Meeting customer demand for seamless payments can have a positive impact on merchants’ businesses. Research conducted by

Despite these changing times, and the opportunities presented by new technology, many merchants still rely on a one-stop-shop, one-size-fits-all payment solution. There is an expectation that customers should change and adapt their particular payment habits to match what the retailer has on offer.

Such thinking will not wash for much longer. Consumers have a choice when it comes to the merchants they shop with. If a business doesn’t meet their needs, whether by not offering the right products, by not providing the right channels, or by not accepting the payment methods they prefer, consumers will simply take their money elsewhere. If this happens, the merchant will lose out, not just on that sale, but on repeat business.

If merchants are serious about continuing to appeal to their existing customers, or if they want to target new demographics or international markets, they need to change their approach to payments. They need expert local knowledge and cannot rely on any one payment partner’s approval rates alone. Nor should they be satisfied to have a single point of failure — merchants still want to be able to accept payments, should anything go wrong with their payment partner’s system.

What can be done to address these issues for merchants?

Increasing the number of payment connections a merchant has is one way to achieve this goal. It can not only increase the number of payment options available for customers, but help to mitigate the risks associated with a single point of failure. Nevertheless, to simplify their business operations, many merchants may still prefer no more than two processors.

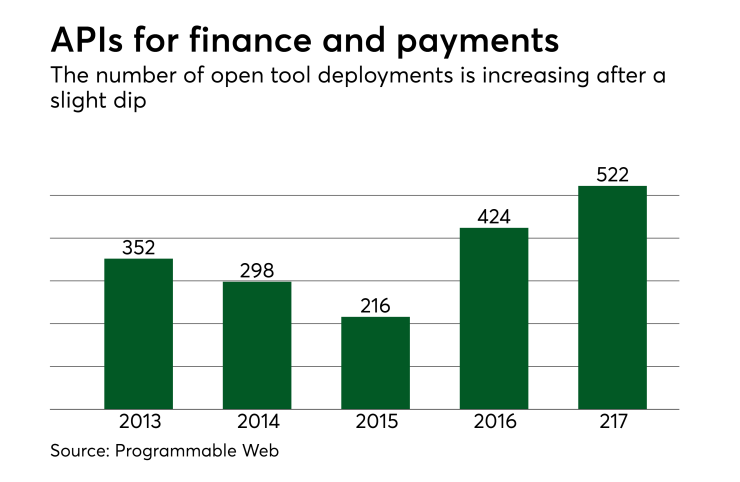

Another important solution is the development of open-source payment solutions. These are particularly useful, as they can provide connections on demand, allowing merchants to accept a range of payments without having to rely on any single provider. Interest in this area is growing, and we can expect open-source systems and those players with an open mind and agile technology to be embraced by a large number of merchants.

The development of such solutions, however, will rely on knowledge sharing and cooperation between payment providers and others in the industry.

There are some great examples of successful collaboration already taking place in the industry, and the payments world is far more open than it was five years ago.

For me, though, the chief driver of this collaboration has been the evolution of open and quicker integration possibilities between technologies, thanks to the development of application programming interfaces. These provide clearly defined methods for different apps and technologies to communicate with each other easily. Used by payment providers, APIs can allow different payment solutions to be compatible with each other, helping to streamline the ecosystem for merchants so they can offer their customers the payment options that are needed at any given moment.

This is just a snapshot of what is possible. The industry is becoming more demanding, driven by desire to have more and better features, products and services. And this drive is coming from our consumers, aka the shoppers. Processors cannot deliver all best-in-class solutions on their own, which makes the need for collaboration all the more urgent.

The industry has laid some solid foundations for collaboration and sharing in recent years. Now I would like to see the sector go further, fostering partnerships between schemes, issuers, acquirers, processors and merchants. There needs to be even more openness — of accessibility, transparency, data and understanding.

Working together, we will all be able to design a payment solution that truly minimizes the friction in the transaction process, while achieving other goals, such as cutting false decline rates and fraud. In doing so, we can take a major step forward in creating a payments process that truly works for everyone, from the consumer, to the merchants and processors.