In a bid to expand contactless card acceptance, Mastercard is testing its Cloud Tap on Phone tech with Napa, Calif.-based IT services provider Computer Engineering Group (CEG).

The pilot with CEG, in partnership with Global Payments and NMI, follows live product testing on Mastercard’s Purchase, N.Y., campus. The Cloud Point of Sale (POS) technology is an enhancement of Mastercard’s

Cloud POS moves key parts of the acceptance software for contactless transactions and certain security functions into the cloud. By moving this technology off the smartphone itself, Mastercard can reduce development and maintenance costs, provide security and enable rapidly scalable distribution of the contactless technology through partners.

“The pandemic has permanently shifted the way global commerce operates, forcing companies to respond to increased demands for safe commerce solutions, such as mobile ordering and contactless payments,” said Jim Egbert, senior vice president for business development and strategic partnerships at Global Payments, in the release. “As an innovation leader in the payments industry, we are proud to partner with Mastercard on the new Cloud POS acceptance technology solution that will better equip merchants of all sizes to provide a faster, safer and more secure experience to help better serve consumers and their preferences for more advanced digital commerce solutions.”

The launch of the Cloud Tap on Phone pilot with CEG is the result of the creation of an ecosystem in which Mastercard created to enable its partners to roll out the service globally. NMI is providing the systems integration, Global Payments is providing the POS technology and ISO BNG Payments is servicing CEG’s account. The software is hosted on Microsoft’s Azure cloud platform.

Mastercard will make its pre-certified Cloud POS software development kits (SDKs) openly available in multiple cloud environments to encourage companies to innovate and co-create cloud-first acceptance products.

Cloud POS is a product of Mastercard’s multi-cloud strategy and aims to drive affordable contactless card acceptance to small businesses by not forcing them to acquire and maintain dedicated POS terminals and hardware. Mastercard plans to conduct further Cloud Tap on Phone pilots and commercial deployments in other markets in 2021. Currently, Mastercard’s Tap on Phone solution is in 16 markets across Europe, Asia Pacific, Latin America, North America, the Middle East and Africa.

"Tap on Phone technology perfectly complements the acceleration of contactless payments in the U.S. market,” added Nick Starai, chief strategy officer at NMI in the release. “This is a ground-breaking step in creating a world that enables merchants to turn their smartphones into a payment acceptance device without the need of an externally paired physical card reader.”

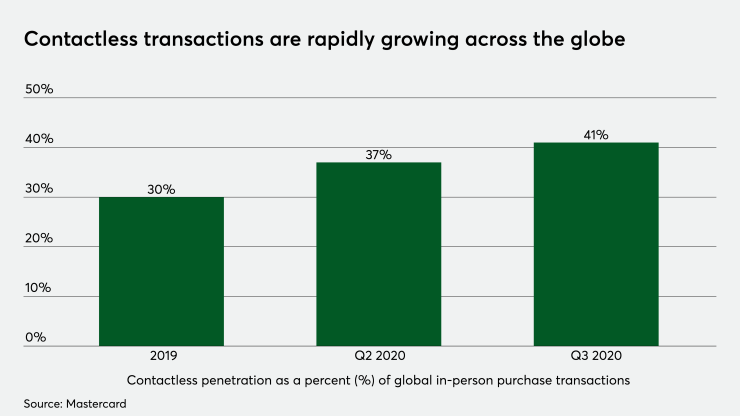

Mastercard noted that due the pandemic, contactless payment adoption has been rapidly growing and represented 41% of global in person purchase transactions in the third quarter of 2020, up from 37% in the second quarter and 30% one year earlier.

By moving the Tap on Phone solution to the cloud, Mastercard is aiming to accelerate the adoption of contactless payments, particularly at small merchants that tend to rely on cash and checks.