As financial technology and payment solutions have modernized and expanded, the volume of transactional data produced has grown exponentially. This increase in data gives compliance teams more hits to filter through and more risk to manage.

Compliance processes are often cited as one of the largest daily pain points for banks. Pull back the covers and you will find that compliance officers have to overcome dated technology, multiple stand-alone systems, and stale data which lead to a series of inefficiencies as false positives are filtered and true positives are missed.

Some argue that the cost-ineffectiveness disincentivizes compliance forcing financial institutions to rely on legacy systems which increases their financial crime risk. As transactions modernize and the regulatory environment becomes more complex and demanding, institutions need to turn to innovative technology such as artificial intelligence and machine learning to meet the growing demand for an efficient and effective risk-based approach to compliance.

Prime for a PR nightmare, financial institutions have recently found their names splattered across newspapers detailing complex money laundering scandals. Money laundering issues are not new. Identification of money laundering has been a consistent pain point for financial organizations using legacy technology from the early 2000s.

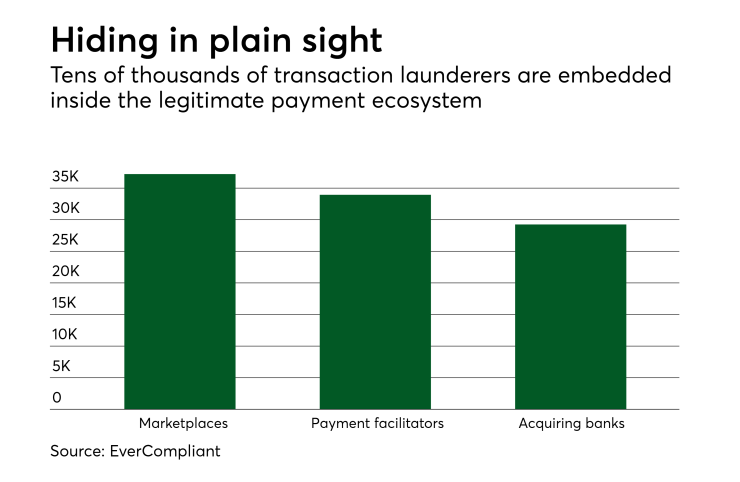

The internal challenges of compliance teams’ onboarding and monitoring tools create a global ecosystem where only 1-3% of money laundering activities are detected.

Banks should expect to see very little sympathy from regulators if they continue to utilize failing technology. Compliance officers should demand better means to quickly gather, organize, and view data regarding accounts and transactions that may be partaking in financial crime. The time of blaming antiquated compliance modules and cost ineffectiveness is quickly passing, and financial institutions’ regulatory reputation and future are on the line. Innovative technology may be one of the only means of appropriately managing risk for today’s excess of data available for monitoring.

As such, compliance officers should not be reluctant to partner with young and innovative regtechs. In parallel, regulators should encourage the industry to partner with younger regtech firms who are utilizing innovative technology and advise the industry that legacy solution providers do not shield organizations from further regulatory scrutiny.

Those trying to launder funds are often quicker to adopt new payment tools and technologies for illegal practices than institutions are in detecting new threats. In order to not be undercut in their response, industry leaders need to seek out innovative solutions to close this gap. While manual decision-making from compliance leadership is still necessary, there is currently great potential for AI functions to parse through the sea of transactional data to generate actionable information and make decisions. AI allows financial institutions to more accurately vet, manage, and evaluate their firm’s risk profile through deeper analysis and maintenance of data, instead of manually maintaining and updating the data which is costly, time-consuming, and prone to errors.

AML compliance is becoming more complex on both regulatory and data-driven ends of the spectrum, and the traditional systems simply aren’t keeping up. Rather than continue to struggle through older processes, banks should seize upon this new wave of AI innovation to get ahead of regulatory demands and showcase their organizations as drivers of compliance.