PayPal has launched a new buy now, pay later (BNPL) product in the U.K. called “Pay in 3” to take on rivals Afterpay, Klarna and others ahead of the winter holiday shopping season.

The new Pay in 3 BNPL program is available to all U.K. merchants for purchases of £45 (about $59) to £2,000 (about $2,600). The program splits that cost into three interest-free payments. The first payment is due at time of purchase with the remaining two payments made as automatic withdrawals in the following two months (one per month). The Pay in 3 product will appear in customers’ PayPal wallets so they can manage their payments online or through the PayPal app.

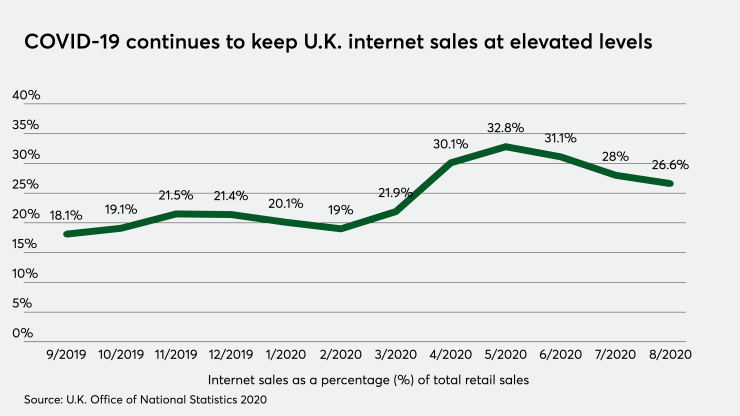

“During the coronavirus pandemic, we have seen the number of people in the U.K. shopping online increase dramatically,” said Rob Harper, U.K. director of enterprise accounts at PayPal, in the release. “At the same time, many more consumers are looking to spread the cost of those purchases. We have developed PayPal Pay in 3 to meet that need, building on our heritage as a responsible lender through PayPal Credit, which we launched in the U.K. in 2014, and has served more than two million customers to-date.”

The launch of Pay in 3 takes advantage of the upcoming winter holiday shopping season which includes Black Friday and Christmas. It also comes at a time when PayPal is attempting to take the wind out of the sails of its competitive rivals who have been gaining traction in the U.K. and other markets, in particular

Australia-based

Swedish rival Klarna has been aggressively growing in Europe and the U.S. with a wide array of BNPL products that include the more traditional installment loans to the short-term deferred charge program of splitting purchases in four no-interest installments. Most recently

According to the

According to the U.K.’s

In August