While cross-border travel revenue for card networks and processors has rebounded in many global regions — surpassing pre-pandemic levels — Asia's recovery has lagged behind primarily due to lingering lockdowns. That's poised to change as China this week reopened its borders for travel.

There are already indications of strong pent-up travel demand that could be a boon for Mastercard and Visa, which have each seen significantly lower revenue from cross-border travel spending in Asia since the pandemic began.

Other Asian nations have begun rebuilding travel-spending momentum in recent months. Singapore reopened its borders for travel in stages last year; Hong Kong eased pandemic-related travel restrictions in September 2022 and Japan removed restrictions on individual travel in October.

Mastercard said its overall cross-border travel spending through the third quarter of 2022 surged to 124% of pre-pandemic levels, while overall Asia's travel-related spending was about 25% lower than 2019 spending levels through September.

Visa has seen cross-border travel spike in many regions — particularly Europe — while travel spending in Asia through the third quarter of last year reached only about 75% of pre-pandemic levels, according to Jeni Mundy, global senior vice president of sales and acquiring at the San Francisco-based payment network.

"You have to expect with China opening, it will have an impact on travel spending, and a big one," Mundy said.

Trip.com Group, a leading travel-booking platform for Chinese travelers, logged a 254% surge in outbound flight bookings the morning after China announced it was lifting travel restrictions — nearly three years after the pandemic began.

The Shanghai-based firm had to apply extra support for the surge of booking requests, but Trip.com Group said in a recent press release it's confident its systems can handle the uptick in demand.

But analysts caution that emerging economic factors could dampen the outlook for an Asian travel-spending rebound, even with China's long-awaited border reopening.

"Uncertainty remains on the 2023 travel outlook given concerns around recession risk, inflation and normalizing consumer credit coinciding with a potential moderation in post-pandemic travel demand," Morgan Stanley financial industry analysts said in a Jan. 3 note to investors.

Different governments' policies around COVID-19, along with cultural and economic issues, created some unusual cross-border travel-spending spikes last year in certain regions that might not be easy to repeat.

For example, Visa reported last year that travel spending in the European region surged to about 130% over 2019 levels last September, and Mundy said several factors played into that trend.

"European travel-spending volume really benefited from the strong U.S. dollar," she said, noting that because leisure travel recovered faster last year than business travel, consumers seized on temporarily lower pricing for some hotels and travel corridors.

"Many leisure travelers went to secondary cities that are typically business-travel destinations and got great deals," Mundi said, adding that Visa data showed Lyon, France — which usually hosts many business events for foreign travelers — saw a surplus of tourists last year.

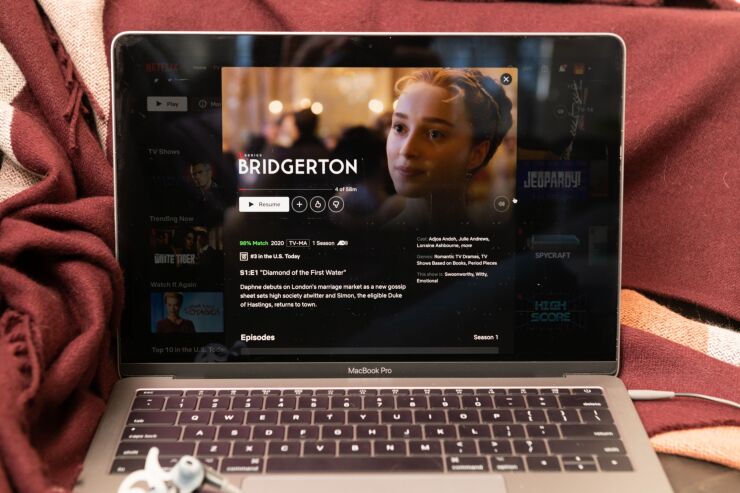

Bath, England, also saw an unusual spike of leisure travelers last year, which Visa attributes to the pandemic-era popularity of the Netflix series "Bridgerton." Bath's travel recovery outpaced that of perennially popular locales London and Edinburgh, Visa said.

"During the pandemic people were doing a lot of streaming, watching movies and boxed sets, and we saw from research there was a real pull toward some of those featured destinations," Mundy said.

The strong dollar also helped drive cross-border travel volumes in the Middle East, Africa and Latin America last year, but it caused inbound travel-spending volumes from tourists to the U.S. to be "sluggish" last year, according to Mundy.

Some observers say China's potential for a post-pandemic travel-spending rebound will depend on whether the global recession deepens, and the extent to which China's economy thrives this year.

When China's

China-based Ant Group's

Between April 2019 and March 2020, the Alipay app

Prior to the pandemic, Las Vegas hosted about 200,000 Chinese tourists annually, according to the Las Vegas Convention and Visitors Association. The average Chinese traveler visiting Las Vegas stopped in an average of four cities on their trip, stayed an average of 18 days in the U.S. and spent about $4,500 during their trip, according to LVCVA data.

The organization declined to forecast when significant numbers of Chinese visitors may arrive in Las Vegas, but the city's post-pandemic tourism rebound with other origination points has been strong.

Harry Reid International Airport in Las Vegas logged a 266% increase in international flight arrivals through November 2022 compared with the same period a year earlier, according to its monthly report.

Josh Swissman, founding partner at the Strategy Organization, which analyzes the Las Vegas gaming industry, expects China's travel reopening to have a meaningful impact this year on many U.S. businesses.

"Chinese visitors to Las Vegas include business travelers, high-end individuals and hundreds of thousands of ordinary citizens who come on group tours to major cities, and some of these groups will show marked growth this year over last year," Swissman said.