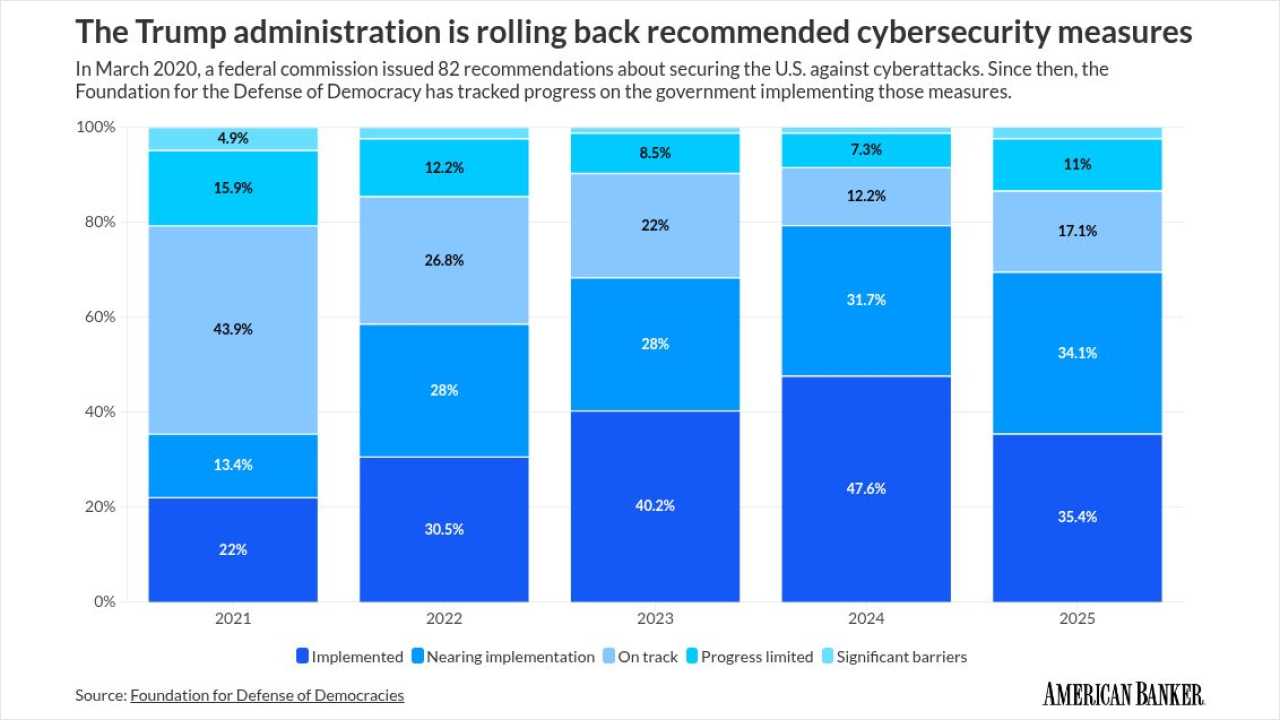

A think tank report details setbacks in U.S. cyber strategy, from shuttered partnerships and staff cuts to the expiration of key info-sharing laws.

October 24 -

Robert Hartheimer's arrest comes at a time when the bank is trying to recover from a consent order and the Synapse mess.

October 24 -

There are regulatory and technology efforts to reform international payments, but it's a multifaceted, long process. Swift, The Federal Reserve, and fintechs like Wise and Revolut are pushing potential solutions. Here's what banks need to know.

October 24 -

The bank asks a federal court to toss claims from five certified classes, arguing victims have been paid and that fraudsters are included in the suit.

October 23 -

BNY's Carolyn Weinberg believes blockchain technology could be the key to an always-on operating system for the New York-based custody bank.

October 23 -

The agents could overcome the consumer inertia that keeps people in low-yield bank accounts, the consultants say.

October 23 -

The company's software automates much of the process of getting money transmitter, lending and other types of licenses.

October 23 -

Five years after the government struggled to disburse pandemic relief checks, the Fed is using improved processing for emergency funds as a reason for banks to get onboard with FedNow.

October 22 -

Revolut receives a banking license, while SumUp introduces its payments hardware. That and more in the American Banker global payments and fintech roundup.

October 22