However, it would appear that momentum is continuing unabated for blockchain projects and ICOs (initial coin offerings), as the potential for blockchain continues to be realized.

This week we take the temperature of the blockchain and ICO landscape to gauge where they are headed in 2018 and beyond.

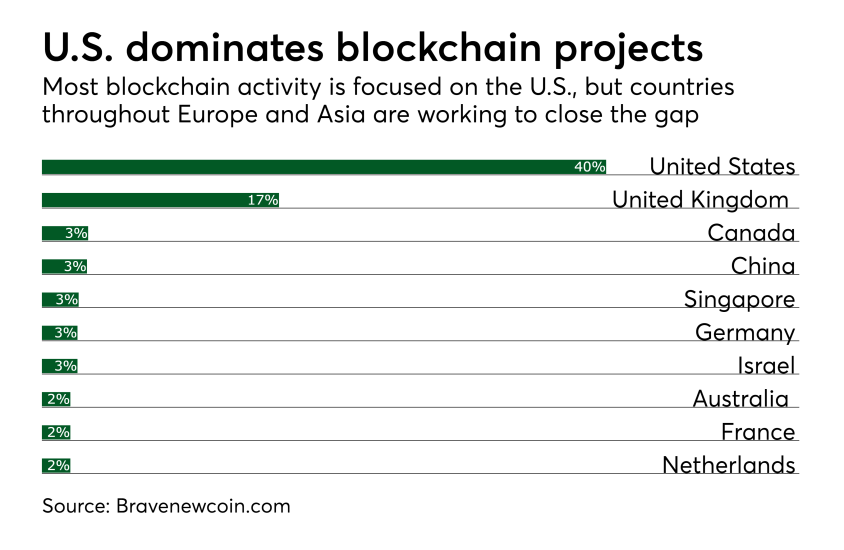

There are also a notably high number of Asian countries closing in on the dominant North American and European ones.

These are not necessarily surprising goals since there is a universal need for for speed, security and cost reduction across all businesses. The question remains — will the promise of blockchain meet these lofty expectations?

However, 2018 ICO funding levels have already dwarfed these figures...

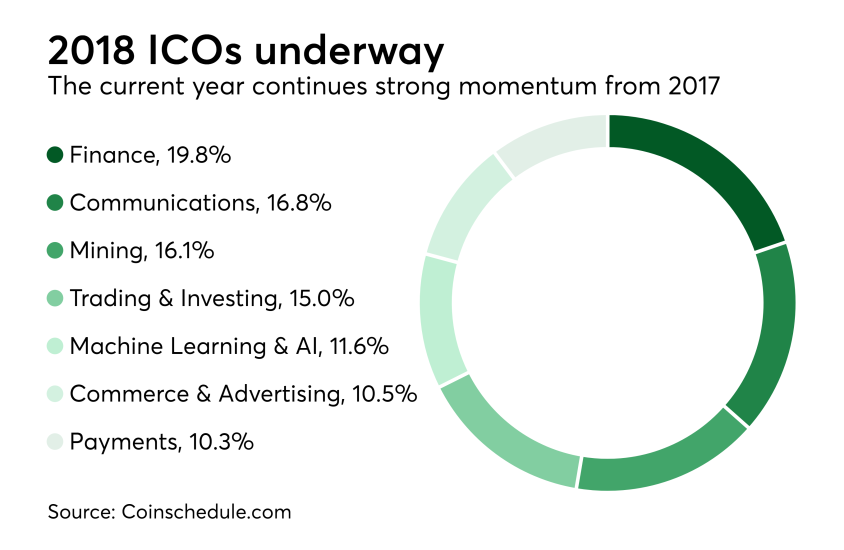

This marks a change from 2017 where the top three categories for ICO funding were infrastructure, finance and trading. Also, it is early to say, but there may be a move away from more frivolous — and plain fraudulent — ICOs, as regulators such as the SEC become increasingly stringent on the quality and availability of these offerings.

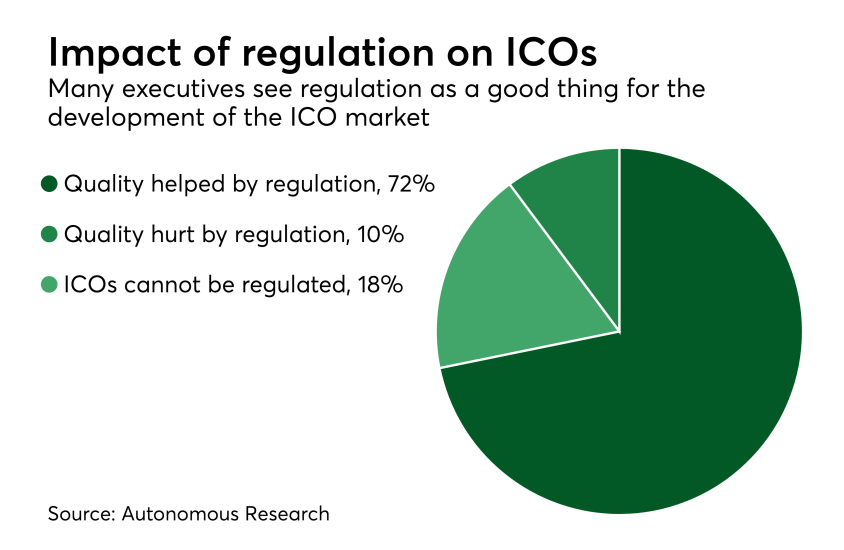

In a survey conducted by Autonomous Research of executives familiar with ICOs, nearly three quarters agreed that the quality of ICOs would be helped by regulation, with just 10% stating the quality would be hurt. Reflecting the somewhat anti-establishment roots of the crypto community, a further 18% stated that ICOs cannot be regulated.