While major retailers like Overstock and Microsoft are starting to accept digital currencies, why aren’t they universally accepted at most major retailers? Accepting cryptocurrencies as payments can increase a retailer’s customer base, reduce transaction speed and eliminate costly payment processing fees.

In spite of these valuable benefits, most retailers and brands struggle with the idea of accepting something they do not understand.

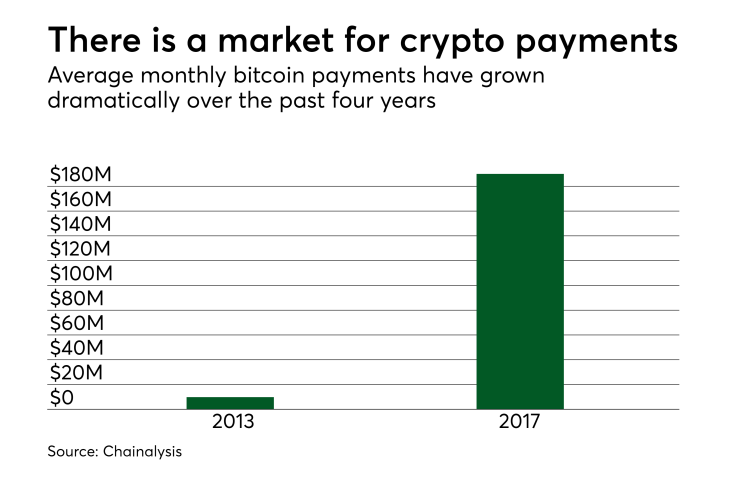

Yet with over $275 billion in cryptocurrencies in circulation today, there is no reason not to accept digital currency as payment for an increasingly digital consumer. It’s similar to the e-commerce boom in the late '90s, where few retailers wanted to enter the unknown online retail territory because it seemed risky. Consumer adoption of crypto hasn’t taken off precisely because most places they buy from still do not accept digital currency.

To lay the groundwork for future success, retailers need to create a digital currency strategy. Most retailers and online brands are aware they need a digital currency plan but don't know where to start the process.

The first option is to set up a wallet with one of the major currency exchanges, such as Coinbase. Please be mindful that your research and due diligence should focus on the regulated exchanges. This kind of exchange can accept crypto, dollars, euros and all global currencies, and for a small fee, convert it as the retailer wishes.

The second option is a white-label digital wallet payment solution, allowing the retailer to accept fiat currencies as well as bitcoin, Ethereum and other digital currencies. This kind of convenience is not currently available otherwise. A retailer would want to exchange crypto to dollars within its own ecosystem to avoid additional regulatory issues and fees.

Countries such as France are ahead of the curve, having adopted a cryptocurrency payment system developed by Global POS and payments platform Easy2Play, enabling consumers to make legal, regulated purchases with their cryptocurrencies at brick-and-mortar stores. With this new platform, an estimated 25,000 new retailers—including major brands like Sephora—will begin accepting crypto as early as next year.