Combined with the paranoia created by 2008’s financial crisis, the availability of hundreds of similar mobile payment and other financial services means millennials lack the loyalty traditional banking institutions have come to expect from older generations.

These digital consumers can choose from virtually any global offering that’s been evaluated, reviewed and rated by the thousands of people who’ve already experienced the offering firsthand.

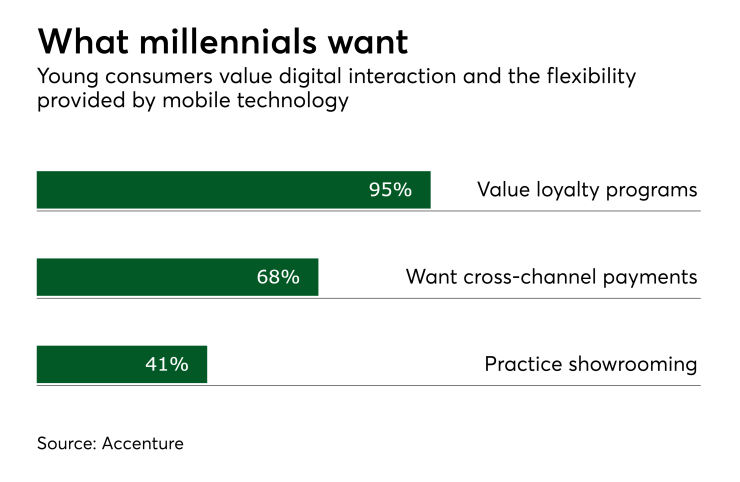

It’s no secret that millennials are fans of mobile technology. If they don't have them in place already, financial services firms need to provide digital budgeting tools, mobile payment and banking services, and wealth management expertise at an absolute minimum if they hope to compete for and retain this audience as loyal customers.

Before anyone rushes to blame millennials for the downfall of another industry, there’s been a recent boom in digital financial services and payments—and this generation just happens to be the most likely group to take advantage of these tech-driven developments. Here’s why.

By 2025, millennials will make up as much as three-quarters of the global workforce. That means banks, payment companies and other financial services providers will be forced to cater to this demographic sooner or later. After all, millennials are the fastest-growing customer base in the financial services market. Out of more than 300 million Americans, more than 83 million already belong to this age group.

While this is encouraging news, the truth is most of today’s finance companies haven’t been able to capitalize on these numbers—at least not yet. Less than a third of the millennial generation say they’re fully engaged with their current bank or financial institution. That’s lower than any other generation by a wide margin.

Financial institutions need to do some serious work to improve the average customer experience. First and foremost, millennials look for solutions that are extremely convenient and easy to use. After all, what good is an innovative new product or service if it’s too complex to be relevant for everyday applications?

However, cutting-edge mobile technology and straightforward solutions aren’t the only thing millennials expect from today’s leading financial management providers. On top of tech-driven products and services, millennials consider the brands they align themselves with every bit as important. Therefore, organizations must do more than talk the talk—it’s important customers see and experience authentic interactions as frequently as possible.

Simply put, traditional approaches to mass media advertising aren’t how brands create value in the minds of the millennial generation. Even a more convenient mobile app is enough motivation for nearly two-thirds of this group to make a change.

Online offerings also greatly benefit banks. Compared to the average $4 cost required to perform any transaction offline, digital and mobile banking options provide identical products and services for a fraction of the spend—an average of nine and 19 cents per transaction respectively.

Additionally, digital banking customers perform 11 times as many transactions a year as their traditional counterparts.

And unlike older generations, millennials are not only used to sharing private data with financial services organizations—they’re excited for the opportunity to help improve provider products and services. Most of the millennial generation is happy to share personal spending information if it consistently improves customer interactions or creates the potential for more accurate, relevant recommendations.

That means things like secure digital forms, which have been the banking industry standard since the inception of online offerings, are being increasingly phased out in favor of quicker, easier registration forms that take less time to complete and aren’t detrimental to the overall customer experience.