The payments space, which boasts one of the biggest growth markets in the world, fintech, is expected to grow substantially in the year ahead, and companies in several key industries need to keep track of to stay competitive.

Research estimates that global

B-to-B payments are further behind than that industry should be.

This is often attributed to the complex nature of B-to-B payments, most transactions involve multiple stakeholders, are usually attributed to budgets, and are managed manually. The check still holds as the most common method of payment acceptance in U.S. B-to-B payments, but only just. The Association for Financial Professionals has found that in 2004 81% of B-to-B organizations paid by check, but by 2016 this number had shrunk to 51%.

The U.S. government has

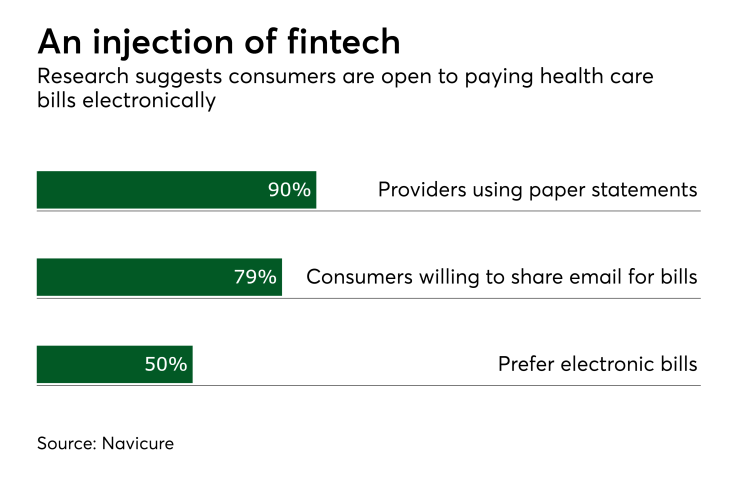

Health care is another industry driving fintech investment. According to eHealth

Maximizing the chance of capturing patient payments means providing a friction-free payment process.

The reality of the rising number of patients with high-deductible health plans or PPOs means more health care payments will fall into accounts receivables management (ARM). Much like providers themselves, health care ARM organizations need to be able collect payments online using all payment types, including the ability to accept health savings account (HSA) and financial savings account (FSA) payments.

The BillingTree annual

Card brands and credit unions will also make major inroads in fintech. Currently, the costs for using a card to settle community fees and rent payments are higher than those consumers are used to when purchasing retail goods. In order to compete with debit account and ACH rates, costs for settling rent payments and community fees need to come down.

Already, certain card providers are creating new rate categories for apartment due payments and rentals. In 2018, this will open the door to the availability of more electronic payments options which offer convenient ways for tenants to settle rent and community fees, increasing revenue for property managers and customer service.

For credit unions, 2018 will carry a familiar challenge, which is staying competitive with the big banks. This means creating competitive offerings while delivering a personalized service to keep its members happy in the hope of luring them away from larger institutions.

When it comes to technology, the size of credit unions can actually become an advantage. Smaller business have smaller infrastructure, so adapting to integrate new technologies takes less time, meaning they can quickly accommodate the evolving needs of a