PayThink is focused on the rapidly changing, inter-connected markets of debit, credit, mobile, prepaid and digital payments. As the payments industry strives for faster innovation to launch new products ahead of competitors, PayThink provides insight from market participants and innovators leading the way. PayThink is designed for executives looking to stay relevant in the ever-changing payments ecosystem by finding and honing their competitive edge.

-

Ida Liu, who resigned from Citi earlier this year, will join HSBC on Jan. 5 as the CEO of the private bank. Liu will be tasked with accelerating the growth of the private bank "at a defining moment for wealth," she said in a LinkedIn post.

December 22 -

-

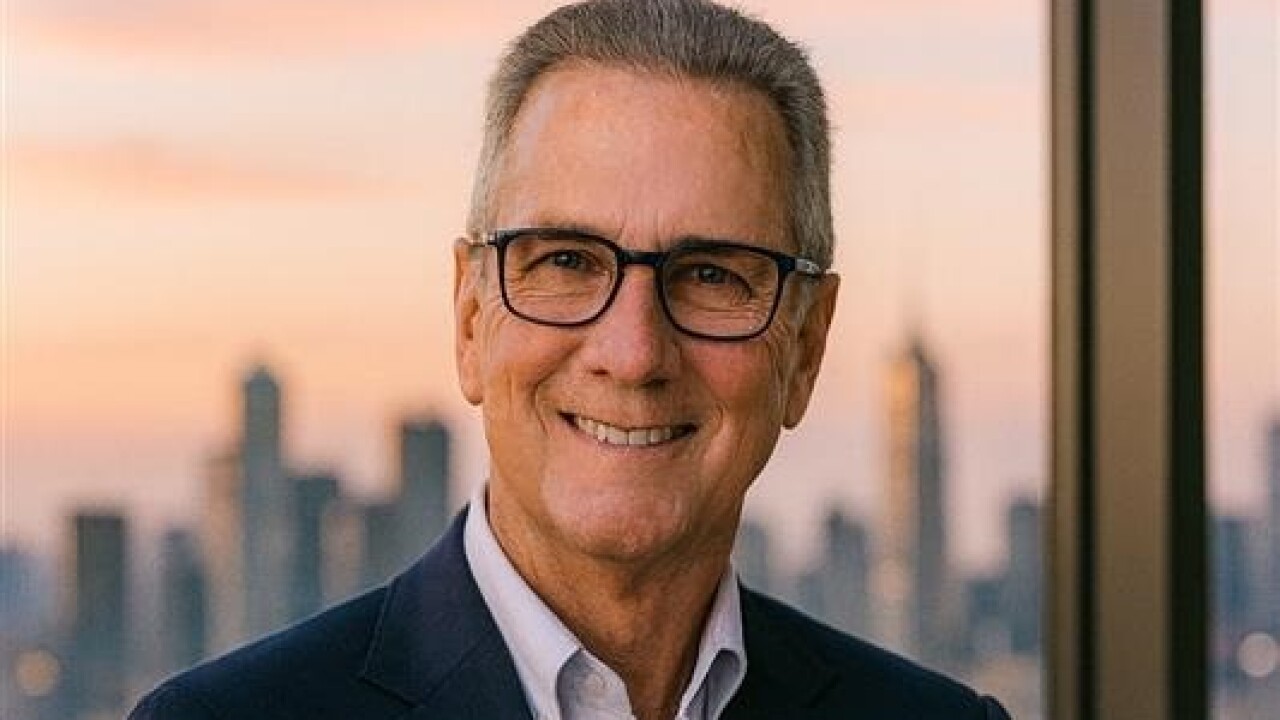

Rick Hirsh is a seasoned executive with 30+ years of experience leading management, sales, finance, and operations to drive growth in technology and software-enabled B2B services. He currently leads as CEO of

Beneration , an insurtech platform built to cut waste and simplify the most error-prone parts of benefits billing for employers. Rick has driven organic growth, completed over a dozen acquisitions, and led four successful investor exits. Previously honored as Ernst & Young Entrepreneur of the Year, Rick and his companies have been recognized on the Inc. 500, Deloitte's Fast 50, and CRN Solution Provider 500.December 22 -

It is long past time to revisit the regulatory regime implementing the Bank Secrecy Act. In a good sign, key elements of the Trump administration seem to be in alignment on reform.

December 22

-

Once its second deal in less than three years closes midway through 2026, the Alexandria-based company will operate more than 100 branches and hold $11 billion in assets.

December 19 -

The bank technology company is adding offices in the U.S. and India as part of its quest to reach clients outside of its U.K. home base.

December 19 -

The Swedish financial institution has developed an open standard that allows merchants' products to be catalogued and discovered by AI agents. It was designed to complement Stripe and OpenAI's Agentic Commerce Protocol.

December 19 -

The card networks have entered a series of partnerships in Europe and Asia amid signs of growing demand and Apple's waning control over the underlying technology.

December 19 -

Mercantile's pending acquisition of Eastern Michigan is approved by the Federal Reserve Bank of Chicago; the National Community Reinvestment Coalition and Rise Economy announce a $2.5 billion addendum to Columbia Bank's community benefits agreement following its acquisition of Pacific Premier Bank; the Federal Reserve Board and CFPB raise the thresholds for certain credit and lease transactions; and more in this week's banking news roundup.

December 19 -

Here are the 10 stories our readers paid the most attention to in a year of political, economic and technological change.

December 19