As busy consumers with on-the-go lifestyles, we are always looking for ways to save time and simplify our daily routines, from finding the fastest route for our commutes, the shortest line at the grocery store, or the easiest way to order ahead.

What’s become startlingly clear over the last few years is that consumers have come to expect and deserve fast, easy and secure experiences, and how we pay for goods and services at the stores we visit every day is no different. And with four out of five Visa transactions in the U.S. today taking place in the face-to-face environment, the need for convenience at the point-of-sale is as important as ever.

Contactless payments have simplified the checkout experience around the world, allowing customers to get on with their lives a bit quicker with a simple tap of a contactless-enabled card, phone or device.

Contactless payments are already the norm in many countries. Nearly one in three Visa face-to-face transactions outside the U.S. are contactless. Contactless cards offer a fast and convenient way of paying with a method that is already popular and preferred by many consumers. In the U.S., contactless cards are not mainstream yet, but are expected to become commonplace in the coming years. With the

A new study from

Typically, once cards are introduced into a market, adoption happens quickly as consumers embrace this fast and easy way of tapping to pay. Visa has seen some markets go from single digit contactless penetration to more than 50% in just 18-24 months. Most recently, we’ve seen this play out on a global stage at this year’s FIFA World Cup where Visa , the official payment services provider, found that from the opening match on June 14 through the semi-finals on July 11,

Why? A simple tap with a contactless-enabled Visa card, smartphone, or other wearable device allowed fans to speed through lines and get back to the action on the field. With positive global momentum, contactless payments can deliver a consistent way for how we quickly, easily and securely pay at checkout around the world, whether it be on a card, phone or wearable device.

The good news for consumers is that contactless cards are expected to arrive in the U.S. soon. A.T. Kearney forecasts contactless card issuance to pick up significantly in the next 12 months, based on a high level of interest from U.S. banks given merchant readiness and consumer demand.

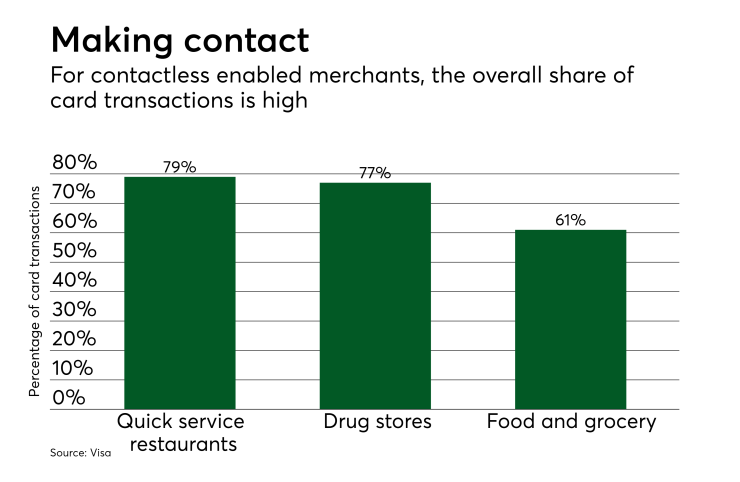

The readiness of merchants in the U.S. today is evidenced by the already-high share of transactions occurring at contactless-enabled merchants, the number of locations that have the required hardware for accepting contactless payments, and the share of new terminals shipped that are contactless-capable. According to A.T. Kearney’s research, 48% of face-to-face transactions occur at contactless-enabled merchant locations and the majority (70%) of terminals already have the necessary hardware to accept those payments.

Globally, contactless usage is especially strong at merchants with high transaction volumes and low average ticket sizes, an area where checkout speed and convenience matter most. That includes places such as transit, quick-service restaurants, drug stores and pharmacies, and grocery stores. Merchants in those categories can see widespread benefits from accepting contactless payments, including increasing speed of service, growing sales volume by serving more customers, and reducing both time and money spent on handling cash.