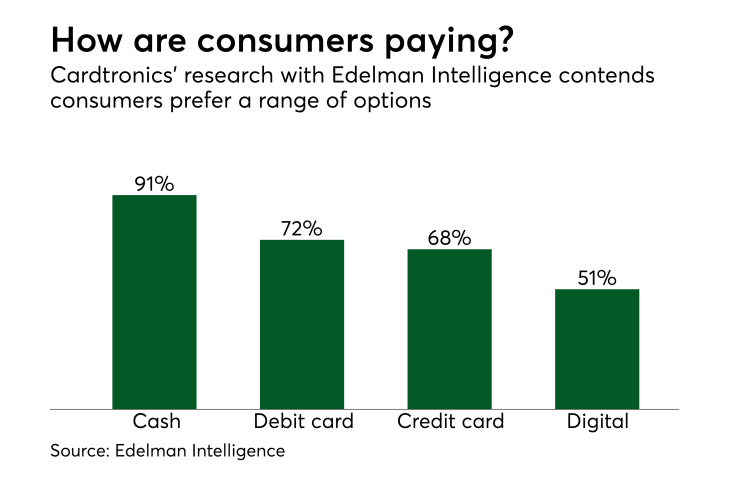

Contrary to the desires of Visa and PayPal, cash payments remain a vital segment of retail purchases. Although a smaller percentage of transactions than card transactions overall, cash still accounts for $2.2 trillion of the $10 trillion in sales in the U.S., according to

The amount of cash in circulation is now $1.6 trillion and the

For consumers, cash is attractive because bank notes do not require swiping or a PIN, nor do they require a signature. In addition, dollar bills cannot be hacked, and they leave no footprints. For retailers, cash is attractive because it helps them save money on transaction fees of 1% to 4% and settlement times of one to four days before they get paid. Plus, there are no charge backs.

To avoid being charged fees by credit card processors more and more retailers are now offering incentives for cash sales such as discounts of 4 to 8 cents per gallon of gasoline. Some retailers are even offering cash discount programs — charging either a 3-5% fee on the total sale price or a flat rate transaction fee. For consumers these actions decrease the attractiveness of plastic and mobile-wallet purchases.

But with all these attributes cash sales do have the disadvantage of exposing the merchant to theft and shrinkage. And cash also comes with costs such as manually separating and counting notes, filling out bank slips and then finally transporting the cash to the bank, either via a courier or personally.

However, there are solutions to these disadvantages — smart safes. Smart safes meet the primary goal of safety and security but also solve overhead costs. Smart safes have bill acceptors that count the cash deposited into them, print detailed reports for every deposit and then the next business day the money is provisionally deposit the cash into the retailer’s bank account.

Though weekend and holiday sales, which account for 50% or more of many merchant’s business, are not credited until the next business day, the use of a smart safe allows merchants earlier access to their money and reduces the number of armored carrier pickups. And even after paying a monthly fee of $500 to amortize the cost of the safe and paying for cash-in-transit services, the use of a smart safe allows retailers to save $500 to $1,000 per month.

The installed base of smart safes in now approximately 100,000, but according to forecasts by the market research firms