-

Fintechs sought to acquire the rights and privileges of bank charters in various ways this year, from de novo applications to buying up banks.

December 31 -

The year was marked with six state regulations, new entrants, product and market expansion from existing EWA providers and buy-in from investors.

December 30 -

The fintech IPO drought ended this year with several large public exits by firms such as Chime, Klarna and Circle.

December 30 -

There is a narrow window of opportunity for banks to position tokenized deposits as an alternative to stablecoins for customers seeking the convenience of cheap, blockchain-enabled payments.

December 30

-

As stablecoins become an increasingly prominent feature of the financial landscape, Noelle Acheson gives us her top five trends to watch out for.

December 30 -

Stories about data breaches, fraud and one neobank were reader favorites this year.

December 29 -

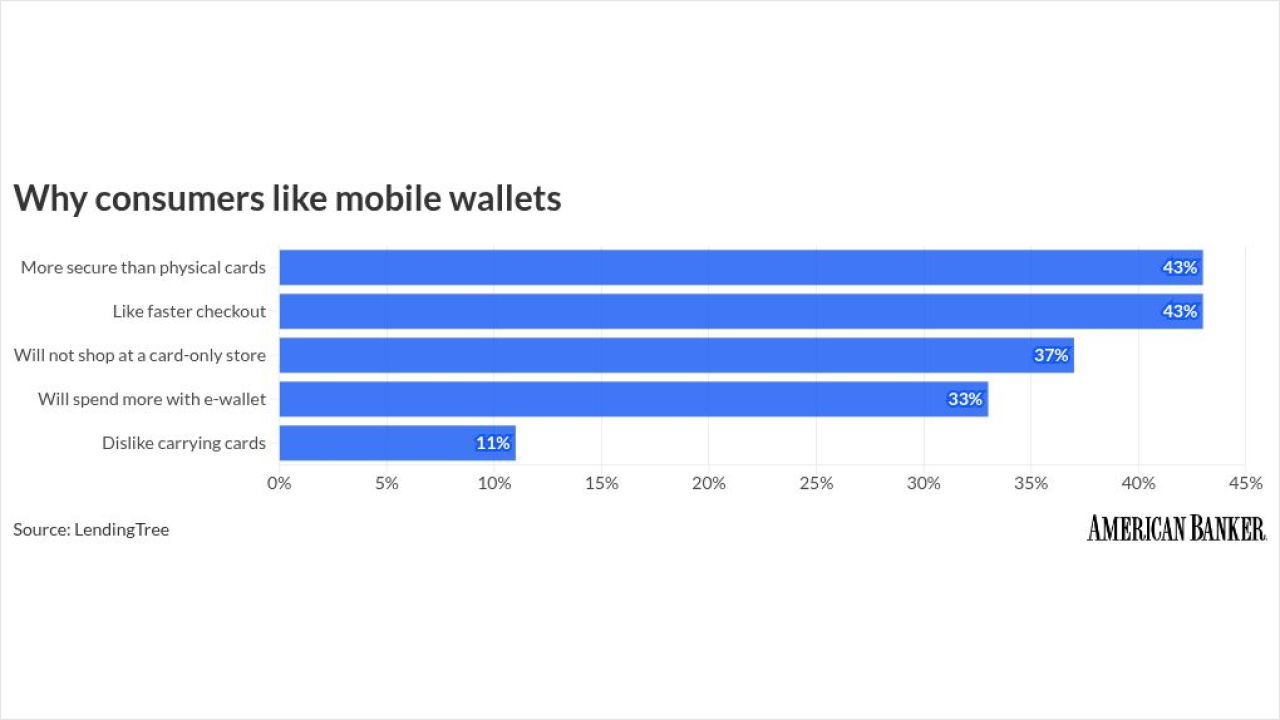

Consumer appetite for mobile wallets is growing, challenging banks to innovate to stay ahead.

December 29 -

Articles about stablecoins, scams, fintechs, premium credit cards and open banking were just some of the topics that struck a chord with American Banker subscribers in 2025.

December 26 -

From credit bureaus to software providers, 2025 saw attackers bypass bank defenses by targeting the supply chain and using social engineering.

December 26 -

Banks are beginning to engage with decentralized financial infrastructure. But until lawmakers create a foundation for allowing legally recognized entities like LLCs and nonprofits to govern these networks, compliance burdens will hinder full adoption.

December 26