Powerful analytics software is now providing operational insight and visibility far beyond transactional data; it is providing a platform for HR, IT, loss prevention and treasury to derive value apart from the monetary value of the payments themselves.

Retailers have until recently relied heavily on in-house developed systems for monitoring and analyzing cash transactional data. They’ve kept tabs on the movement of cash into their till and into their bank accounts but have missed the wealth of data by not monitoring the path and treatment of cash within their organization.

Retailers are keenly aware of the cost of each transaction conducted via credit and debit cards in their business as the cost structure can be monitored and forecasted across large enterprises with relative ease. In contrast, the cost of cash is not as easily monitored, optimized and forecasted.

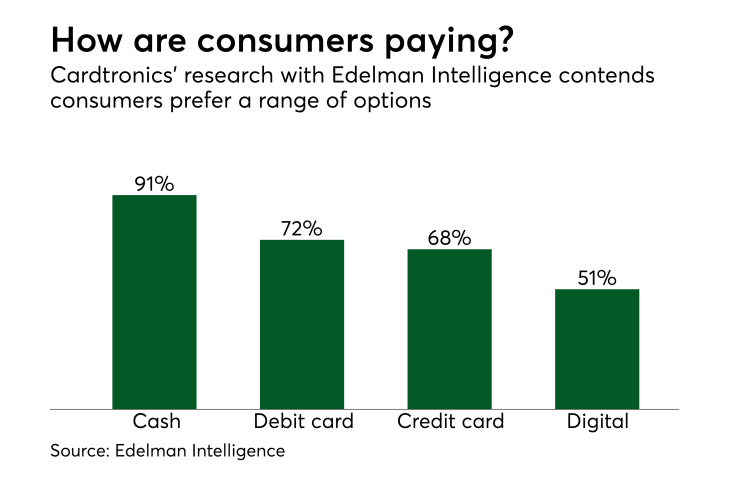

Of note, a recent study conducted by the

In recent years, cash management tools have developed beyond simple safe-keeping functions. For example, cash acceptors equipped with counting sensors and validation technology are now sophisticated cloud-based software solutions that reduce losses, save time on back office duties and deposits, as well as deliver a verifiable return on investment with an industry-wide acceptance rate of approximately 95 percent. Some of these functions include: Preventing counterfeiting; capturing inaccuracies; saving time; streamlining cash handling operations’ reducing profit loss.

Whether it’s external cash management associated with currency logistics such as CIT or provisional credit from banks - these advanced systems allow businesses of all sizes to manage working capital more effectively.