In the world of financial services and payments technology, a growing asset is artificial intelligence (AI), which is capable of completing tasks with limited human oversight.

AI addresses real-world problems in payments and financial services by automating actions to analyze transactions, manage client experience through robotic assistance, and provide personalized, predictive next steps based on data.

With the high-performance and capabilities AI provides, this technology will serve as one of the most valued assets in the future. But how can issuers and financial institutions ensure data is kept secure and not subject to suspicious or even fraudulent activity?

At its core, blockchain is a security measure for online transactions. The technology can be applied to many verticals, such as health care, but as the foundation for cryptocurrencies, financial services is leading the way.

By leveraging blockchain’s incorruptible digital ledger, financial institutions can enhance malicious agent detection in autonomous AI-dominated systems, as well as maximize the efficiency of securely tracking large amounts of data.

AI accelerates the analysis of massive amounts of data while blockchain offers the security and control. This powerful integration can enable reliable decision making across several initiatives, including financial trading, supply chain automation, market prediction, pattern analysis and infrastructure operations. In addition, it is crucial to note blockchain has served as a positive disruption in all industries as a decentralized service, which frees up resources to further maximize efficiency.

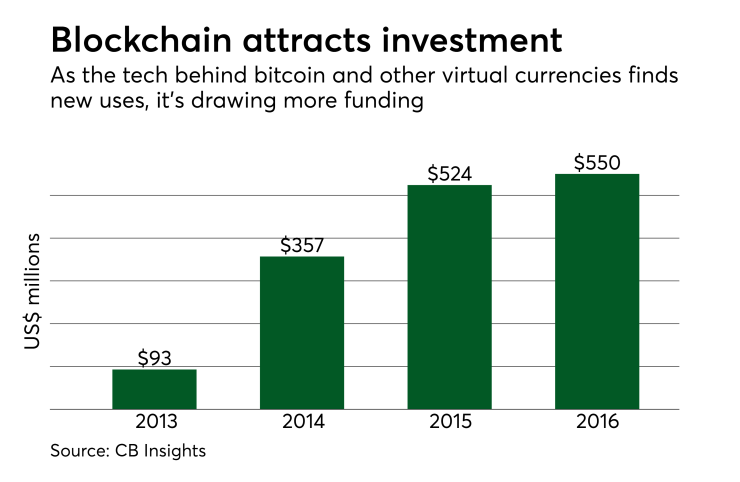

The security program’s popularity is expected to increase in upcoming years. In fact,

While AI and blockchain are powerful separately, combined they are driving some of the industry’s leading projects. Do not dismiss these revolutionary technologies, because now is the time to analyze IT systems and begin the implementation and transformation process.