As payment options and point-of-sale technology continues evolving, consumer demand for financial flexibility will continue to increase as well. Diversifying payment options will soon be essential for retailers to maintain their customer base and build brand loyalty, and retailers that don’t offer alternatives risk getting left behind.

By 2021, over half of all online transactions are predicted to be made using alternative payment methods—a number we anticipate will keep rising.

Providing a smooth and engaging checkout experience resonates with consumers. This rings true even for consumers looking to make bigger purchases—with an emphasis on providing control—so retailers need to adopt new ways to help shoppers boost their purchase power.

This means they should consider alternative payment options that enable their customers to manage their cash flow.

Financing options are also empowering for shoppers. With flexible, easy-to-use credit, customers feel in charge of their own payment experience. Instant consumer finance is proving particularly successful with bigger purchases, as

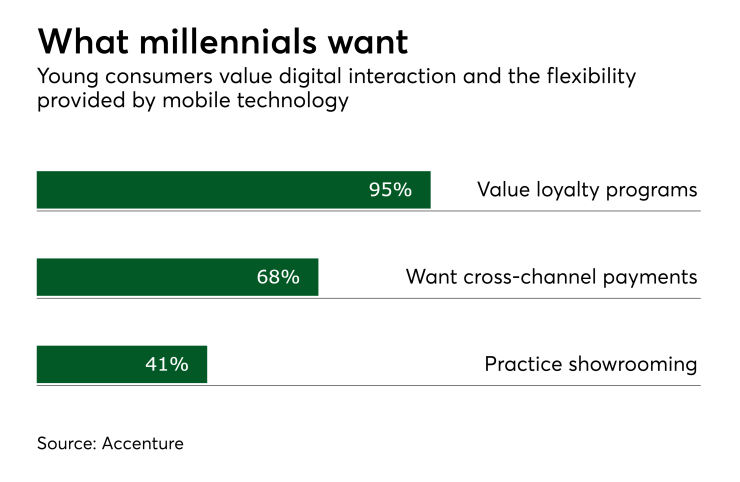

Again, the trick to conversion and loyalty with younger consumers is eliminating the friction at the point of sale and replacing it with convenience and choice.