If you had a choice between eating a higher payment processing fee or losing some customers to cart abandonment, which would you choose? While the math is complicated the bottom line is you should integrate payments or risk losing some sales.

When e-commerce websites decide between using their own payment form or integrating with services like PayPal and Venmo, they face that dilemma. It’s a difficult choice because no one wants to do the math. I did it, and yes, it’s messy.

Let’s use PayPal since they are the most common online payment integration and have 203 million users. For online sales in the U.S., a merchant will pay 2.9 percent plus $0.30 per transaction with PayPal. How does that compare to average credit card processing fees?

It’s hard to tell. Everyone who shares “the average” happens to sell credit card processing services, and rates are negotiated, so they have an incentive to hide (or skew) the number. Plus, if we start comparing flat, interchange and tiered rates, the numbers become hopelessly confusing.

Based on a sampling of estimates, let’s say you can get a 2.3 percent flat rate for card-not-present (CNP) transactions. That narrows the decision down to a 0.6 percent difference with PayPal. Now, we need to consider the role of cart abandonment.

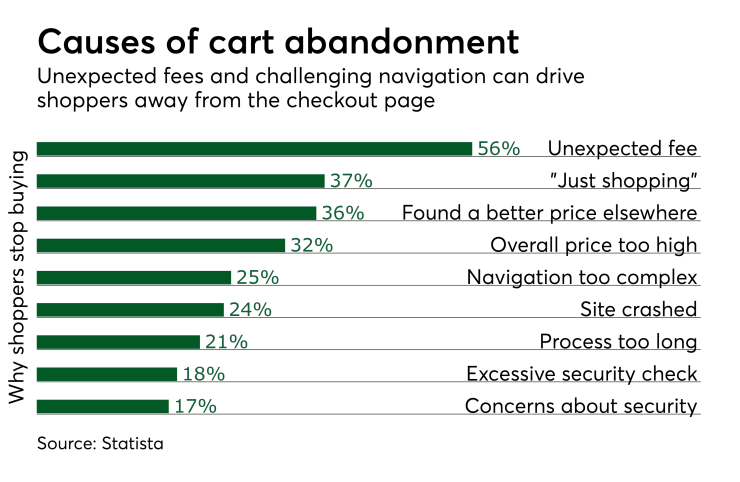

When the Baymard Institute

New customers would be more vulnerable to cart abandonment because none have saved payment information with you. Some might have saved credit card information in their web browser and therefore could fill out payment forms quickly. Some might have a PayPal account, in which case they’d be tempted to use that integration versus your payment form.

Let’s say your flagship product costs $100. If 10,000 people bought that product through your native form, you’d make $977,000 factoring the 2.3 percent processing fee. How many additional units would you have to sell via PayPal to make same revenue? Almost 93, by my calculation.

Thus, in an extreme scenario where 10,000 customers use PayPal (unlikely), you’d have to convert just 0.93 percent more people to break even. Keep in mind that convoluted payment processes might cause buyers to abort up to 20 percent of all purchases (28 percent of 70 percent).

In other words, the chance of losing money on a PayPal integration is extremely low, and you could achieve a double-digit reduction in cart abandonment. The upside is much greater than downside.