Large U.S. financial institutions converting their credit and debit portfolios to contactless technology this summer are betting that transit agencies like New York shifting to open-loop NFC will help drive mass adoption.

But for thousands of card issuers serving consumers in small towns and rural areas, mass transit isn’t a factor. In these regions, contactless adoption will depend on having a concentration of local merchants supporting tap-to-pay.

“We’re not a transit-centric nation—there are 200 million people who don’t live in areas mass-transit serves,” said Thad Peterson, a senior analyst at Aite Group, speaking during a panel at Card Forum in New Orleans.

In smaller population centers, quick-service restaurants will likely play a big role in driving

Eighty of the top 100 U.S. merchants already support contactless, which including quick-service chains like McDonald’s and Dunkin Donuts that reach nearly every county in the U.S., Giorgio said, adding local merchants will lag behind national chains in adding NFC support. But wherever issuers supply consumers with contactless cards, consumers will figure out how to use tap-and-pay faster checkout, Giorgio said.

One example of this phenomenon is in Bangor, Maine, where a local savings bank committed to contactless cards two years ago, far ahead of its peers.

The 54-branch Bangor Savings Bank rolled out contactless Mastercard-branded debit cards in June of 2017 in an area where several outlets of major fast-food and drug store chains were already NFC-enabled.

At Mastercard headquarters, a surge in contactless debit card volume suddenly showed up on the card network’s radar.

“The bank in Bangor just started issuing contactless cards and with no significant marketing, people began using it because of the greater convenience,” said Berke Baydu, director, market product management for cyber and intelligence solutions at Mastercard.

The recent moves by several

Mastercard research indicates that the habit changes when a consumer uses a contactless card to make four payments within a week. A transit rider paying with contactless can accomplish that with two round trips in two days, but most consumers around the U.S. will spread contactless out among more merchants.

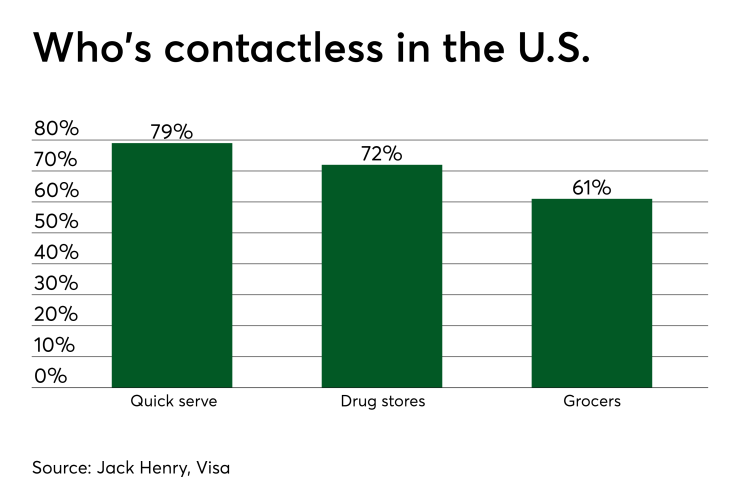

“This will be happening gradually, because more than 60% of merchants are accepting contactless across the U.S.,” he said.

The majority of smaller financial institutions are not yet issuing contactless cards, for different reasons.

“We want to issue contactless cards—it’s on our road map—but it depends on our processor, and we’re still not able to do it,” said Diana Meyer, vice president of payments at Logix Federal Credit Union, a 15-branch institution based in Burbank, Calif.

Central Bank, a small institution in Jefferson City, Mo., is taking a wait and see approach to contactless cards, said Debra Lake, the bank’s product manager for bankcard services.

“We actually got involved in contactless years ago in its first generation in the U.S in 2005 and we saw it fall on its face. So we’re not eager to jump into this yet,” Lake said.