While it might be tempting to treat this generation as simply another homogenous group of mobile-savvy kids, this group is significantly different from older segments of the population. Those planning to attract and retain Gen Z-ers will need to recalibrate strategies to cater to their unique attributes.

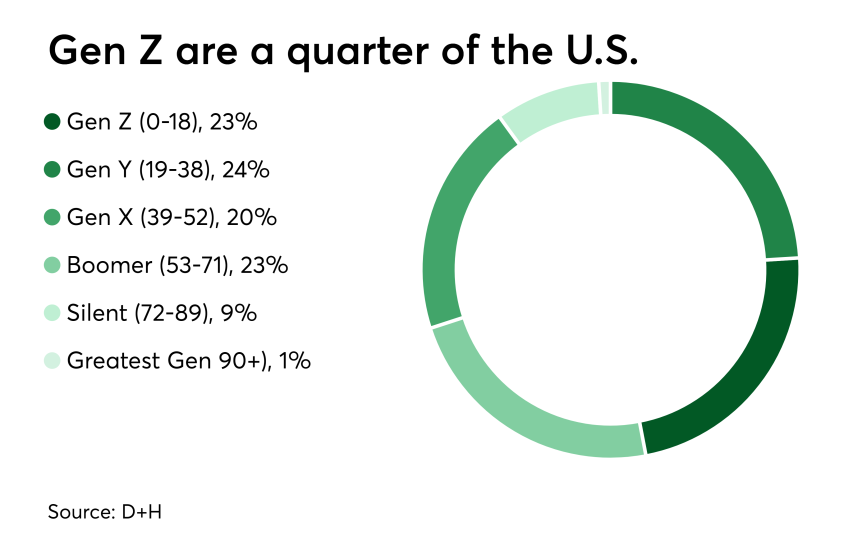

What is also surprising is how large this segment of the population is — according to D+H, Gen Z represents nearly a quarter of the population, about the same as both Gen Y (millennials) and Boomers. While they do not necessarily have the purchasing power now, according to Accenture, Gen Z-ers are projected to make up 40% of consumers by 2020.

According to research by Adyen, 41% of Gen Z stated that Facebook advertisements had influenced their buying decisions. A further 30% had been influenced by YouTube videos and 26% via content on Instagram. For Gen Z, the purchase funnel often begins on their smartphones.

With the assumption that Venmo is the payment mechanism of choice for millennials, it is also a little unexpected that Gen Z shows such low usage of P-to-P payments — just 15% stated they have used or had experience with P-to-P.

Another attribute of Gen Z is a pronounced desire to control their finances. Experian reports that 18- to 20-year-olds are more likely to pay off their balances each month than younger millennials, those ages 21 to 27.

In a GfK survey, 53% of Gen Z stated that they were looking to make more transactions via mobile devices, compared to 45% of millennials and 30% of Gen X. In terms of actual usage, the patterns are similar — 53% of Gen X have made a mobile payment in the last 6 months, compared with just 37% of millennials and 27% of Gen X.

However, their familiarity with and possibly even addiction to mobile devices does not mean they are totally digital in their purchasing patterns.

According to Vantiv, 98% of millennials still shop in-store and 64% prefer to use cash. They are also after a frictionless physical experience while in-store — according to Adyen, 66% of Gen Z want to check store inventory beforehand to ensure what they have browsed for digitally is there physically. They also don’t appreciate store clerks making recommendations — just 7% stated that they found this appealing.

There is also not a universal acceptance of authentication tools such as biometrics — over a third of Gen Z don’t want biometrics to be a part of their shopping experience.

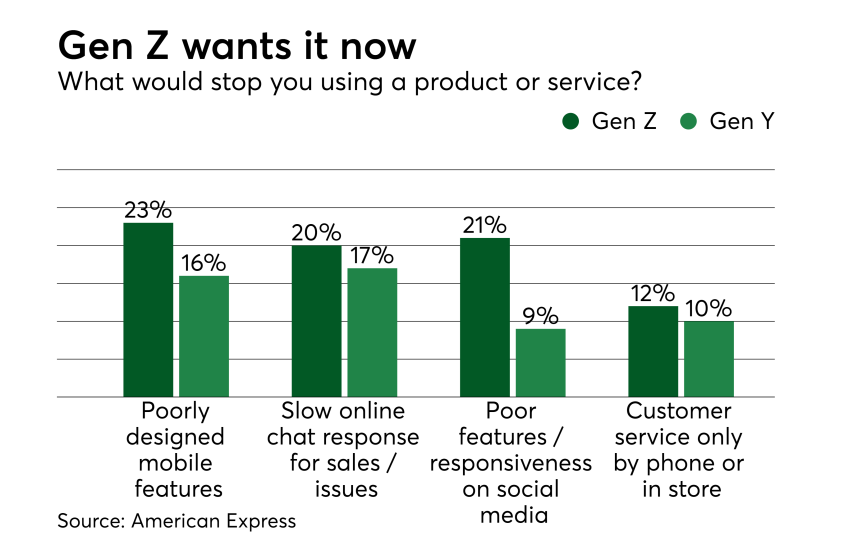

American Express asked both Gen Z and Gen Y what would stop them from using a product or service. Twenty-three percent of Gen Z stated poorly designed mobile features, compared with 16% of Gen Y. Further, 20% of Gen Z would stop using a product or service because of slow online chat responses for sales and/or issues, compared to 17% of Gen Y. But the real dealbreaker for Gen Z is poor features and/or responsiveness on social media — 21% stated they would stop using a product or service because of this, more than double the number of Gen Y.

In summary, it would be a dire mistake to treat Gen Z as millennials 2.0. Payments providers need a keen understanding of the complexities and nuances of these newly minted consumers and their requirements for omnichannel immediacy.