While cryptocurrency certainly represents an opportunity for vendors and payment intermediaries, their involvement with cryptocurrencies also brings legal and regulatory risks that merchants do not face when using other forms of payment.

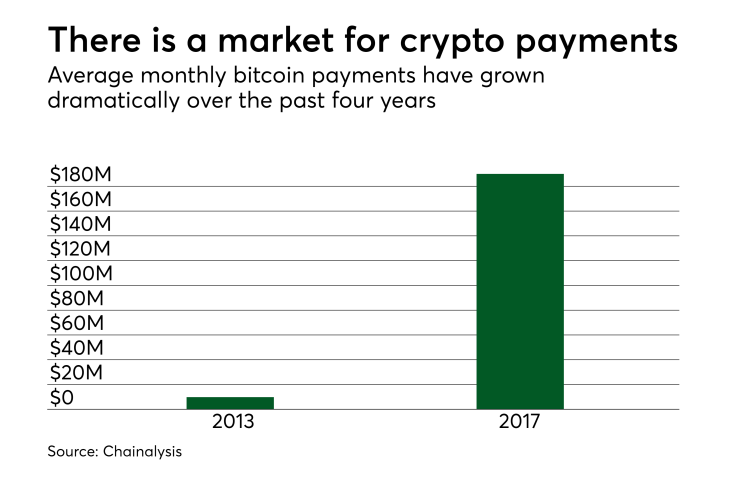

According to estimates by the publication Chainalysis, which monitors cryptocurrency data, consumers used bitcoin for payments for a monthly average of $190.2 million in 2017, compared to $9.8 million per month in 2013. Many commentators point to the potential for this number to grow exponentially, given the efficiencies cryptos may offer in terms of lower transaction fees and costs.

While more traditional forms of payment require vigilance with respect to money transmission laws and anti-money-laundering, cryptocurrencies add concerns in other broad areas of federal law such as securities and commodities regulation.

Numerous regulators, both federal and state, are involved in this space and have stepped up their enforcement efforts. Recent reports noted a significant increase in Securities and Exchange Commission and Commodity Futures Trading Commission enforcement actions in this space in the first half of 2018, and the regulators have given no indication that they have been less active in the second half.

State regulators have also been very active — in fact, in August the North American Securities Administrators Association stated that more than 200 investigations were pending into initial coin offerings and crypto-related investment products.

Not only have the regulators begun investigations, but they also have scored some important “wins”. In August 2018 a federal judge found that CabbageTech Corp. and its founder had engaged in a fraudulent scheme relating to virtual currencies and imposed penalties and restitution over $1 million.

On Sept. 12, a federal judge in the Eastern District of New York issued an order denying the pretrial motion of criminal defendant Maksim Zaslavskiy to dismiss his indictment in connection with a case alleging fraud in connection with initial coin offerings; the case was originally brought as a civil regulatory matter by the SEC, but criminal charges are now separately being pursued by the Department of Justice.

Whether the federal government will ultimately prevail will be a factual matter ultimately resolved by a jury, but the importance of the judge’s denial is that he permitted the action to go forward despite the defendant’s argument that the securities laws should not apply to cryptocurrencies.

What do these actions mean for merchants and payment intermediaries — are they at risk merely for accepting cryptocurrencies as a means of payment? The answer is most likely no. After all, the actions described above were brought against the principals who promoted and developed an initial coin offering or cryptocurrency product. Relevant federal statutes generally provide for liability on the party of “aiders” and abettors,” as well as the main violators, but in general, courts will not hold a defendant liable for aiding and abetting unless the defendant in some way associates himself with the venture and seeks by his action to make it succeed — mere “knowledge” plus “substantial assistance” is not enough.

As a factual matter, however, the dividing line between “associating” with the venture and “substantial assistance” may be hard to discern. Merchants and intermediaries who plan to accept crypto payments should ensure that they have compliance programs and policies in place to ensure that they can appropriately diligence the use of cryptos so that their involvement with these new products does not enhance their liability risks.