The staggering popularity of QR code payments and mobile wallets in Asia continue to rise, demonstrating high consumer demand for quick and easy services and new frontiers for biometric authentication.

Mobile phones can also be used to accept payments, opening new doors for merchants. SoftPOS solutions allow NFC and QR code-enabled mobile devices to accept contactless payments. These new payment acceptance methods are growing in usage as they give businesses of all sizes cheap and simple ways to accept digital payments. The introduction of these ways to pay demonstrates the willingness of Asian merchants and to adopt new and innovative technologies, ahead of much of the world.

Along with the rising popularity of mobile payment solutions comes the increased importance of strong customer authentication. Conversations at local conferences have centered around the delicate balance between adding new security measures without creating more points of friction for consumers. Among the new measures is EMV 3-D Secure (3DS), a messaging protocol which improves communication between the issuing bank, acquirer and merchant.

This means that basic account holder information can be automatically shared in a frictionless way to perform risk-based authentication. This cuts out complex additional steps for consumers, reducing cart abandonment, false declines and resulting in better sales for retailers.

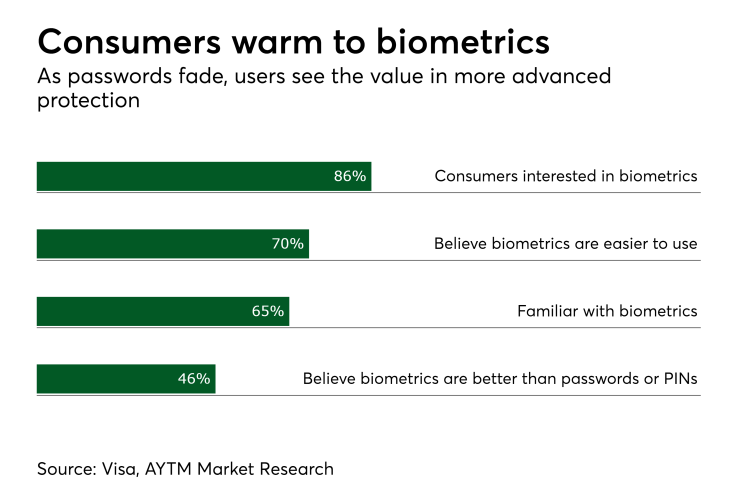

EMV 3DS isn't the only focus point of authentication. Across the board, new types of payments authentication are making waves in Asia. Biometric authentication is a big trend due to the increased convenience and security that it offers consumers. It can also be integrated into a variety of form factors, giving end users a range of seamless and secure payment methods. Facial recognition-based payment systems are just one of these emerging options. Consumers can now pay using just their face to buy fried chicken or travel on the subway.

And this isn’t the only biometrics-based payment system being introduced into the daily lives of Asian consumers. Biometric smart cards are one of the biggest trends in payments currently, delivering the convenience of contactless payments with an additional layer of trust. The availability of biometric payment methods mean that terminal, device and card manufacturers are becoming more creative to fit with consumers’ diversifying expectations.