In the wake of increased mobile wallet adoption, many banks have conceded mobile payments business to so-called “xPay” providers such as Android Pay, Apple Pay and Samsung Pay because, when viewed merely as a method of payment, there is seemingly little payoff in simply performing payments.

But beyond the face value of transactions, banks must consider the longer-term benefits of offering their own mobile wallet experiences, as well as potential ramifications of conceding the business to third-parties.

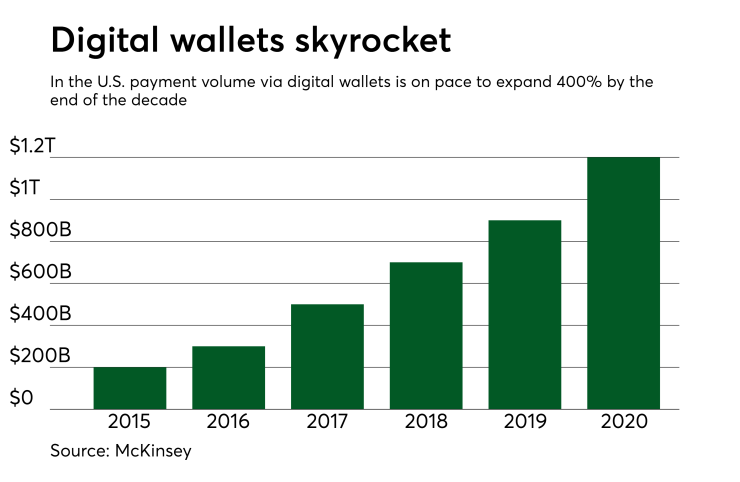

According to McKinsey & Company, mobile wallets currently facilitate approximately $300 billion in transactions within the U.S. The research firm is predicting that this volume will expand to $1.2 trillion by 2020, comprising 18-20% of total U.S. retail spending.

Because of the forecasted increase, the industry has seen a proliferation of mobile wallet providers battling over a greater share of the consumer’s spending.

Here are three compelling reasons banks should consider creating their own mobile wallets:

Preserve ownership of the customer relationship. Banks have already done much the hard work of relationship-building and establishing trust with their customers. Increasing numbers of consumers already transact with their bank daily via the mobile device. Building mobile wallet capabilities into existing mobile banking platforms is a natural extension of the existing relationship and an overwhelming opportunity to add value to it.

Non-traditional financial services providers continue to vie for an increasing share of consumers’ wallets, hearts and minds. Consumers must now navigate a growing playing field of companies for not only new ways to pay for goods and services, but new ways to send and receive money, as well as new sources of lending. These are all transactions previously held in the exclusive domain of banking institutions.

Each new non-traditional provider that enters the fray chips a little further into the consumer’s wallet and psyche. For banks to retain as much of the consumer’s share of wallet, as well as their loyalty and receptiveness to cross-sell, they must offer innovative technology that answers their customers’ needs under their own brand.

In addition to creating the perception of convenience within the mind of the consumer, continuing to “own” more of the consumer’s financial relationship diminishes the ability of third-party mobile wallet providers to swoop in with offers for additional value-added, and income-enhancing, products and services.

Whether securing discounts and special offers with partner merchants, creating loyalty rewards programs or cross-selling convenient bundled services, non-bank mobile wallet providers continually seek creative ways to increase consumer loyalty and cement the relationship.

Retain access to valuable customer insights. Data makes our always-on world go around. Banking relationships provide you with valuable insights for running your business more efficiently and profitably.

The ability to study and predict customer behavior to tailor product offers and retain your relationships is predicated on the volume, quantity and freshness of information at-hand. It’s crucial for financial institutions to understand customer preferences and qualifications so that they can target offers to increase a customer’s “sticky” factor, as well as their satisfaction.

Sacrificing such information to third-parties, on the other hand, equips them to lure more of your customer’s relationship away based on value-added and timely offers of interest and positioning them as “first” in the mind of the consumer.

Retain control of security to assure your position of trust and authority. Regardless of who owns the front-end of a mobile payments transaction (retailer, xPay or bank), banks and credit card issuers bear the brunt of the cleanup related to hacks after-the-fact.

On the other hand, banks already hold a coveted position of trust with their customers and are highly focused on security, another compelling reason banks should seriously consider creating their own mobile wallet capabilities. Doing so affords the bank control over the security of the mobile wallet.

Solutions are available that provide permanent mobile device identification, integrity screening and advanced security features, as well as perform deep risk assessment for devices transacting through mobile applications. This level of control will enable banks to mitigate against fraud and digital attacks, while offering customers a frictionless payment experience.

As mobile wallet adoption continues to play out in the U.S. in coming years, tremendous opportunities for income growth and increased consumer share of wallet will present themselves. Banks that wish to capitalize on these opportunities, as well as avoid longer-term ramifications of conceding business to non-traditional financial services providers should start thinking now about launching mobile wallet capabilities under their own brand.