The technology arms race among payment fintechs is converging on the market for credit and loans, with

Square and other point of sale companies are under pressure to support larger purchases than what can be handled at the micro-merchants they traditionally served, while also helping those smaller businesses handle more complex transactions. One way they can do this is to offer consumer credit via their point of sale systems — and Square is far from the first to reach this conclusion.

Square's announcements builds off the success of Square Capital, the merchant advance product that provides funding based on a merchant's cash flow through Square hardware and software. Merchants pay back the loan through future Square sales. Square Capital will also cover the credit Square now offers to consumers at the point of sale in 22 states, in values of $250 to $10,000.

That means Square pays the full amount and the consumer pays back Square, with three-, six- or 12-month installment payments with zero interest to 24 percent APR.

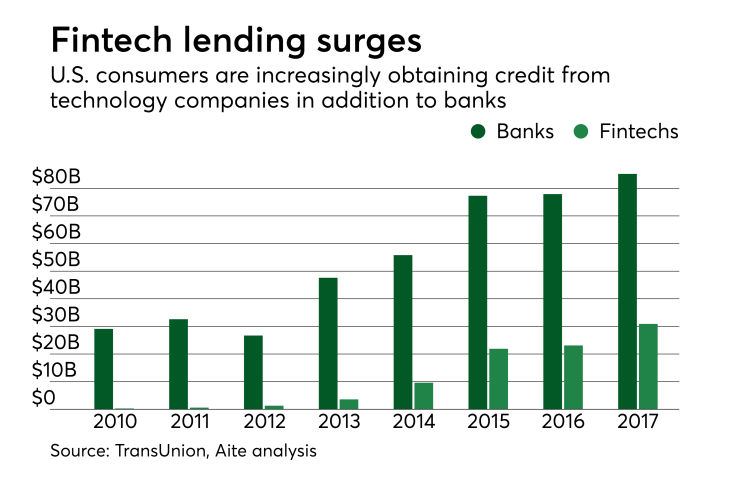

The fintech share of the personal loan market in the U.S. has expanded to more than a third this year, from practically zero in 2010, according to Aite research released in August. The fintech consumer lending market uses alternatives to bank credit decisioning such as advanced analytics, AI and big data to manage the risk. But until a downturn occurs, there's no way to know if default risk is being reduced, according to Aite, which predicts some companies in the online consumer lending space will fail in the next economic downturn.

"Consumer lending is generally more vulnerable to downturns since it is unsecured and often targeted toward mass market/underbanked customer sets," said Thad Peterson, a senior analyst at Aite Group. "The possible offset is that some of these companies are using underwriting protocols driven by AI that could theoretically do a better job of managing risk in the space. But most have never been tested in a downturn."

Given the competitive need, most payment fintechs now offer some form of merchant credit, usually supporting installments for larger ticket items.

“Installment payments are both a competitive offering for Square as well as a way to provide their merchants with an opportunity to increase sales and also increase average order value,” said Peterson.

For Square, it's the latest in a long line of products it has added to shore up its appeal to merchants. Square recently added support for

Square’s consumer installment payment offering is different simply because it’s part of this broad Square platform, said Rick Oglesby, founder and president of AZ Payments Group.

Installments "can be fully integrated into Square’s payment processing, POS and Square Cash products to make the product easier to offer, easier to use and easier to sell than competitive products,” Oglesby said. “It makes Square's platform even more valuable.”

Square’s hardly alone as consumer credit becomes near table stakes for payment technology companies. In the past year,

And it’s also not

Machine learning does give these new lenders an edge in risk management to go along with online applications which replace traditional paper-based in-store credit—creating a better user experience and reducing declines, according to Crone.

“AI is the secret sauce. It gets smarter … not just with every application or ever originated loan, but every key depression gets recorded,” Crone said. “That brings in more data and reduces the risk.”

The argument for the products are obvious. Square would not comment on the record for this story, but it told

Square also provided a case study on early installment payment adopter

“Several organizations are offering different flavors of installment lending including zero interest offerings like PayPal Credit,” Peterson said. “Making the application process simple, fast and non-intrusive is critical to the success of the offering at the point of sale, but if it crosses that hurdle, the capability will energize merchant sales. This is a strong addition to the Square value proposition with merchants.”