This has been a pivotal year for consumer empowerment. Between data privacy regulations expanding from the EU into the U.S. and rising scrutiny into the operations of companies like Facebook, it’s clear that consumers will have more control over their data in 2020 and beyond.

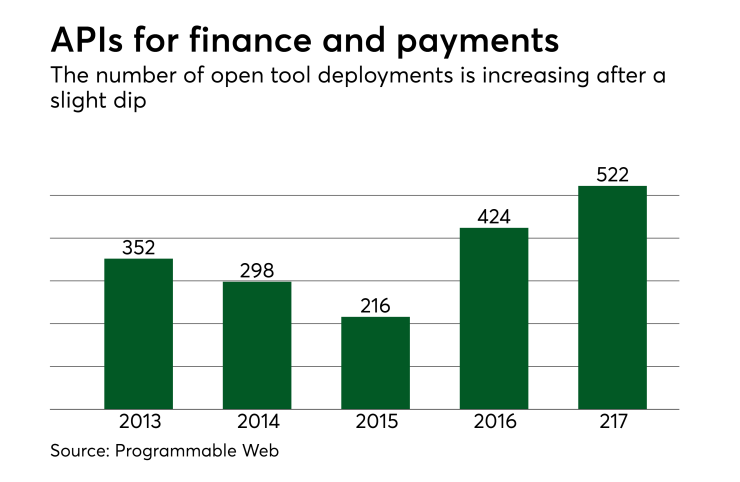

Banking is no exception. Open banking — an approach using open APIs that would allow banks and fintechs to securely share customer-authorized financial data — is already growing in popularity across the U.K., EU, China, and India. With the help of fintechs, some of the world’s largest financial institutions have gotten ahead of the curve to implement data sharing programs that put the consumer first.

Wells Fargo recently announced a

This comes just one year after Wells Fargo launched

In a similar move, U.S. Bank has partnered with several fintechs and data aggregators to expand its suite of API tools in the

U.S. Bank also announced future plans for capabilities that allow customers to gain a 360-degree view of how their account data is shared. This emphasis on the customer perspective is noteworthy: Both U.S. Bank and Wells Fargo are prioritizing initiatives that not only support data privacy, but also continue to improve the digital user experience.

Data sharing innovations extend beyond banking as well. Credit reporting agencies have recently prioritized consumer-permissioned methods for incorporating alternative data into credit risk models.

Banks and fintechs will always be in friendly coopetition to create the best possible experience for customers. But when they join forces, consumers get the ultimate benefits, and the financial ecosystem evolves into an open, transparent platform of collaboration and innovation.