We use many smart devices every day — sometimes without even realizing it — and they’re transforming our lives.

All of these smart machines belong to the family of Internet of Things (IoT), an ever-growing world of interconnected devices and sensors that promise to make our lives easier, and the use cases for these devices are endless: smart watches, speakers, fitness trackers, buttons, voice assistants, door locks, TVs, home appliances and more.

Driven by the rise of IoT devices, machine-to-machine (M2M) payments, the communication between machines (connected devices) without human intervention, are poised to play a bigger role in the payment ecosystem. Many in the industry are taking note of this previously unseen potential.

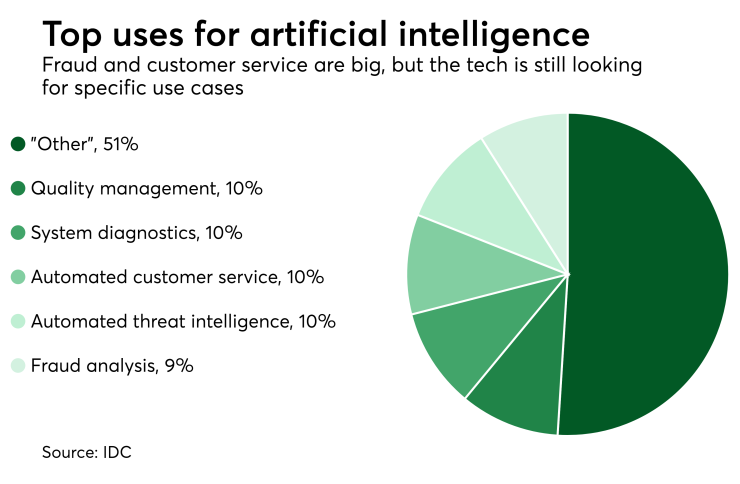

However, there’s need for pause before hopping on the human-free bandwagon. For M2M payments to work, the already smart IoT devices will need support from other technologies —namely, artificial intelligence. Elements of AI are heavily interwoven in processes within the financial industry but face a few key challenges that need to be addressed before widespread adoption of M2M payments can move forward.

AI can do great things and is very accurate most of the time. However, when AI gets something wrong, there’s a huge risk that it gets it very, very wrong. Training data (the data that is used for AI algorithms to learn) can be biased and, consequently, could train a system to adopt an unintended behavior.

One famous example is an image classification algorithm that had seemed to successfully learn to distinguish — with high accuracy — two different but closely related animals, based on images provided as training data. However, the researchers later found that the training algorithm in fact achieved its success rate based on identifying the image background (e.g. snowy versus non-snowy landscape) and not on the features of the animal itself. This example may appear insignificant at first, but it highlights the risk of cognitive bias creeping into more complex use cases with more serious consequences.

As with other disruptive technologies, the regulations around AI and, in particular, AI-powered payment transactions need to catch up to provide clarity around its use. Two key factors will need to be addressed by these regulation. First, who’s accountable for the M2M transactions if carried out incorrectly: the software manufacturer, end user, or payment processor? And, what is required to prove that an AI algorithm has made the right decision in lieu of the human whose data was used to train the machine?

Additionally, privacy concerns abound when it comes to the data used in the AI-powered M2M payments. With regulations such as General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA) and Revised Payment Service Directive (PSD2) in play, data privacy is paramount, and should be kept top of mind in light of data breaches increasing in frequency and scale.

With all of the different types of smart devices that will be transacting with each other, standards will need to be put in place to ensure interoperability. This responsibility will lie with device manufacturers and consortiums as they’re looking to expand the IoT network and facilitate payment transactions, and can be augmented by methods and technologies beyond just AI. Still-evolving standards and technologies like 5G networks or real-time payments can aid in the further evolution and scale of the developing device ecosystem, and should be leaned on as the number of IoT devices continues to exponentially grow.

M2M payments and AI are paving the way for dynamic and rapidly adapting ecosystems, and it’s an exciting time to be in the payments industry. However, with all the transformation, financial institutions and regulators should be aware of the latest developments to adequately shift their strategies. If done correctly, M2M payments have long-term potential to vastly speed existing payment processes and further reduce transaction costs, making the bottleneck of human interaction progressively obsolete.